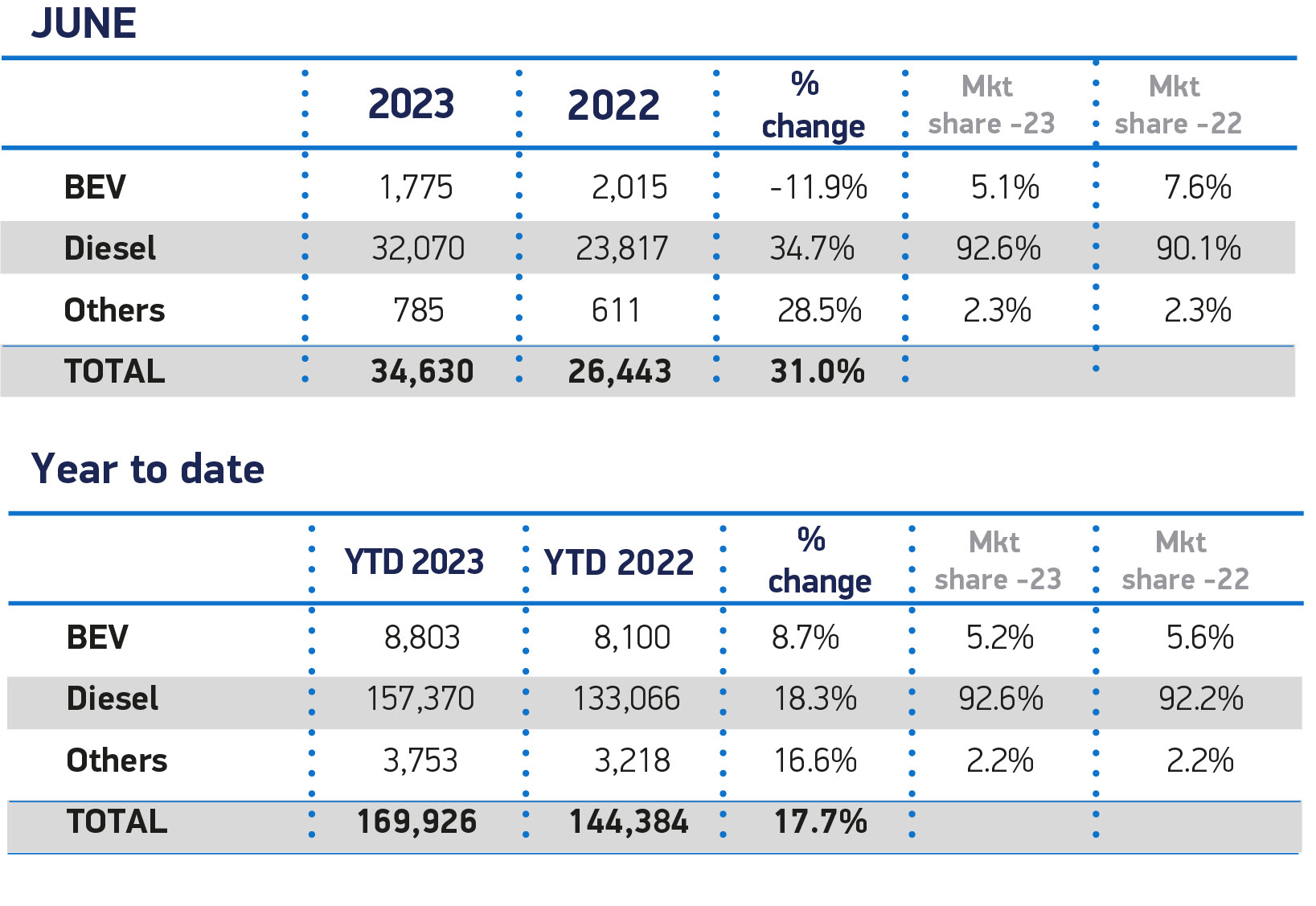

Despite overall growth, demand for battery electric vans (BEVs) fell by 11.9% in June, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

Some 1,775 fully electric vans were registered, even with a growing number of models coming on to the market.

It brings the total of all electric vans registered so far this year to 8,803 units, a year-on-year increase of 703 but a market share decline to 5.2% in the year-to-date.

Given that commercial vehicles are integral to keeping Britain on the move and subject to the same end of sale date as the much further progressed passenger car market, the SMMT says that urgent action is needed to accelerate uptake ahead of a zero-emission vehicle (ZEV) mandate set to be implemented in just six months’ time.

Mike Hawes, SMMT chief executive, said that the fall in electric van uptake was “very concerning”.

“Despite the continued availability of the plug-in van grant, more needs to be done to give operators the confidence to make the switch,” he added.

“This means a long-term plan which supports purchase and helps overcome some of the barriers to the installation of van-suitable charging infrastructure, given the unique needs of this sector.”

The availability of charging points that are suitable in both size and location for van use remains a major obstacle to the take up of electric vans, says the SMMT.

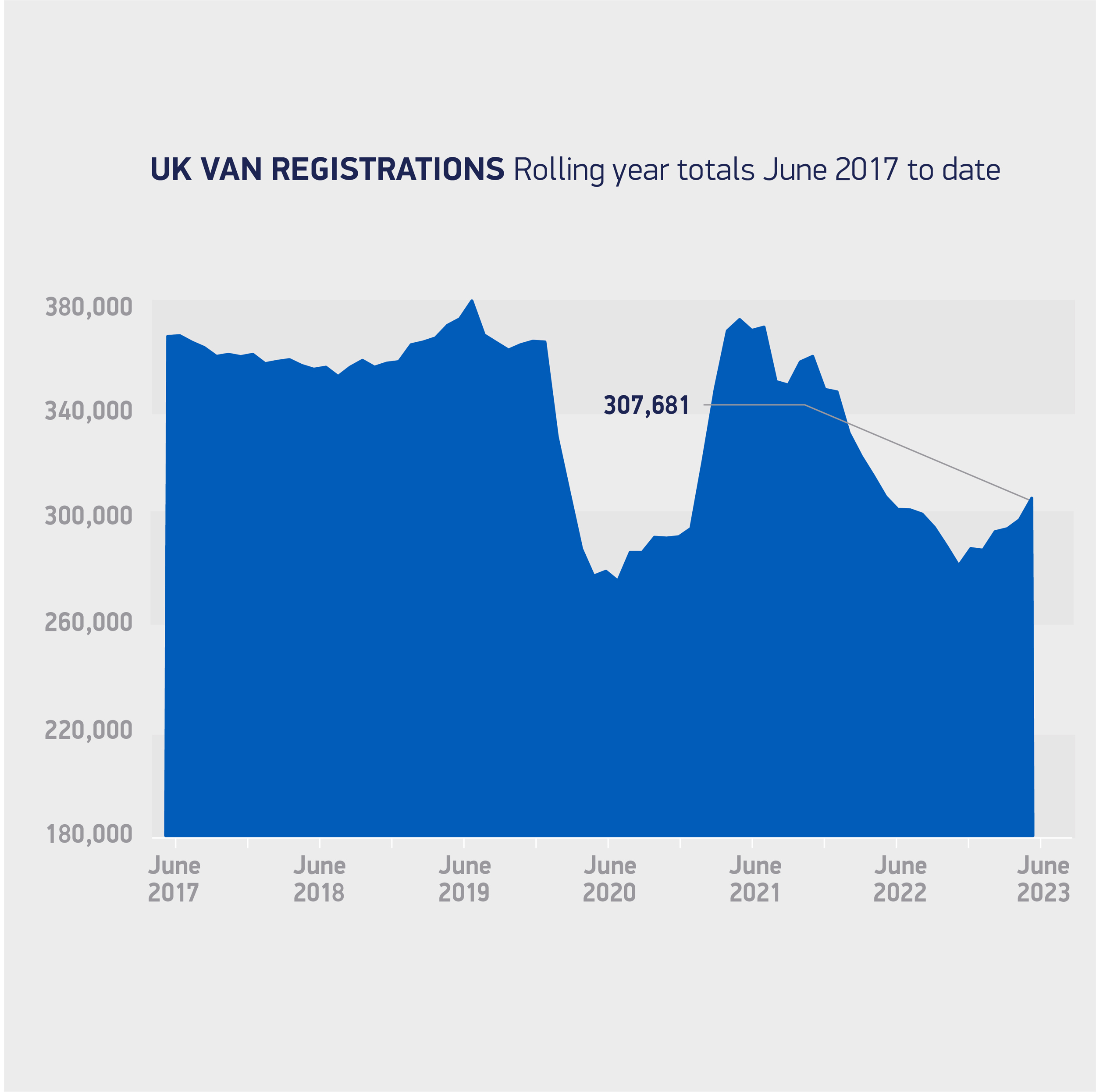

Best performing half year for new van market since 2019

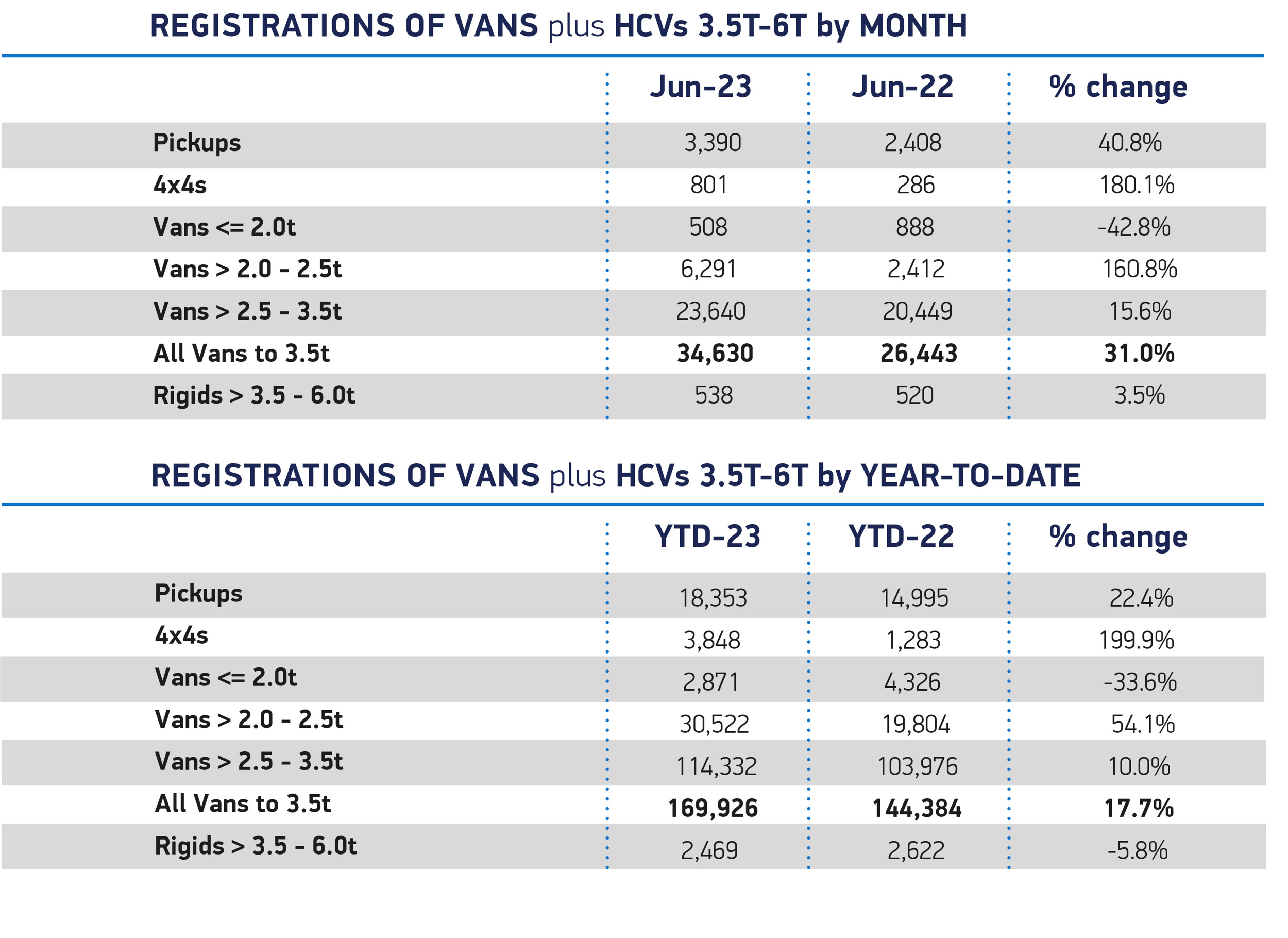

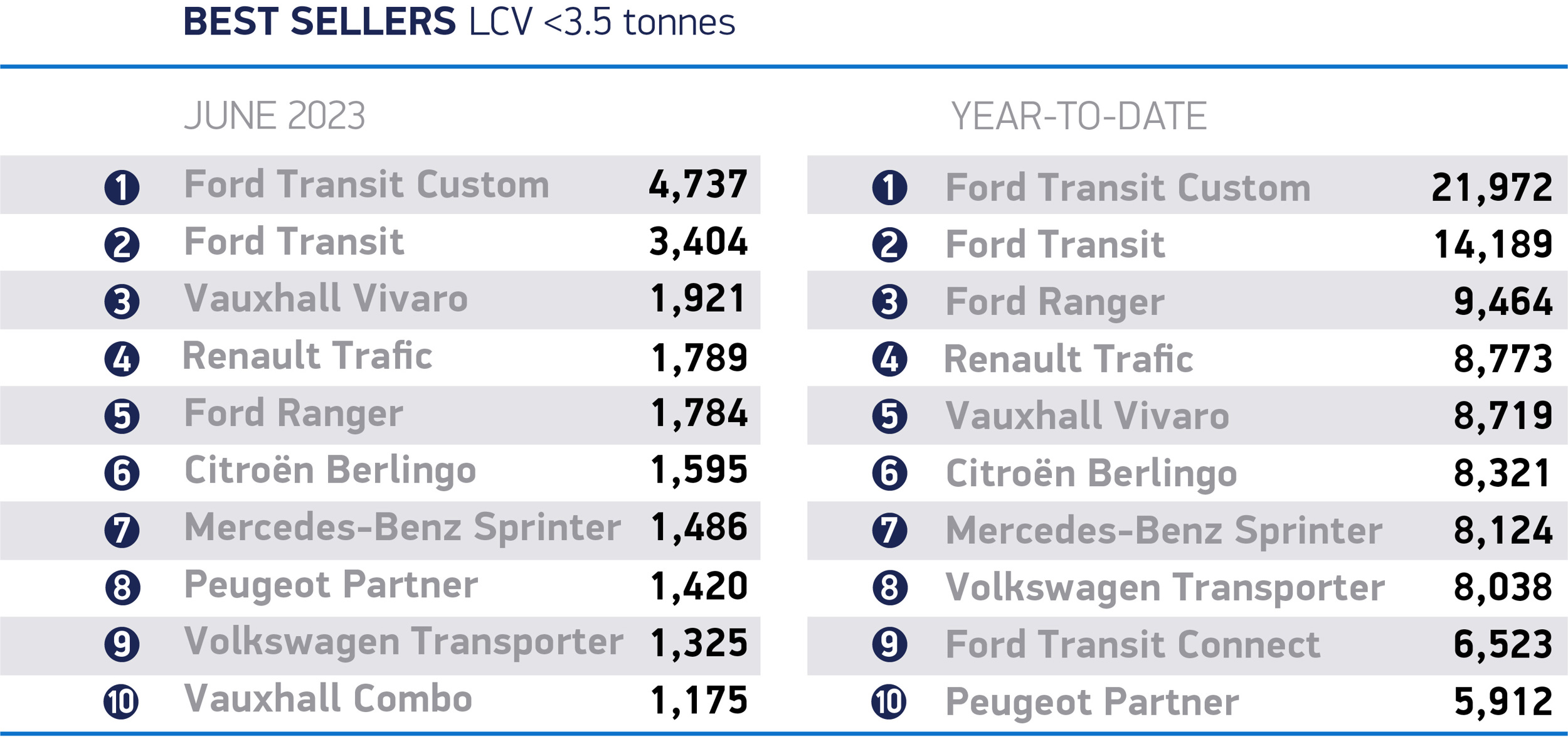

Overall, the UK new light commercial vehicle (LCV) market has risen for the sixth consecutive month, growing by 31% to 34,630 units in the best June since 2019.

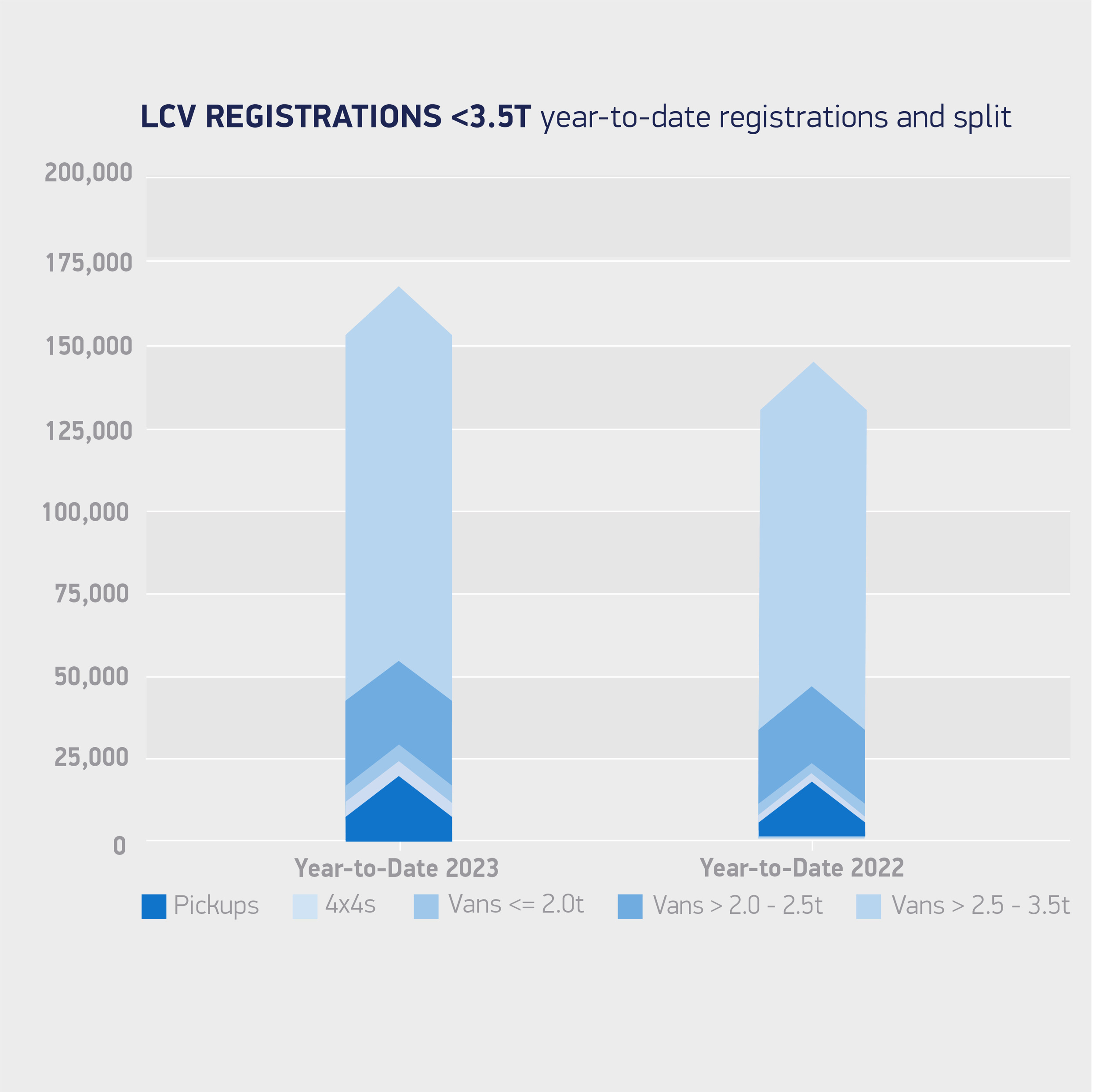

Some 169,926 new vans, pickups and 4x4s were registered in the first half of 2023, up 17.7% compared with the same period last year, as once persistent supply chain shortages ease.

Registrations of the largest LCVs, weighing greater than 2.5 to 3.5 tonnes, rose by 15.6% to 23,640 units to account for 68.3% of the market in June, while registrations of medium-sized vans weighing more than 2.0 to 2.5 tonnes reached 6,291 units, up 160.8%.

Registrations of the largest LCVs, weighing greater than 2.5 to 3.5 tonnes, rose by 15.6% to 23,640 units to account for 68.3% of the market in June, while registrations of medium-sized vans weighing more than 2.0 to 2.5 tonnes reached 6,291 units, up 160.8%.

Conversely, lighter vans weighing less than or equal to 2.0 tonnes fell by 42.8%, the only segment to decline and the one which has seen demand consistently fall as operators favour larger workhorses with the potential for greater cost efficiencies. Pickups and 4x4s, meanwhile, increased by 40.8% and 180.1% respectively.

Hawes said, “As we reach the year’s midway mark, the surge in light commercial vehicle registrations is good news and delivers continued optimism to the market.”

Login to comment

Comments

No comments have been made yet.