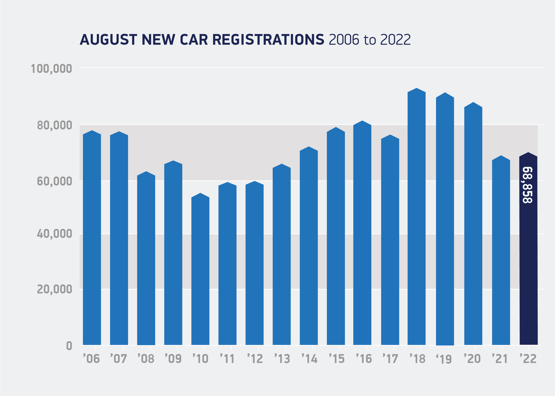

New car registrations made a modest return to growth in August, suggesting the market is starting to stabilise.

Despite the growth, August volumes were still the second worst, for the month, since 2013, as supply chain pressures continued to constrain the market.

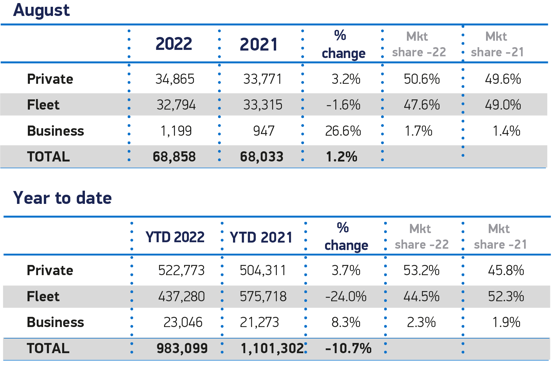

Society of Motor Manufacturers and Traders (SMMT) figures show a total of 68,858 new cars were registered, representing an uplift of 1.2% when compared to August 2021.

Mike Hawes, SMMT chief executive, said: “August’s new car market growth is welcome, but marginal during a low volume month. Spiralling energy costs and inflation on top of sustained supply chain challenges are piling even more pressure on the automotive industry’s post-pandemic recovery, and we urgently need the new Prime Minister to tackle these challenges and restore confidence and sustainable growth.

Mike Hawes, SMMT chief executive, said: “August’s new car market growth is welcome, but marginal during a low volume month. Spiralling energy costs and inflation on top of sustained supply chain challenges are piling even more pressure on the automotive industry’s post-pandemic recovery, and we urgently need the new Prime Minister to tackle these challenges and restore confidence and sustainable growth.

“With September traditionally a bumper time for new car uptake, the next month will be the true barometer of industry recovery as it accelerates the transition to zero emission mobility despite the myriad challenges.”

Fleet and business registrations accounted for 49.5% of the total for August, as decline in the segment began to slow.

Large fleet sales were down by 1.6%, in August, while small business registrations saw the biggest rate of growth (+26.6%).

Since the start of the year, fleet and business registrations are down by 22.9%.

Manufacturers continue to prioritise private consumers over fleet customers as they struggle to fulfil orders for new cars due to ongoing shortages of essential components.

Jon Lawes, managing director of Novuna Vehicle Solutions, said: “These figures illustrate the continued supply-side restraints on the market, which is translating into modest sales growth. However, demand for electric vehicles remains relatively robust, despite enduring protracted lead times which we expect to see continue well into 2023.

“Despite the new Conservative leader’s daunting in-tray, it is crucial we see firm, swift action to support the automotive sector across the board including further significant public charging infrastructure investment and incentives for drivers to ramp up the transition to zero emission mobility by 2030. We would urge the incoming leadership to maintain favourable tax incentives that have been successful in boosting EV uptake to date, such as salary sacrifice, whilst devoting significant resource to improving the charging infrastructure, which remains a barrier for millions of motorists looking to transition to an EV with confidence.”

Overall growth in the month was driven primarily by battery electric vehicles (BEVs), which recorded a 35.4% increase in volumes and a 14.5% market share. However, growth in this segment is slowing, with a year-to-date increase of 48.8%, whereas at the end of Q1, BEV registrations had been up by 101.9%.

Plug-in Hybrid (PHEV) registrations fell by 23.1% to comprise 5.6% of monthly registrations. As a result, plug-in vehicles accounted for one in five (20.2%) of August’s registrations. Hybrid electric vehicle registrations remained relatively stable, falling by 0.7%.

Superminis remained the most popular vehicle class, growing market share to 34%. Multi-purpose, luxury saloon and lower medium vehicles also recorded growth of 31%, 1.5% and 1.3% respectively, while registrations of all other segments declined.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “The ascendency of EV registrations has been a bright light in a relatively gloomy picture for new car registrations this year. Yet, significant challenges lie ahead as we head into the autumn. EV drivers face a substantial uplift in charging costs due to the energy price cap increase and further clarity is needed on company car tax tables beyond 2025 to give fleet managers the insights they need to make long-term purchasing decisions."

Manu Varghese, from Ernst & Young's UK & Ireland Advanced Manufacturing & Mobility Team, added: “Although most automakers announced favourable Q2 earnings on the back of high demand and transformed inventory management practices, rising prices of components dented margins as OEMs continued to feel the heat from supply chain pressures. A British luxury car maker reported a H1 pre-tax loss of £285 million while another global automaker made 3,000 roles redundant in August as part of their cost rationalisation measures – worrying signs as we potentially head towards a recession. Also, urgent action is needed to bring down the high energy costs faced by automotive factories if their competitiveness is to be sustained. A clear challenge for the new Prime Minister."

Login to comment

Comments

No comments have been made yet.