Cox Automotive is reporting a 40% year-on-year increase in the number of light commercial vehicles (LCVs) sold through the company’s Manheim Auction Services division in September.

Prices were also up with an average used value of £10,133 for September representing the strongest monthly average selling price for LCVs in the past 12 months – a £404 increase compared to the previous six-month averages and only slightly less than the same period in 2022.

More than three quarters (77.8%) of used LCVs were sold first time.

Overall de-fleeted LCV volumes also rose in Q3, it says, with 17,344 vans being dealt with by Manheim, representing a 38% year-on-year increase.

Euro 6 derivatives made up 76% of all LCVs sold in the quarter and continued to attract the most attention from buyers.

The average Euro 6 van sold was 49 months old with 68,736 miles on its odometer.

Matthew Davock, director of Manheim Commercial Vehicles at Cox Automotive, said: “Q3’s performance repeated the positive pattern we’ve been experiencing all year and I see no sign of that abating as we move into the final months of 2023.

“The average selling price for vans returned to five-digit figures in September and the number selling first time also increased by 5.6%, which is great news for the LCV marketplace.”

With the number of new van registrations growing steadily, and de-fleet volumes rising accordingly, Davock says it seems “the cork is finally well and truly out of the supply bottle”.

Euro 5 and older vehicles, which made up the majority of other stock handled in the period, are currently proving to be less attractive to buyers, with prices falling by an average of £288 versus the previous quarter.

Davock believes this is down to their age, mileage and condition and the growing number of clean air zone (CAZs) https://www.fleetnews.co.uk/fleet-faq/uk-clean-air-zones-caz meaning more buyers are now avoiding non-compliant vehicles.

Used electric vans

The level of used EV LCVs sold at Manheim locations also recorded a new quarterly record, with 133 selling between June and September, representing a 380% increase versus the last three-month averages.

Overall stock profile is very different in this vehicle segment with average age and mileage being just 36 months and 15,593, and the average selling price £9,170.

“The EV segment has seen some signs of positivity of late and the fact we have sold 133 units during the quarter is encouraging,” said Davock. “That more and more dealers are now getting to handle and sell these assets will only build confidence.

“The overall LCV market has remained more than robust over the past 12 weeks and the quarter has certainly finished on a high note.

“Looking ahead, we are expecting the positivity to continue despite the likely easing of overall volumes as many fleets and rental operators hang onto vehicles to cope with the busy festive period.

“Despite this, the final stretch of 2023 is still set to be a busy and bumper period for UK commercial vehicle sales,” he added.

Diverging market puts pressure on LCV values

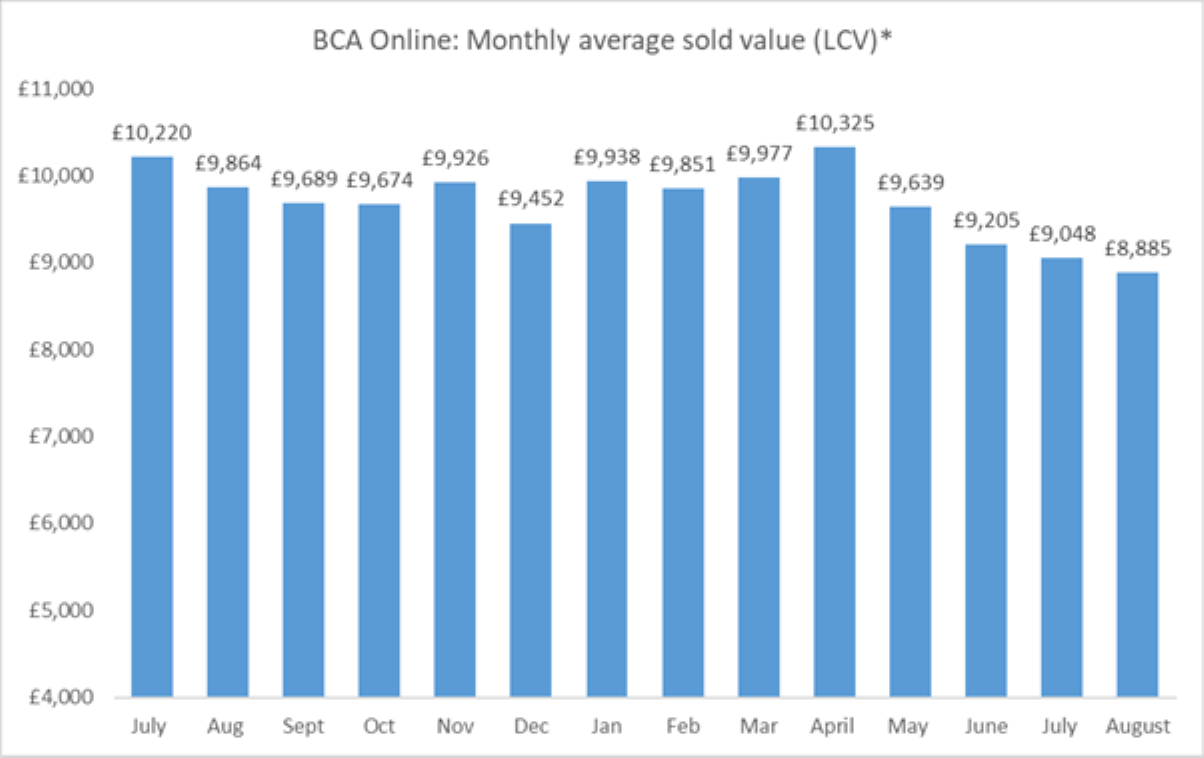

BCA reports that LCV values continued to reflect the changing mix of vehicles reaching the wholesale sector, averaging £8,885 during August at BCA.

Values have fallen steadily since the highpoint recorded in March of this year, it says, with the changing mix of stock and rising numbers of lower grade vehicles being the major factors influencing values over recent weeks.

Average LCV values fell by £163 (1.8%), month-on-month in August, having fallen by a similar amount between June and July. LCVs are currently at the lowest monthly average value recorded since 2021.

Despite this, sold volumes of light commercials remained consistent as BCA’s daily programme of online LCV sales continued to deliver a wide range of stock for buyers, with sellers and buyers being reasonably aligned in terms of price expectation.

Monthly buyer numbers continued to increase and in August reached their highest point this year.

Performance against price guides has improved over recent weeks, sitting at 99.9% in August, underlining that buyers and vendors remain in tune on pricing expectations.

Demand for the very best condition light commercial vehicles continued to significantly outstrip interest in more poorly presented vehicles, it said.

Stuart Pearson, BCA’s chief operating officer, said: “August continued the now well-established trend of a two-tier market, with significant levels of demand and very competitive bidding for well presented, better grade vehicles, with challenging conditions for poorer quality stock – particularly where higher volumes of repeat models have a significant influence on bidding activity.”

He added: “This is a good time to remind sellers that the remarketing basics remain as important as they ever were.

“Where appropriate, mechanical and cosmetic repairs will add value and improve first time conversion, and the right level of preparation and clear transparency around vehicle provenance will also contribute towards achieving optimum value and speed of sale.

“It won’t be a surprise to anyone that the data supports a sensible reserve setting strategy, which attracts the highest number of bids and overall realises the best values.

“With the diverging market, driven by the focus on not just quality but value, any overly optimistic pricing strategies will be found out quickly.”

He concluded: “There’s been a lift in activity in the last few weeks, interestingly aligned with a positive shift in volume, so there’s the anticipation that the autumn LCV market may prove to be a more positive one that seen in the last few months.”

Login to comment

Comments

No comments have been made yet.