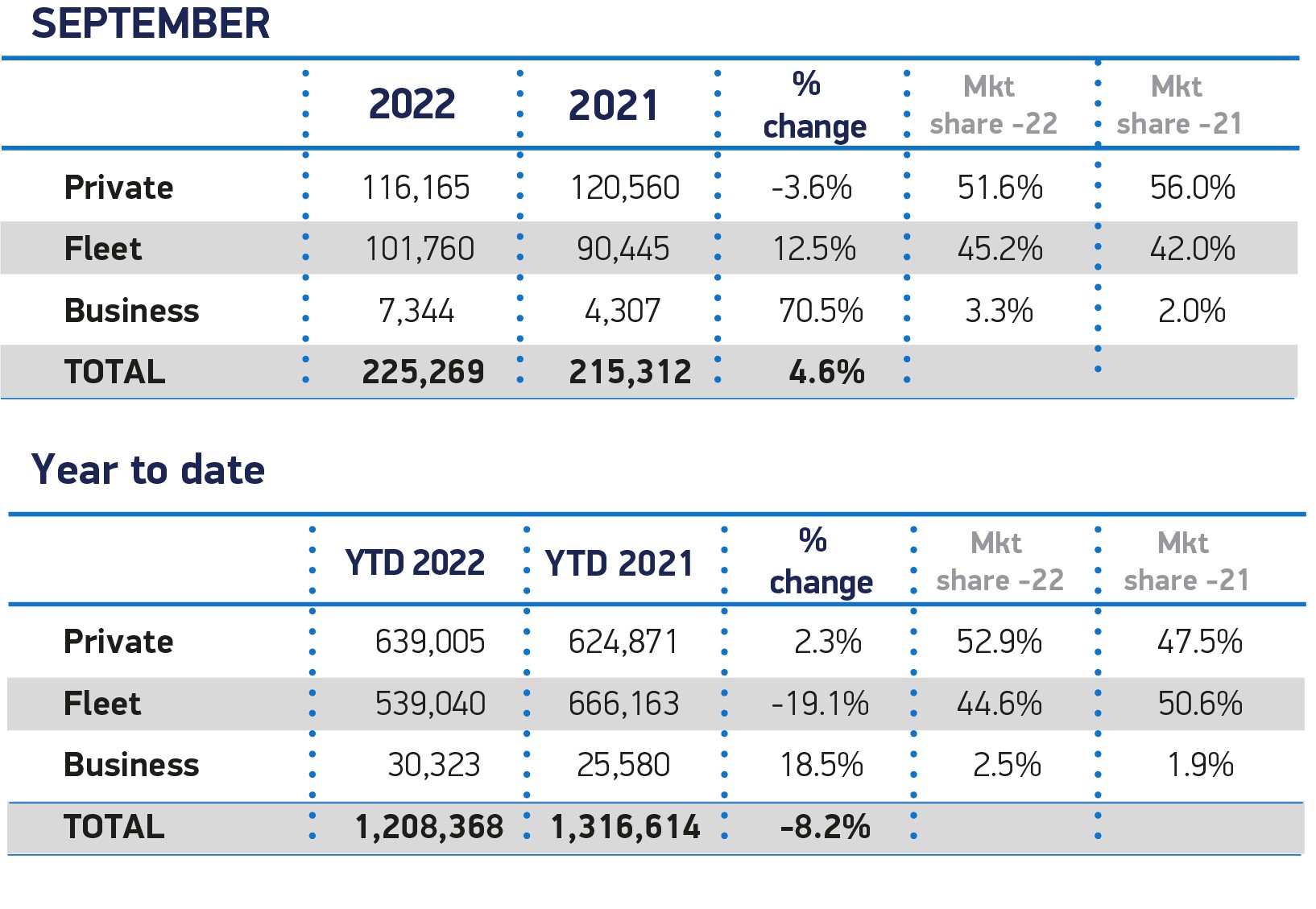

Fleet and business company car registrations were up by almost 15% in September, but year-to-date are still down by 17.7%, according to new sales data published by the Society of Motor Manufacturers and Traders (SMMT).

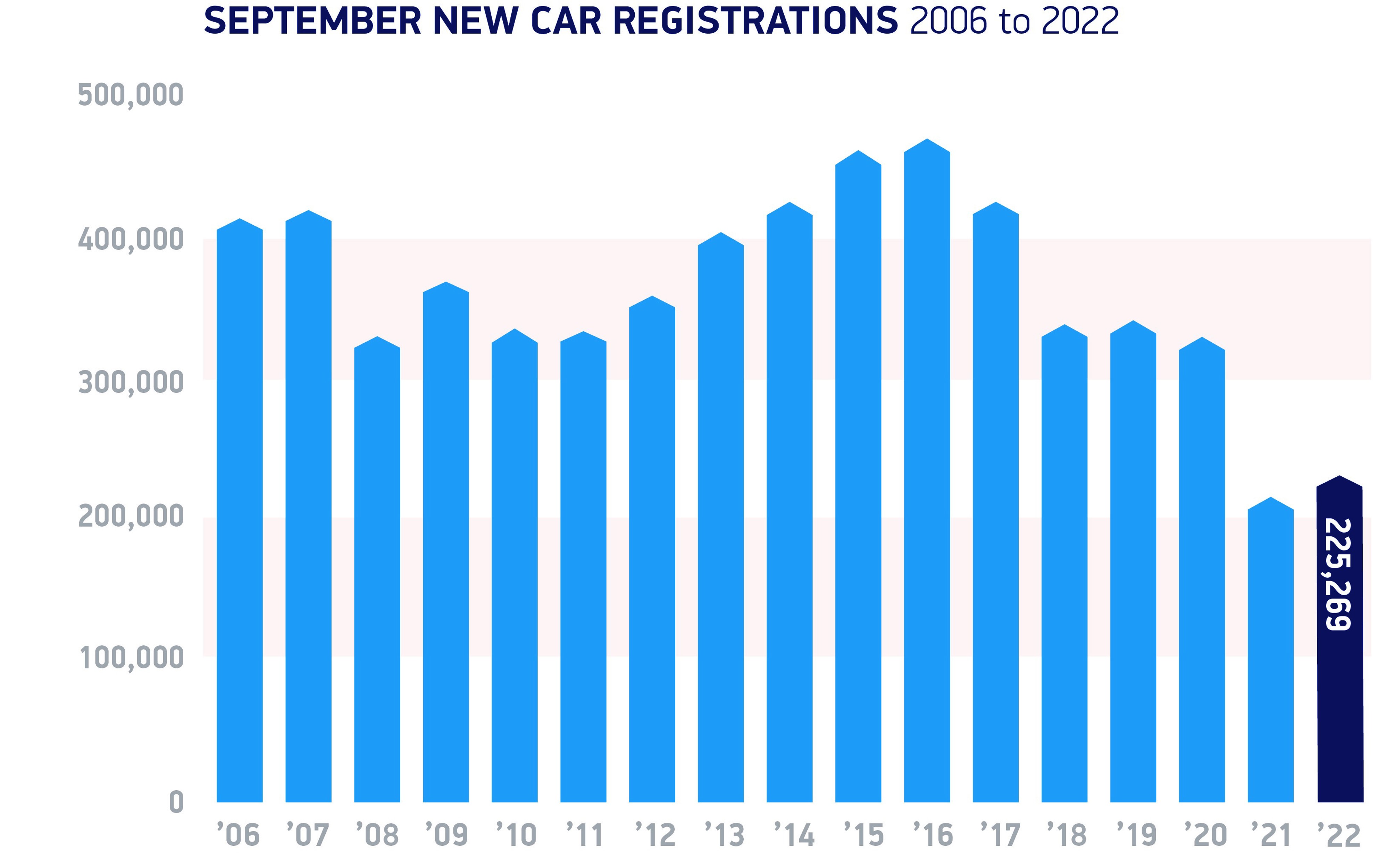

During what is typically the second biggest month of the year for the sector, 225,269 new cars were registered, including private sales.

Fleet and business registrations accounted for 48.5% of the market, with 109,104 units registered, compared to 94,752 cars in the same month last year.

Year-to-date, fleet and business registrations now stand at 569,363 units – 17.7% down on the 691,743 cars registered in the first nine months of 2021.

Despite the welcome upward trajectory of fleet and business registrations in the month, overall it was the weakest September since 1998, and was 34.4% below pre-pandemic levels as the industry continues to battle issues constraining supply to fulfil a backlog of orders.

Britain’s millionth plug-in electric car registered

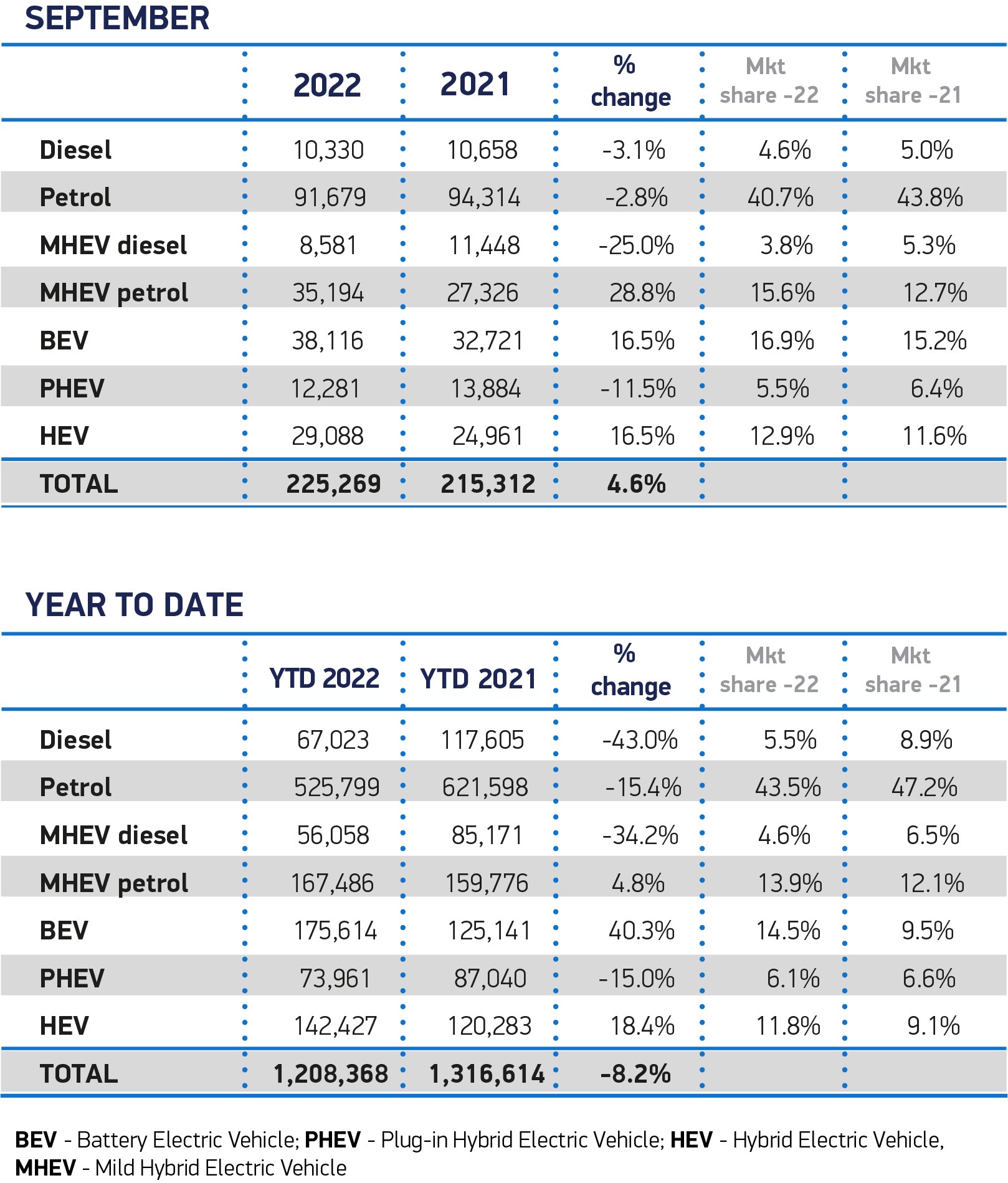

Electric vehicle uptake continued to rise, albeit at a slower rate of growth than seen earlier in the year, with the second highest monthly volume of battery electric vehicle (BEV) registrations in history, up 16.5% to 38,116 units.

Although registrations of plug-in hybrid vehicles (PHEVs) declined by 11.5% to 12,281 units, overall plug-in vehicles accounted for more than one in five new cars joining UK roads in the month.

As a result, almost quarter of a million (249,575) have now been registered in 2022 – meaning that UK drivers and fleets have now registered more than one million plug-in EVs, a quarter of which in this year alone.

Hybrid electric vehicle (HEV) registrations, meanwhile, grew by 16.5% to 29,088 units in the month, as petrol powered cars grew 4.3% to 126,873 units and diesels declined by 14.5% to 18,911.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “September is traditionally associated with a spike in new registrations, as drivers take advantage of the new number plate change.

“Today’s figures are a strong indicator that the new car market is slowly showing signs of recovery amid inflationary pressures and global supply chain challenges.”

She added: “What remains impressive is the continued growth of battery electric vehicles, with the market well on track to surpass last year’s overall registrations.

“Businesses and private drivers are embracing the transition to electric and reaping the many environmental and cost-saving benefits it offers.

“Yet, significant challenges lie ahead. EV drivers face a hike in charging costs and further clarity is needed on company car tax tables beyond 2025 to give fleet managers the confidence they need to make long-term purchasing decisions.

“All eyes will be on the government in the months ahead to ensure that the goodwill and progress made along the road to zero already this year doesn’t start to stall.”

Jon Lawes, managing director of Novuna Vehicle Solutions, says that supply constraints and economic uncertainty have stifled what is usually a bumper month for the motor industry.

Nevertheless, he said: “Demand for electric vehicles has been the positive takeaway for the motor industry this year. Registrations of battery powered vehicles for the year to date are up 40.3% on this time last year.”

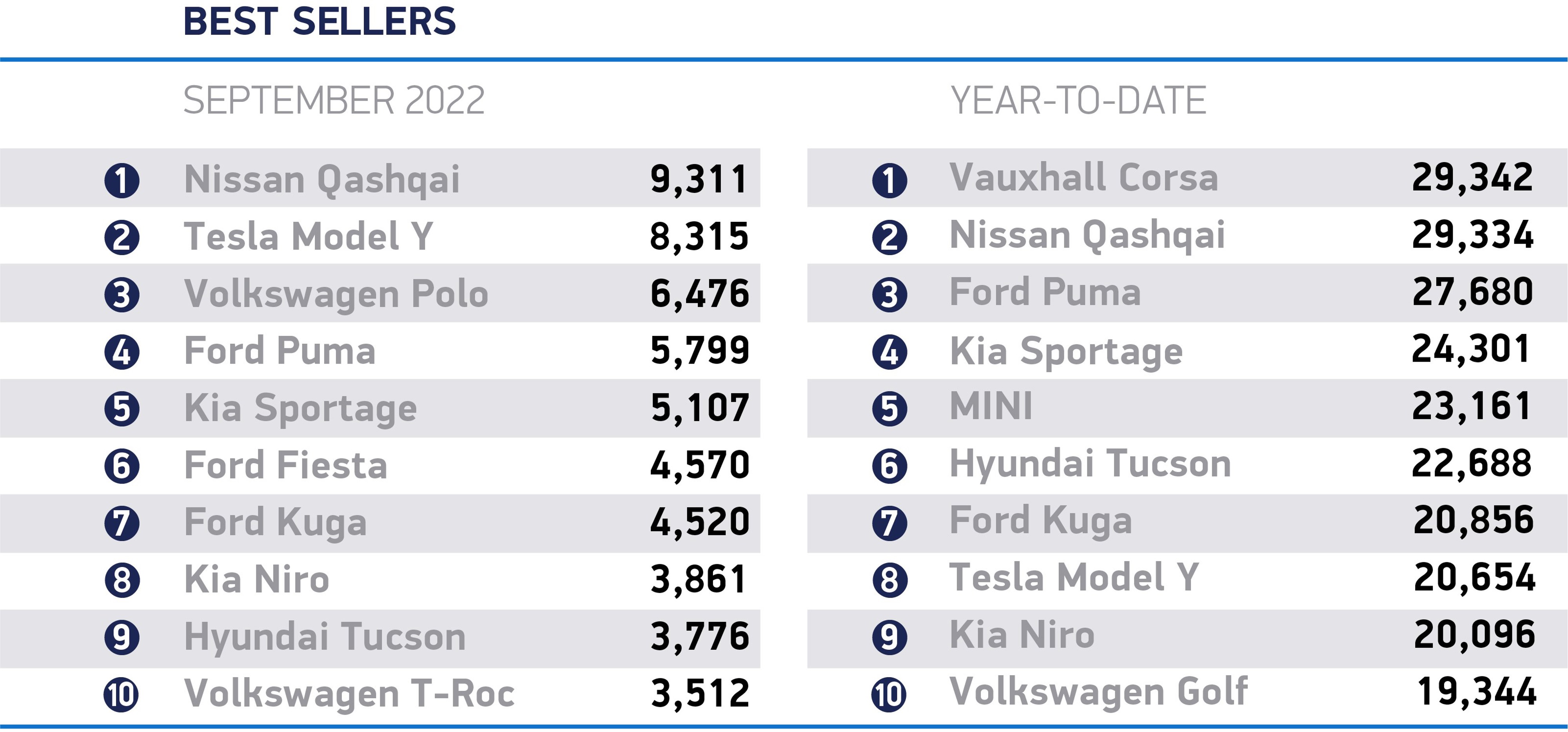

In terms of segments, the largest growth was seen in multi-purpose vehicles, which rose 509.2%, adding more than 10,000 units, to 12,068, a result of key new model availability.

Superminis remained the most popular segment overall, accounting for 30.9% of all registrations.

While growth is welcome following a torrid first half of the year, total registrations for 2022 remain down 8.2% on a weak 2021 performance and more than a third (35.1%) below the first three quarters of pre-pandemic 2019, equivalent to 653,903 fewer units.

Mike Hawes, SMMT chief executive, said: “September has seen Britain’s millionth electric car reach the road – an important milestone in the shift to zero emission mobility.

“Battery electric vehicles make up but a small fraction of cars on the road, so we need to ensure every lever is pulled to encourage motorists to make the shift if our green goals are to be met.

“The overall market remains weak, however, as supply chain issues continue to constrain model availability. Whilst the industry is working hard to address these issues, the long-term recovery of the market also depends on robust consumer confidence and economic stability.”

Kim Royds, EV Director at British Gas, says that as the rate of EV adoption climbs, so does the pressure on the UK’s network of charging points, particularly the demand for super-fast charging which offers more convenience for drivers.

He added: “The continued uptake of EVs is dependent on government and policy makers ensuring the rollout of the charging network is done properly.

“This means focusing on accessibility, convenience for users, and ensuring the latest technology – including super-fast chargers – is put in place to build a network fit for future purpose.”

Login to comment

Comments

No comments have been made yet.