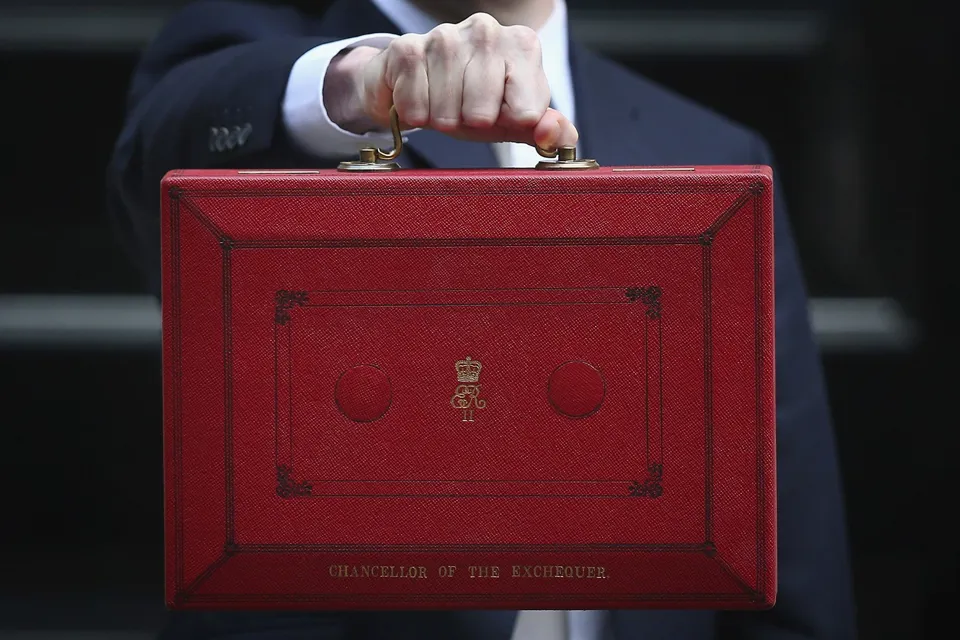

Backed by stronger-than-expected tax receipts, the Chancellor has an opportunity to support the transport and logistics sector by incentivising early take up of next generation vehicles, says the transport and logistics’ team at accountancy firm Menzies LLP.

A fuel duty cut should also be considered to soften the impact of Forex-related cost increases, it says.

Mark Perrin, partner and head of the transport & logistics’ team at Menzies, explained: “While a tax giveaway is unlikely due to uncertainties surrounding Brexit negotiations and the potential for further geopolitical shocks, the Chancellor could address some industry concerns about rising costs and the potential commercial impact of Brexit.

“With a weaker pound, transport and logistics businesses working for exporters continue to generate good activity levels. However, there is considerable uncertainty surrounding Brexit and concern exists over trading relations with Europe.”

For example, Perrin says disruption to the Dover-Calais and Channel Tunnel route caused by the migrant crisis seems to have subsided. However, it remains uncertain whether this will be sustained.

“The potential impact of tariffs and other barriers to market also needs to be considered,” he said.

To support the sector, Menzies believes the Chancellor should consider the following:

- Reducing fuel duty - Cutting fuel duty would be a welcome relief for transport & logistics companies at a challenging time. The weaker pound is expected to keep fuel prices high in the foreseeable future. Some operators have managed to negotiate fuel escalators into their contracts to help pass on some of the cost increases but some smaller operators may not have done this and are currently paying the price.

- Subsidies and tax incentives for new cleaner vehicles - The Government’s focus on ‘clean air zones’, which will restrict the movement of diesel vehicles, is a major challenge for the transport and logistics sector. Tax incentives are needed to encourage UK operators to purchase cleaner vehicles. In particular, smaller operators need extra support to avoid being caught out by the introduction of clean air zones and tax incentives would help them to fund fleet renewals.

- Driver shortages - This continues to be a problem and the government needs to invest more in apprenticeships as well as offering loans/bursaries to ensure driver shortages don’t become critical.

- Transport infrastructure - £2.6bn was committed during the Autumn Statement, but this is not enough. UK infrastructure requires significant investment to bring it up to standard and more importantly, to future proof it to accommodate more traffic and pave the way to driverless motoring and smart motorways. A joined up approach with transport hubs (airports, ports) needs to be taken rather than scattergun projects.

Login to comment

Comments

No comments have been made yet.