Delays to new van deliveries are helping drive used values to recordbreaking levels as fleets hold on to vehicles longer and demand outstrips supply.

The average selling price of a three-year-old medium-sized van, with 60,000 miles on the clock, for example, is 58% higher today than it was at the start of 2020.

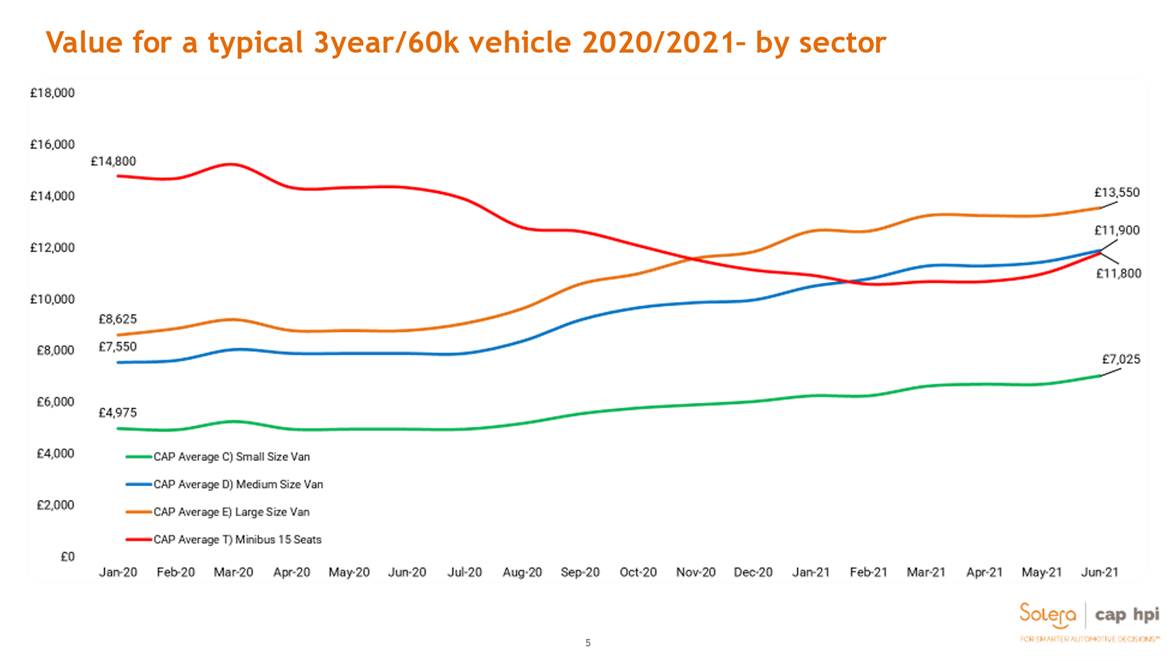

The data, from pricing experts at Cap HPI, reveals that the typical medium van was worth £7,550 18 months ago, but is now achieving an average selling price of £11,900 – an increase of £4,350 (see graph below).

“The used van market is facing a real supply-and-demand crisis,” said James Davis, customer insight director at Cox Automotive.

“Demand for used Euro 6 stock (to comply with clean air zones) is rising month-on-month and we saw our biggest share of Euro 6 van sales in May.”

However, with lead times on new vans stretching into next year as a result of the global semiconductor shortage, fleet and leasing companies are holding onto stock for longer.

Vehicle production lines have been temporarily halted, focus has been shifted to high-demand vehicles, and some options are not being offered.

Furthermore, with the auto industry facing tough new emissions targets, lower emitting models have been prioritised in some cases.

Davis explained: “There are also other material shortages, such as rubber and metal, which are further affecting new van production.

Davis explained: “There are also other material shortages, such as rubber and metal, which are further affecting new van production.

“Early estimates indicate that it will not be until we get well into 2022 that some of these challenges begin to be eliminated and we can really start to talk confidently about a new and used market stabilisation.”

Cap HPI told Fleet News that, even when new van volumes return to normal levels, production lost due to Covid-19 and material shortages will be “lost for good”.

Derren Martin, head of valuations at Cap HPI, said: “The semiconductor issue could well not have done its worst and these supply issues are likely to keep used prices strong for a good while yet.”

NEW VAN MARKET

Growth in the light commercial vehicle (LCV) market is being slowed by long lead times as a result of the semiconductor shortage, new figures from the Society of Motor Manufacturers and Traders (SMMT) suggest.

Every car- and van-maker is being impacted by the computer chip crisis, with many new vans not expected to be delivered until 2022.

SMMT data shows that 34,363 vans registered in June, which was down 14% on 2019, a shortfall of some 5,566 units as supply shortages – notably of semi-conductors – affected production volumes and caused delays in the market. Van registrations remain up 14% on Covid-impacted 2020, however.

Andy Picton, chief commercial vehicle editor at pricing firm Glass’s, said that further lockdowns and Covid restrictions in many European countries continue to affect vehicle production and the semiconductor, steel, rubber and even wood shortages continue to “compound” the situation.

VALUING USED VANS ‘DIFFICULT’

Glass’s auction data shows that the average selling price is 23.27% higher than the same point last year, while the average age of sold stock is 15.9 months older than the same point last year. The latest average mileage is 13,061 miles (16.6%) higher than in May 2020.

Manheim auction data shows its average van selling price has increased by 47% since May 2020 (£6,591 vs £9,678), despite the typical vehicle now being a month older and having covered 5,000 more miles.

At Aston Barclay, average used prices have also continued to rise, increasing by 10%, from £7,080 to £7,801, during the past quarter. “This is the highest average used LCV price Aston Barclay has recorded since its quarterly report was launched in 2019,” said the remarketing company’s national LCV manager, Geoff Flood.

In Q2 2020, average used LCV prices at Aston Barclay were £5,949, which means prices have risen by 31.1% (£1,852) in just more than 12 months.

“It makes valuing used LCVs very difficult prior to a sale as there is huge competition from dealers for every vehicle,” continued Flood.

“Recently a 204PS 67-plate VW Transporter Kombi in black with 110,000 miles made £25,000 compared with a book price of £16,600. Another 16-plate 150PS ex-lease contract VW Transporter in silver with 100,000 miles on the clock made £4,000 more than book.”

Shoreham Vehicle Auctions (SVA), meanwhile, says it sold a used 67-plate Renault Trafic van for £2,600 more than it did two years ago, despite it covering an additional 23,000 miles – a 28% increase.

It had originally sold the van in April 2019 for £9,000 with approximately 30,000 miles on the clock.

The same van was re-sold by SVA in May 2021, still in good condition, for £11,600 with 53,000 miles on the clock.

Average light commercial vehicle (LCV) values at BCA UK remained above £9,000 for the fourth consecutive month in April. This was despite both average age and mileage of sold stock rising, by 19.4% and 15.8% respectively.

Values continued to outstrip guide prices, with significant levels of demand for any vehicle that can be “put to work” immediately, it said. BCA has been averaging more than 107% of guide prices across the past month.

Stuart Pearson, its chief operating officer, said: “The used LCV market remains exceptionally competitive with buyer numbers continuing to climb, and average selling values at BCA consistently outperforming guide price expectations by a considerable margin. This is despite the average age and mileage of stock sold steadily increasing over the past year.”

CLEAN AIR ZONES DRIVE DEMAND

Clean air zone (CAZ) compliance is helping to drive demand in the used market, according to Davis, with Birmingham starting to charge older, more polluting vans from June, and London expanding its ultra-low emission zone (ULEZ) from October.

He explained: “Newer, cleaner, Euro 6 used vans continue to be a priority, with the sold volume share during May, representing 58.5% of total volume sold by Manheim.”

A third (34%) of Euro 6 volume was sold to franchised dealers, up 8% month-on-month. This reflects the increased focus on used retail in the absence of new van volumes.

Davis added: “Many other cities are now refocusing on clean air plans as we exit the pandemic, causing further headaches with the extension of lead times, especially the enlargement of the London ULEZ to include Greater London later this year.”

Long lead times on new vans, however, are forcing fleets to operate vehicles for longer, squeezing volumes into the used market when demand is high.

A business impact survey from the British Vehicle Rental and Leasing Association (BVRLA) revealed the scale of the problem, with 90% of respondents suggesting that the current supply of vans was a barrier to meeting the needs of fleets – 41% said the barrier was “extreme”.

There appears to be no respite either, with 84% thinking that the supply of vans is getting worse.

British Gas has revealed it is running vehicles that are six years old into a seventh year, to cope with the delays, while Altrad told Commercial Fleet that orders placed in Q3 2020 were only now starting to filter through.

BCA believes that, given the general increase in consumer activity as the UK economy slowly reopens, it is likely that the high levels of demand for LCVs will continue in the weeks and months ahead.

“We expect that demand in the wholesale arena will typically continue to outstrip supply and values will remain strong,” said Pearson.

“This is likely to be across the board in terms of product and age/condition profile as buyers chase stock that may be typically older or in poorer condition than they would usually buy.”

Login to comment

Comments

No comments have been made yet.