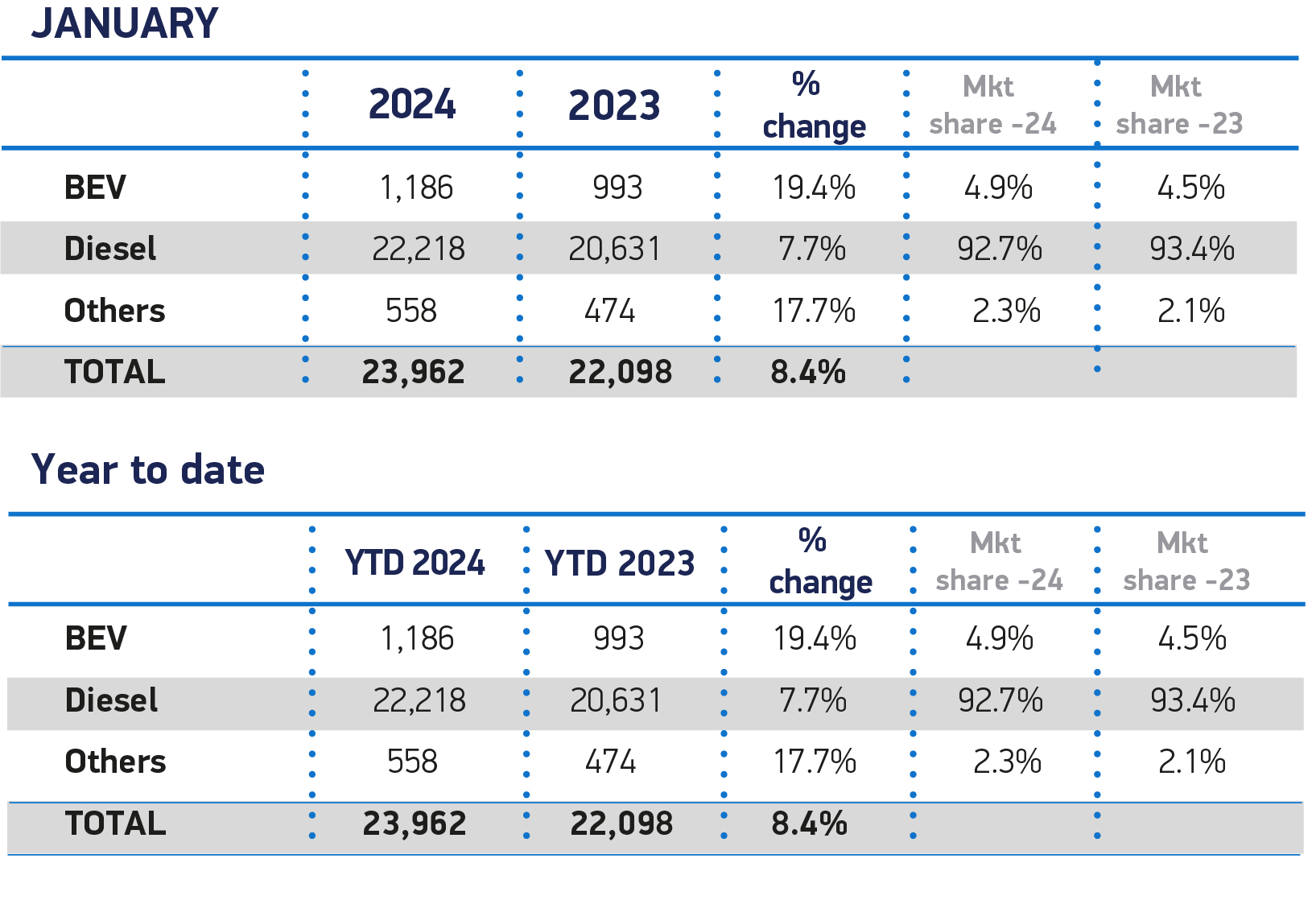

Demand for pure electric vans is increasing, but battery electric vehicles (BEVs) accounted for just 5% of the new van market in January, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

There were 1,186 new, fully electric vans registered during the month, up 19.4% on the same month last year.

As a result, some 60,517 new BEVs have joined Britain’s roads since 2018, with 28 different electric models registered in 2023.

However, the SMMT says that, with the Zero Emission Vehicle (ZEV) Mandate requiring 10% of all van registrations to be zero emission this year, demand must accelerate faster.

Volumes expected to grow from 5.9% of the market last year to 9.4% across 2024 – slightly short of the 10% target mandated by Government.

While flexibilities in the Vehicle Emissions Trading Scheme will enable manufacturers to offset this initial shortfall, the SMMT argues that softening demand underlines the need for greater investment in public charging infrastructure for vans of all sizes, which remains the biggest barrier to faster BEV rollout.

The current level of demand, furthermore, means the plug-in van grant must continue to encourage operators of all types to switch to the very latest technology.

Mike Hawes, chief executive at the SMMT, said: “More than a year of growth shows the importance of vans to Britain’s economy, and surpassing 60,000 electric vans is a crucial step in our net zero journey.

“Industry is ready to deliver a mass market transition, but buyer demand must increase massively, requiring everyone to play their part.

“Ramping up dedicated public van charging infrastructure in particular is essential for all UK businesses to be confident of making the switch, sooner rather than later.”

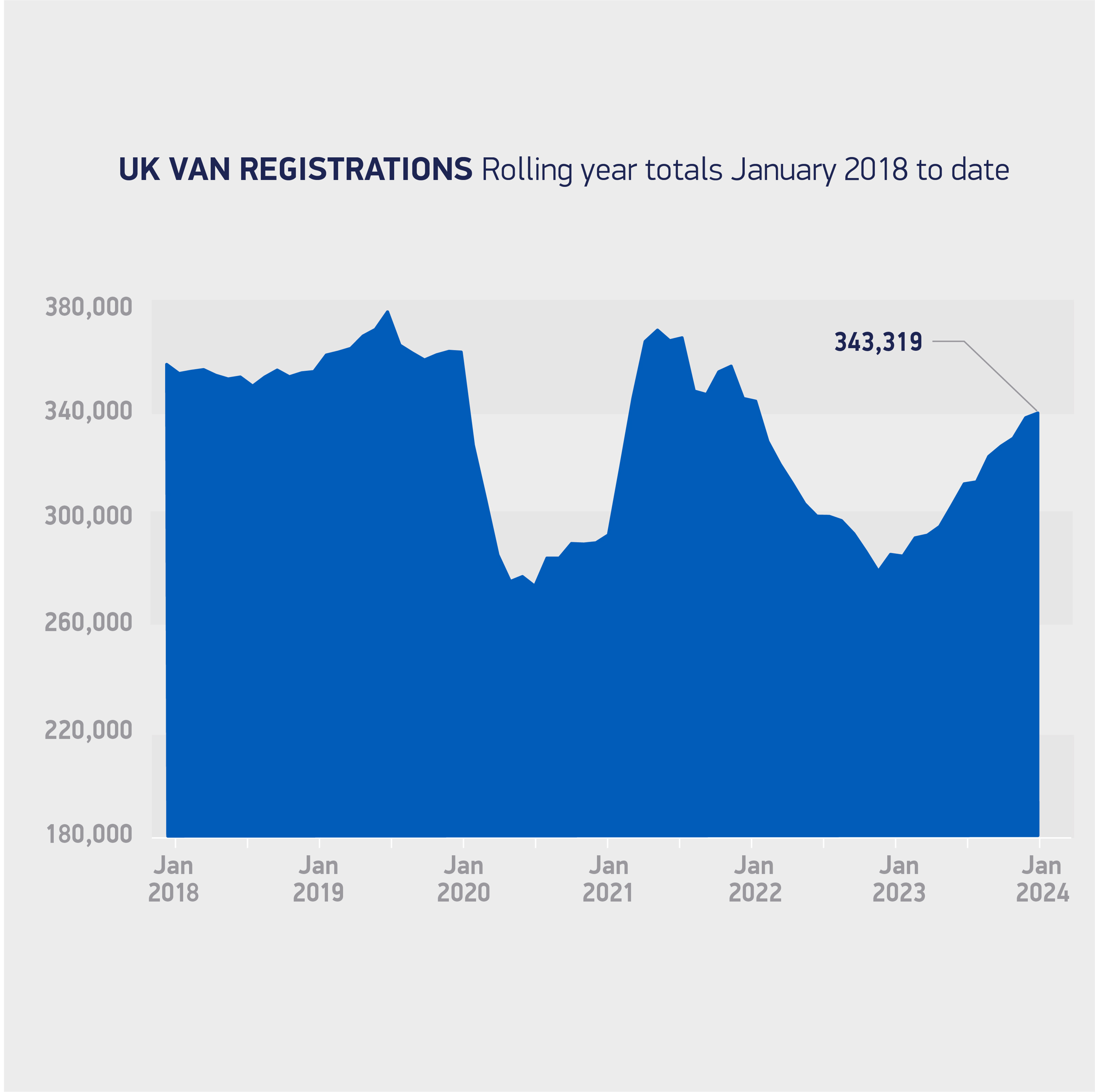

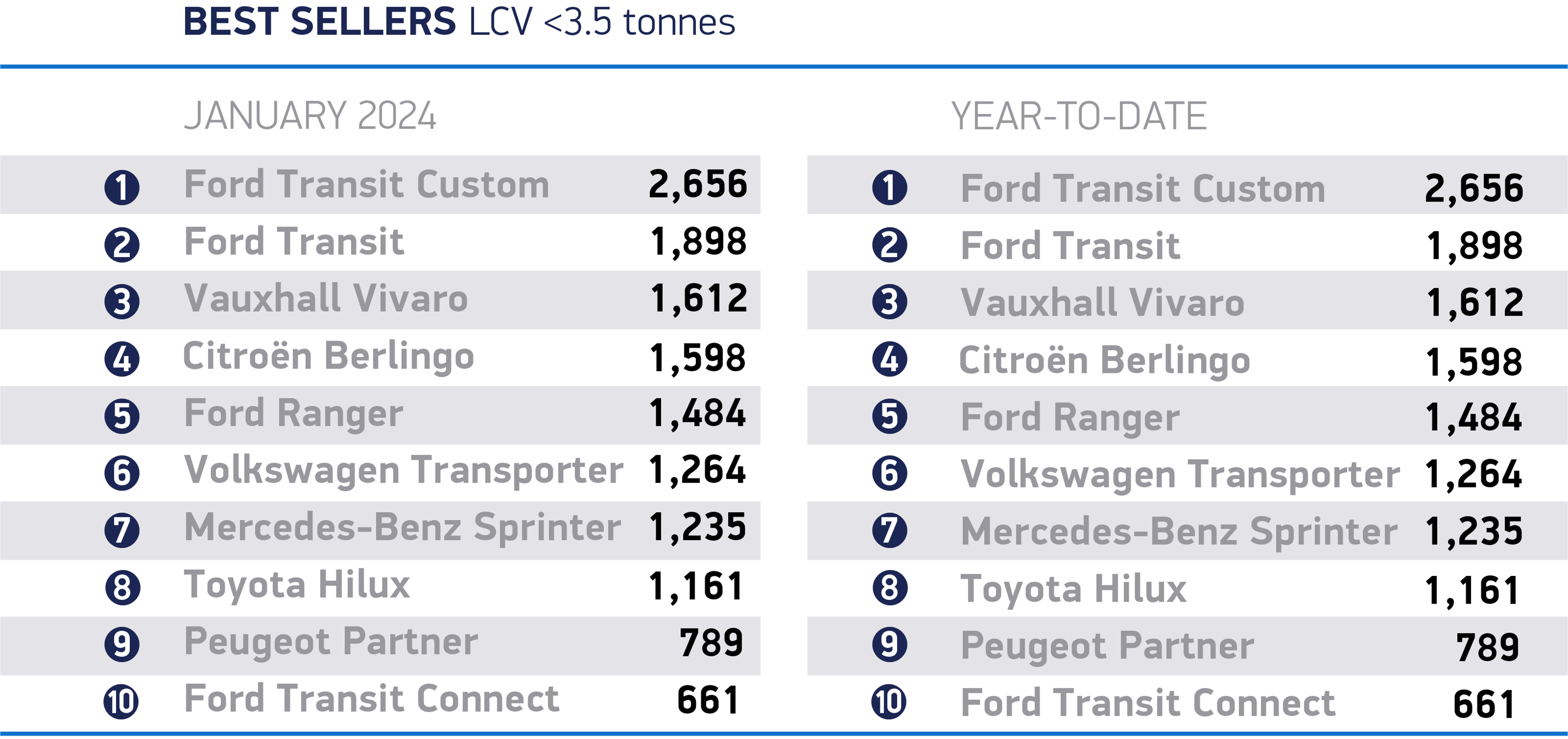

Overall, UK demand for new light commercial vehicles (LCVs) grew by 8.4% with 23,962 vehicles joining across Britain during January.

The increase marks 13 consecutive months of growth and the highest January total since 2021.

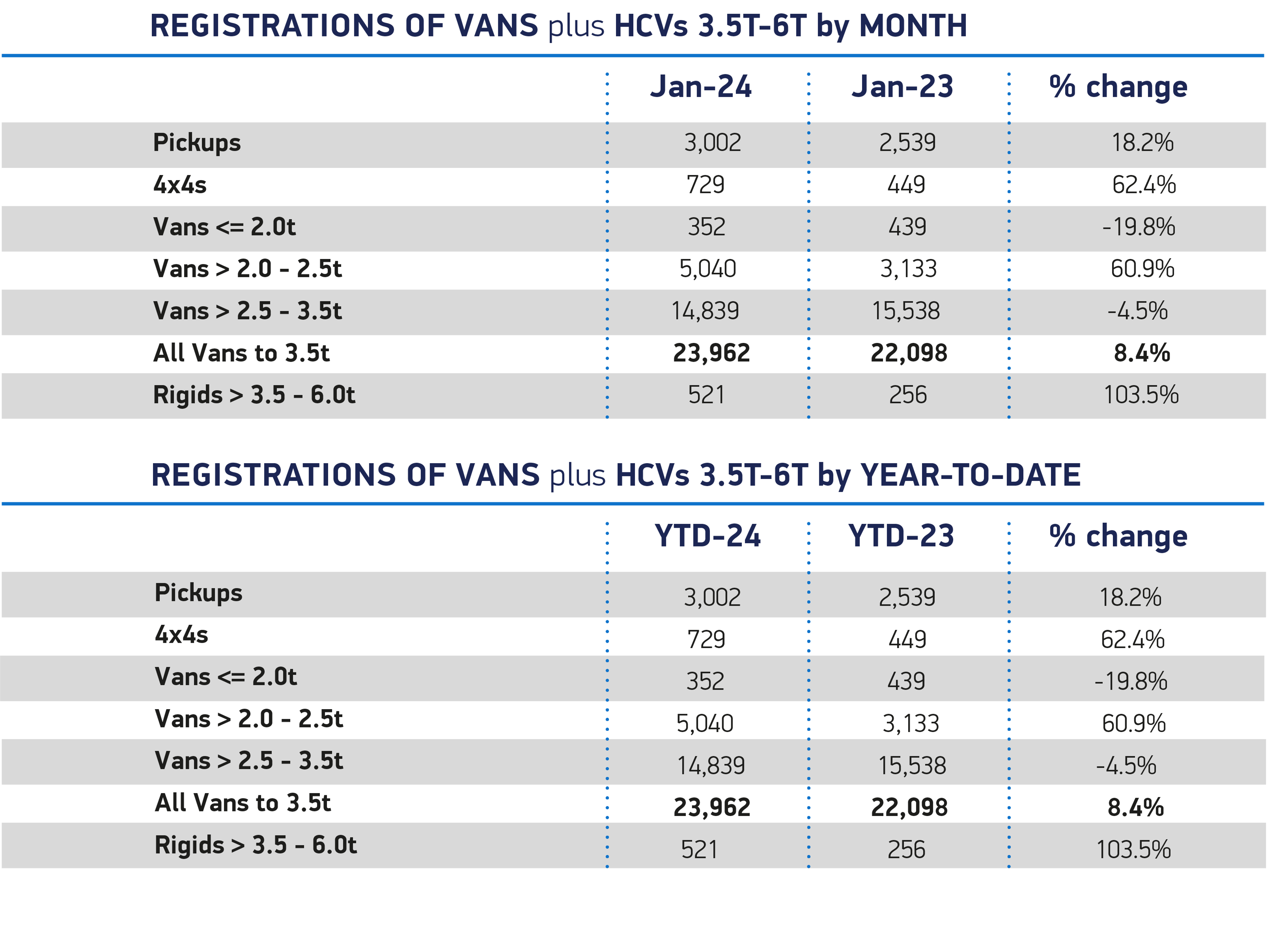

Growth was most pronounced for medium-sized vans, up by almost two thirds (60.9%) as 5,040 were registered.

Representing 21% of the whole market, these vehicles are able to carry heavy loads while also benefitting drivers with smaller size requirements, such as those in cities.

While the largest vans continue to be the most popular, registrations fell by 4.5% to 14,839 vehicles – still representing more than six in 10 (61.9%) of all new vans.

Pickup and 4x4 uptake also increased, up 18.2% and 62.4% to 3,002 and 729 vehicles respectively, while registrations of the smallest vans dropped by a fifth (19.8%) to just 352 units.

Login to comment

Comments

No comments have been made yet.