The sales of new electric and hydrogen trucks continue to rise, according to the latest registration figures from the Society of Motor Manufacturers and Traders (SMMT).

They represented 0.8% of the market in Q3 – the largest quarterly share of 2023, compared with 0.3% and 0.4% in Q1 and Q2 respectively.

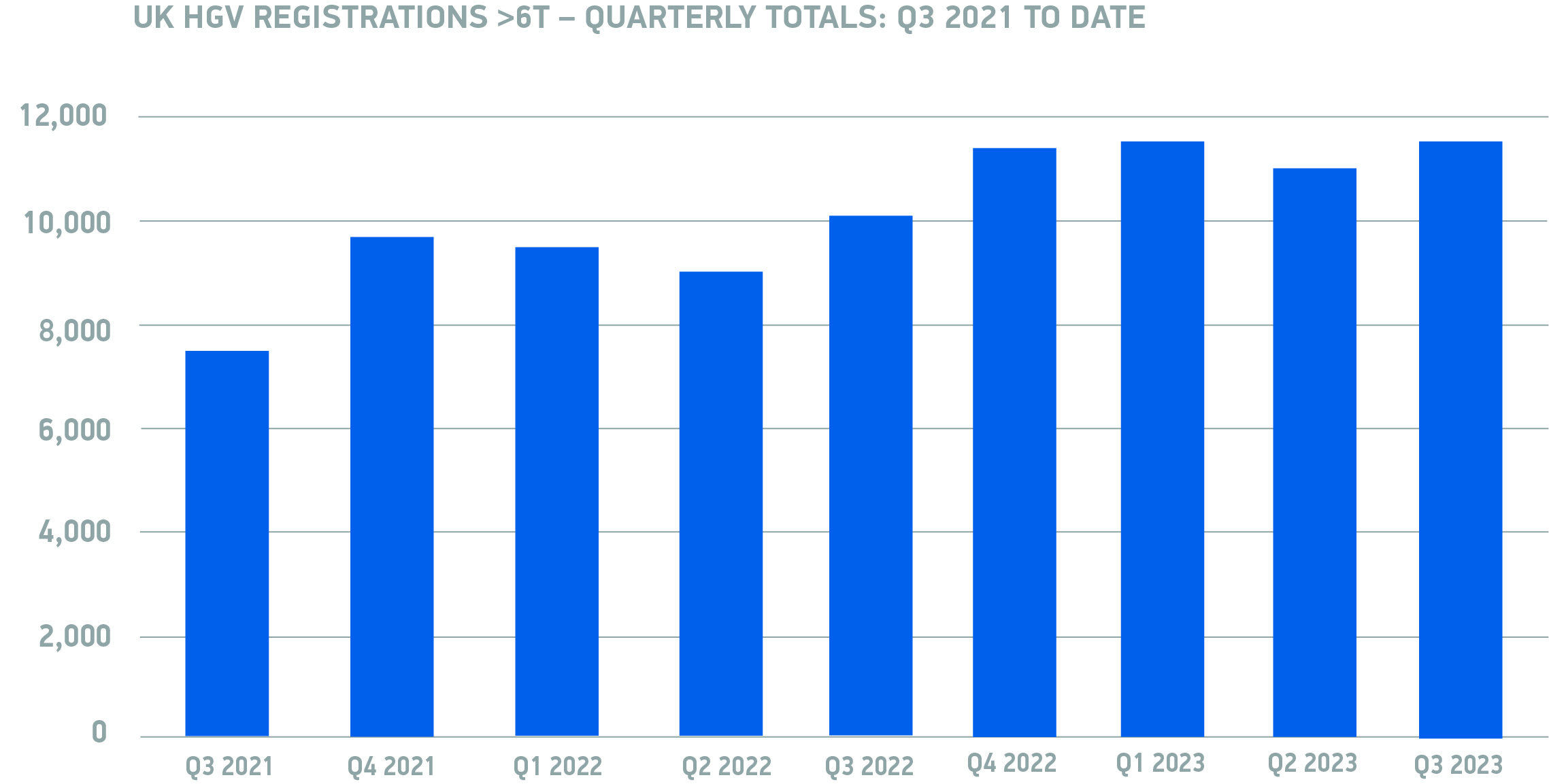

Overall, British demand for new heavy goods vehicles (HGVs) grew by 14.9% in the third quarter of 2023, with 11,531 trucks sold.

It represents the UK’s sixth consecutive quarter of growth and the greatest number of new HGV deliveries in any quarter since the end of 2019.

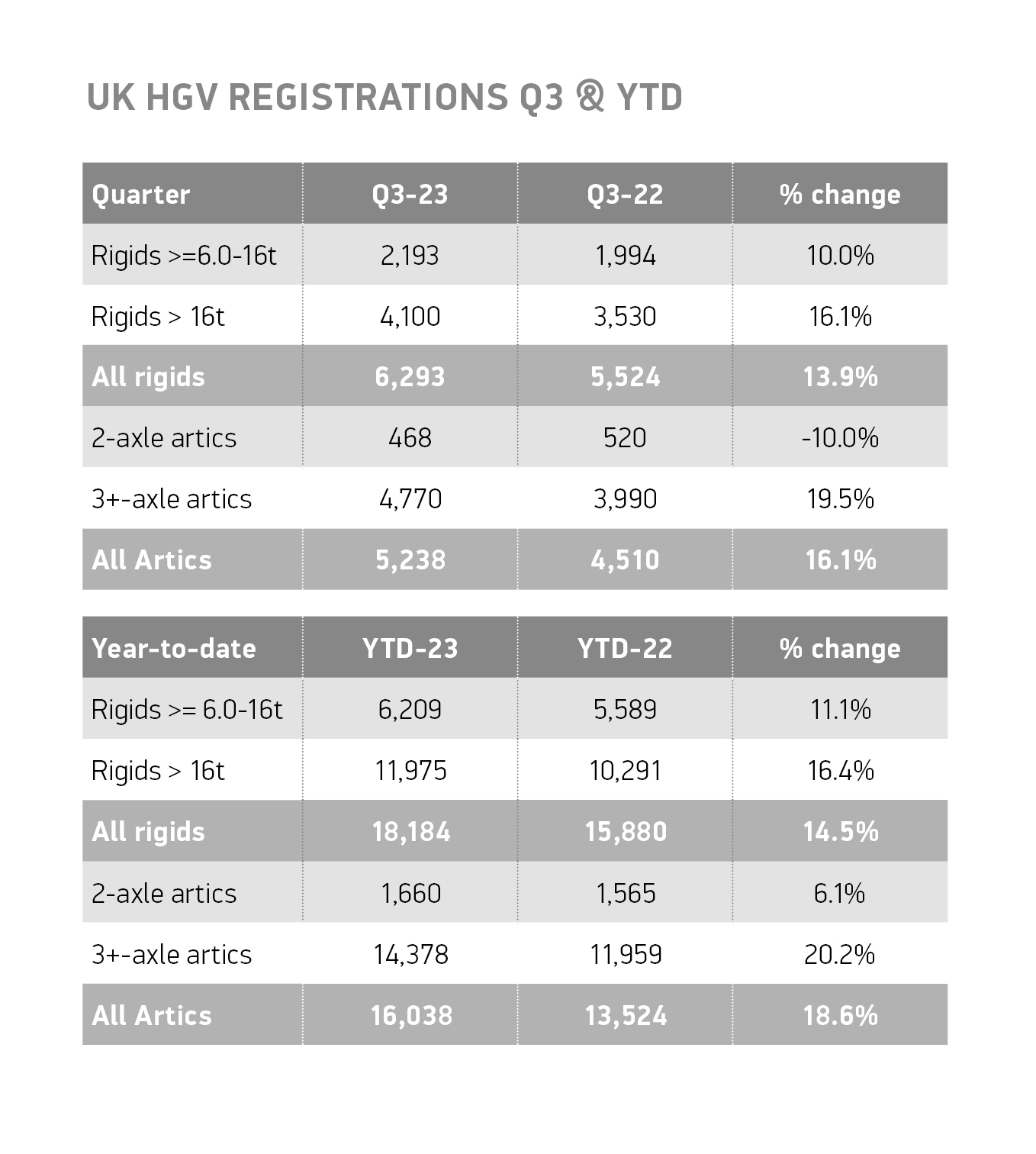

Overall growth was driven by uptake of rigid HGVs, up 13.9% to 6,293 units, while demand for articulated trucks was also strong, rising 16.1% to 5,238 units.

The most popular truck body continues to be tractors, typically used for the largest delivery trucks, up 16.4% to represent some 44.5% of the market.

There was also a rise in demand for box vans – slightly smaller delivery trucks – with registrations up 11.8%, while uptake of curtain-sided trucks and refuse vehicles increased by 62.5% and 16.6% respectively.

Tipper registrations declined, however, down 9.7% compared with a strong third quarter in 2022.

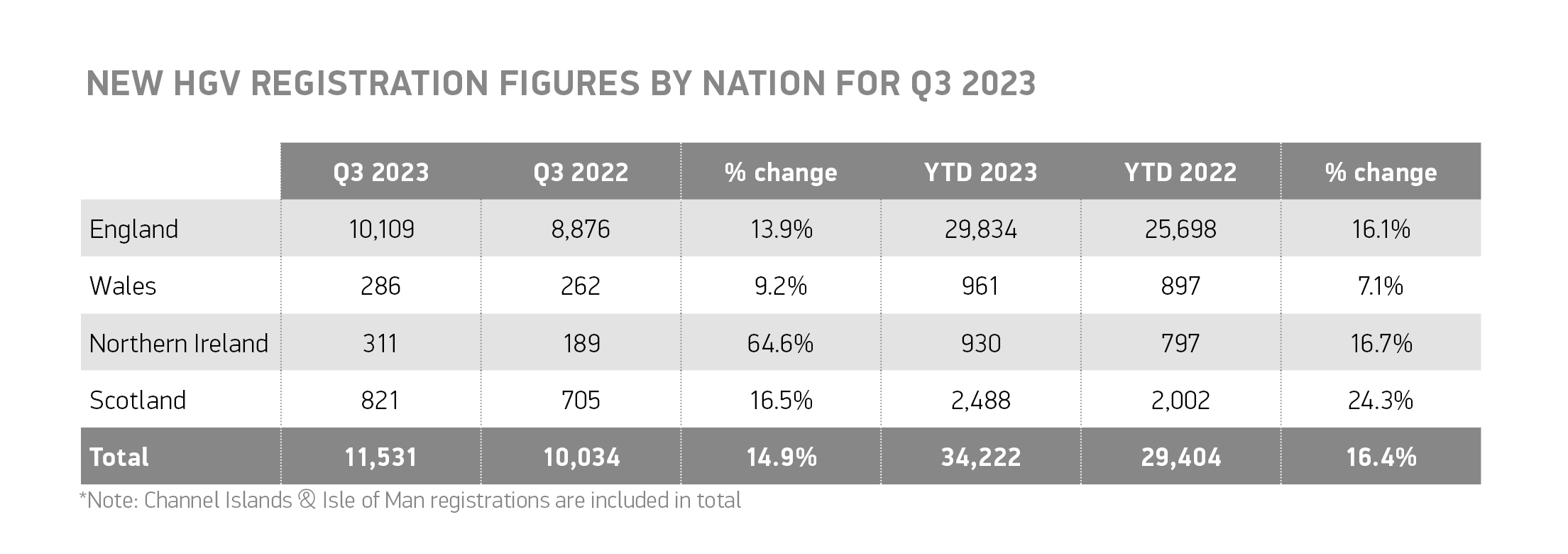

HGV operators in every UK nation continue to make vehicle investments, the vast majority (87.7%) in England in Q3, with registrations up 13.9% to 10,109 units.

Truck fleet renewal in Scotland and Wales rose by 16.5% and 9.2% respectively, while Northern Ireland saw the biggest increase, up 64.6%.

The top UK region for truck investment continues to be South East England – where some of Britain’s largest ports are located – with 2,438 new HGVs entering service there, accounting for more than one in five (21.2%) registrations.

North West England and the West Midlands were the second and third hottest spots for HGV renewal, registering 1,599 units and 1,445 units respectively.

In 2023 to date, truck registrations have grown by 16.4% to 34,222 units, just 5% below 2019 levels – with registrations having increased in every quarter since Q2 2022, as reducing supply chain challenges help to fulfil robust demand.

Transition to zero emission trucks ‘needs to be accelerated’

While zero emission truck uptake has reached record levels, its share is still a fraction of the entire HGV market.

As a result, the SMMT argues that the sector’s transition needs to be accelerated given its time-critical ambitions.

With new registrations of non-zero emission HGVs weighing under 26 tonnes are due to end in 2035 – the same date as cars and vans – zero emission vehicles represent just one in 119 new trucks, compared with one in five new cars and one in 20 new vans.

Operators need confidence to make the switch but have acute concerns over the lack of public charge point infrastructure, given their dependence on commercially viable logistics in order to meet tight business margins, says the SMMT.

With Britain’s first-ever truck-dedicated public charge point opening in the North West last month at southbound Rivington Services on the M61, the SMMT says that the ambition must be to deliver charging infrastructure at depots, truck rest stops and the strategic road network in every UK region – helping convert strong HGV demand into green growth for fleets of all sizes.

Mike Hawes, SMMT’s chief executive, said: “Britain’s sixth quarter of rising HGV rollout and increasing uptake of zero emission trucks this year underlines the sector’s strong position, with operators in all UK regions getting the latest fuel-efficient and very greenest models.

“The rate of zero emission truck uptake must increase, however, both drastically and soon – amid significant obstacles to the sector’s transition.

“With just one public HGV chargepoint in the UK, a national plan for public and depot infrastructure is urgently needed to make fleet decarbonisation a reality for all operators, now and in the long term.”

Mark Main, UK Transport Lead at EY, believes the latest quarterly truck figures underline the automotive sector’s continuing resilience against a persistently complex and challenging economic backdrop.

“Four of the top five brands also saw their HGV market share increase year-on-year in Q3, three of which saw double-digit growth, building an increasing dominance in the market,” he said.

“However, despite this promising growth, challenges continue to persist, with new manufacturers having to navigate complex supply chain issues including component supply shortages.”

“There remains a long and challenging road ahead,” he added. “Progression for zero emissions HGVs is a significant distance behind the inroads made in relation to electric cars, with stubborn challenges continuing to stunt growth.”

For example, he explains that there is a substantial gap between the infrastructure for electric HGVs compared to electric cars, with everything from the manufacture of electric HGVs to the location and availability of suitable chargers in need of significant further investment and improvement.

“This underscores the scale of the task that lies ahead in relation to increasing the volume and proportion of zero emissions HGVs enough to align with the UK’s net zero goals, not least given the fact that electric and hydrogen HGVs remain significantly more expensive than diesel alternatives,” he said.

martinwinlow - 17/11/2023 09:36

All that'll cheer up the Brexiters no end!