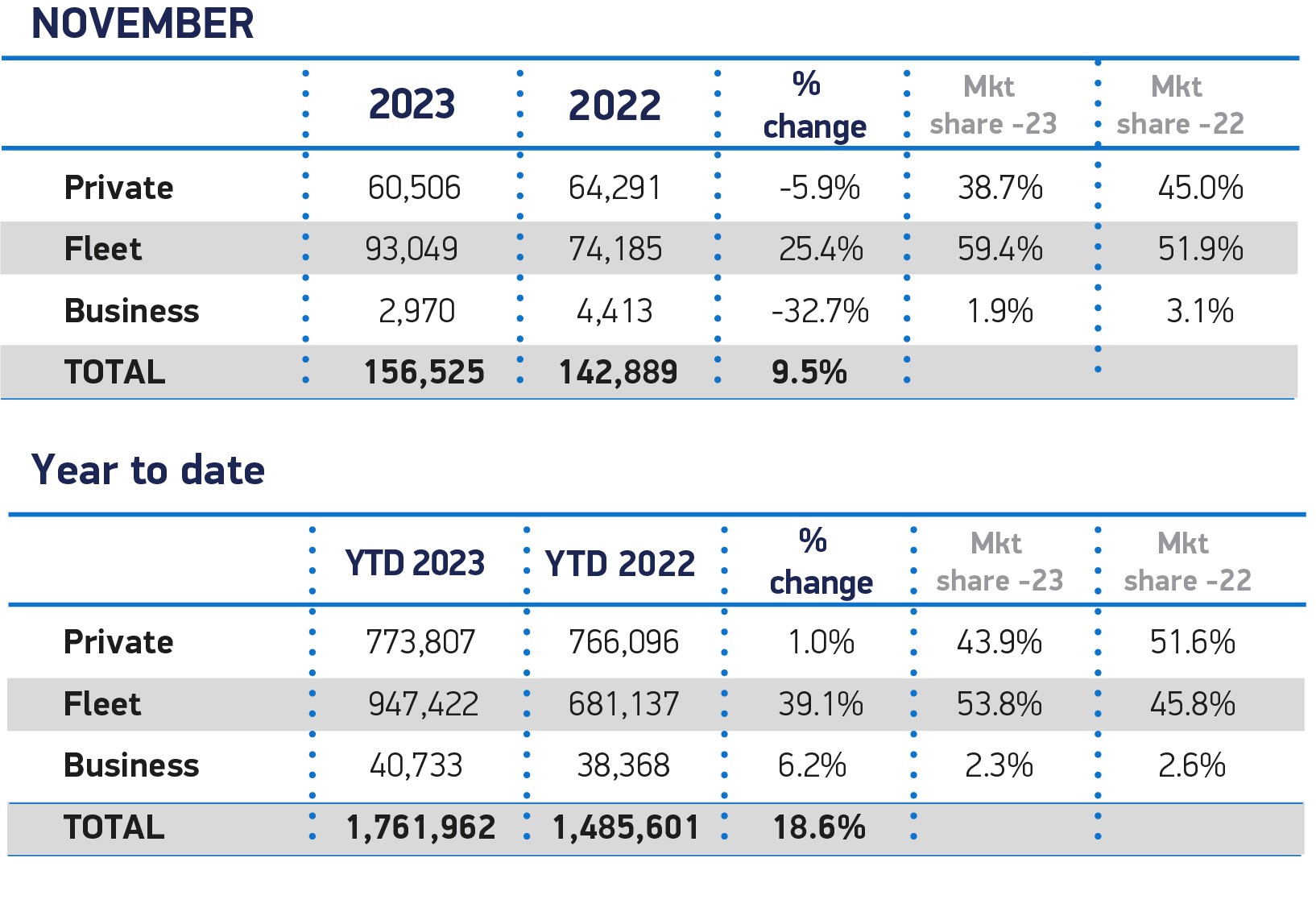

Fleet and business registrations accounted for 61% of all new car sales in November, according to newly published data from the Society of Motor Manufacturers and Traders (SMMT).

There were 96,019 new cars registered to fleet and business in the month – a 22% increase on the 78,598 units in November 2022, when the corporate sector was responsible for 55% of the market.

Private registrations stood at 60,506 in November – a 5.9% decline on the 64,291 cars reported in the same month last year.

Year-to-date, fleet and business registrations now stand at 988,155 units – a 37% increase on the 719,505 new cars registered to the sector over the same time period last year..

It means that fleet and business new car registrations account for 56% of the new car market, compared to holding a 48% market share this time last year.

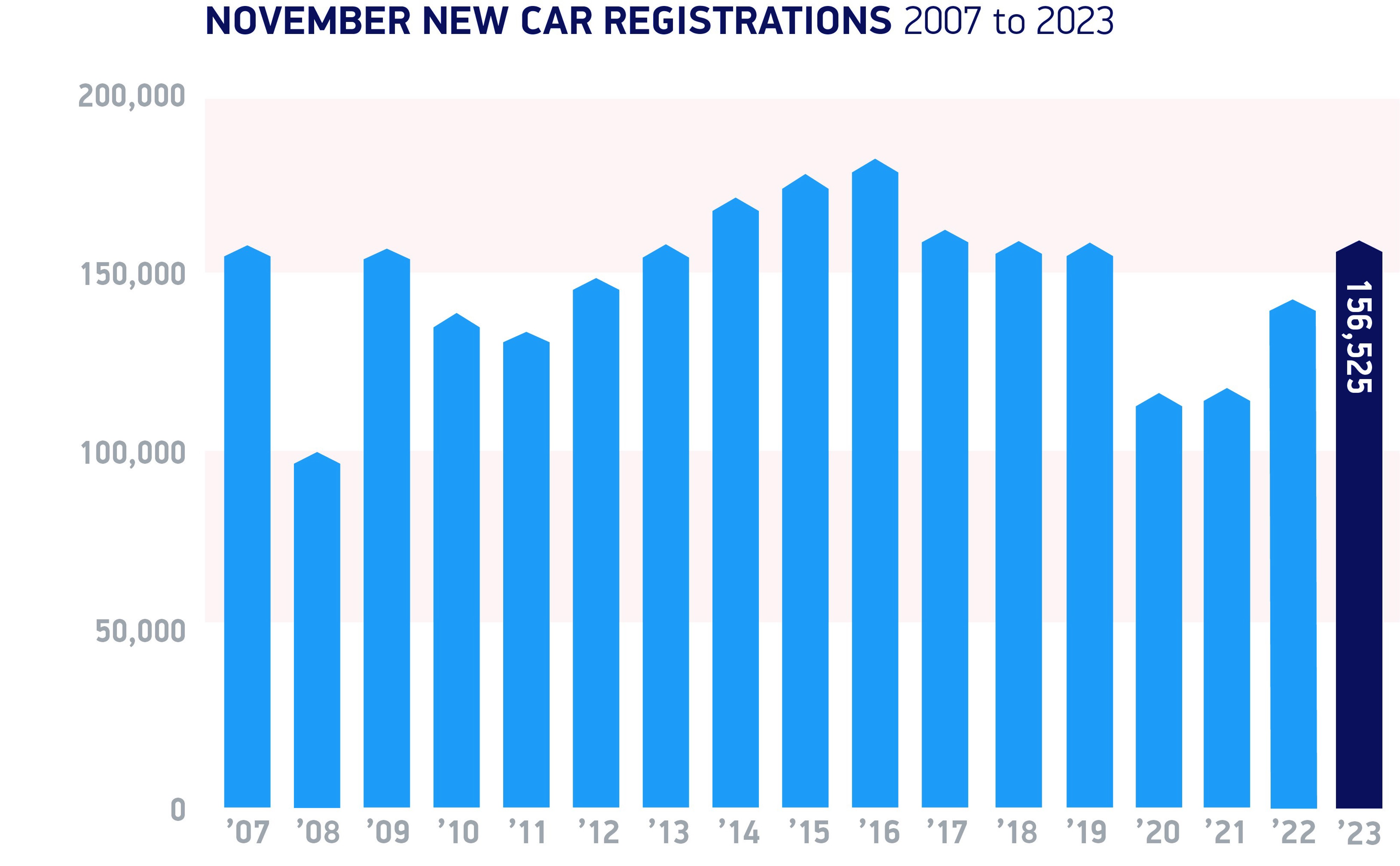

With company car registrations driving the new car market yet again, they helped overall registrations grow by 9.5% in November to reach 156,525 units.

In what was the market’s best November for four years, registrations almost returned to pre-pandemic levels, down just 96 units (0.1%) on 2019.

Year to date, the overall market remains up 18.6% at 1.762 million units, with a return to growth in the corporate market fuelling a recovery that has been underway for 16 months.

Mike Hawes, SMMT chief executive, said, “Britain’s new car market continues to recover, fuelled by fleets investing in the latest and greenest new vehicles.”

Fleets dominate new electric vehicle registrations

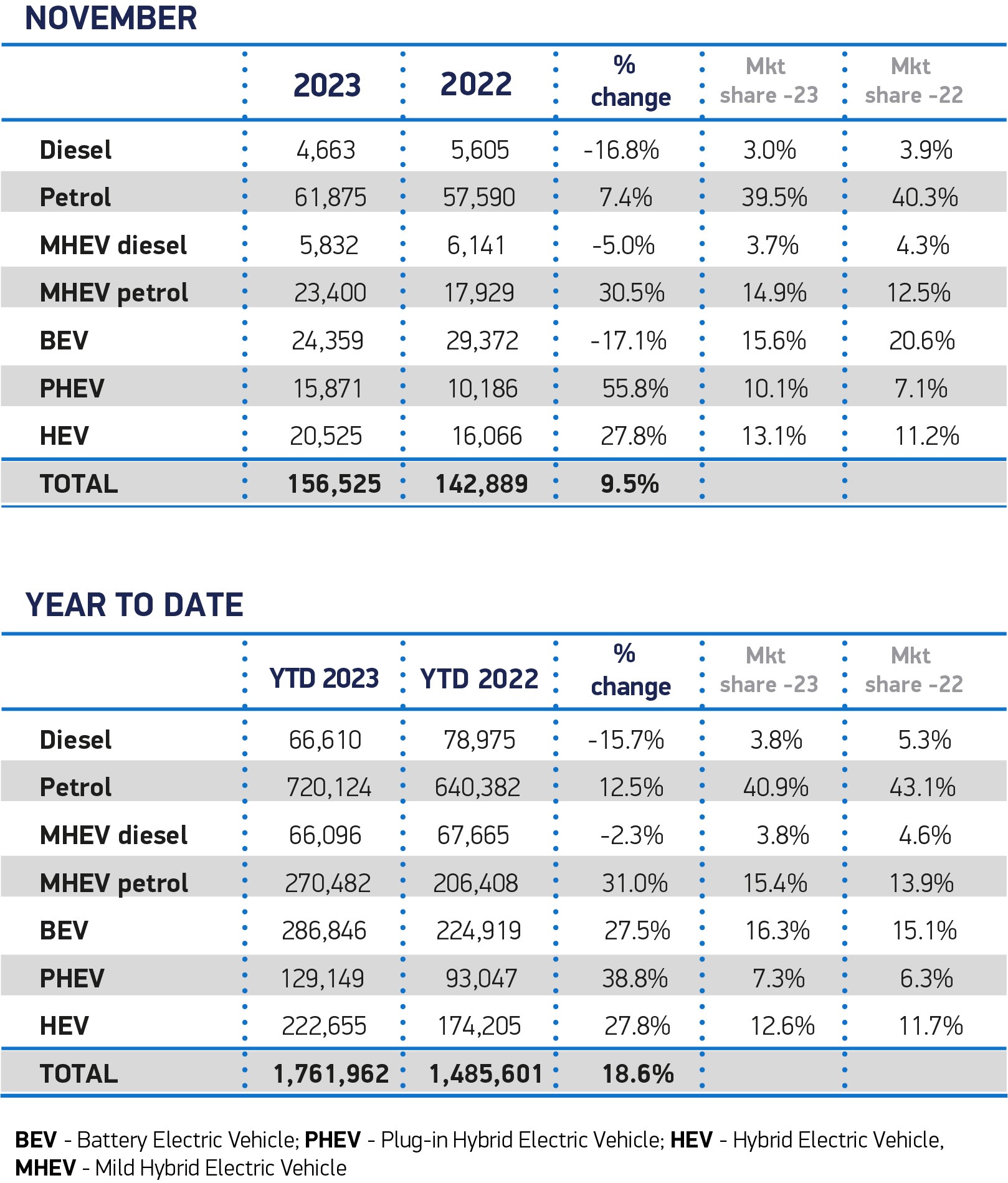

November proved a strong month for both hybrid electric vehicles (HEVs) and plug-in hybrid vehicles (PHEVs), rising by 27.8% and 55.8% respectively.

Fleets also continued to transition to battery electric vehicles (BEVs), buoyed by compelling tax incentives.

Of the 24,359 new BEVs reaching the road in November, 77.4% were taken on by fleets and businesses.

However, overall BEV volumes fell by 17.1%, leading to a reduced market share of 15.6%.

Year to date, BEV uptake is up 27.5% with a 16.3% market share – expected to rise to 22.3% next year.

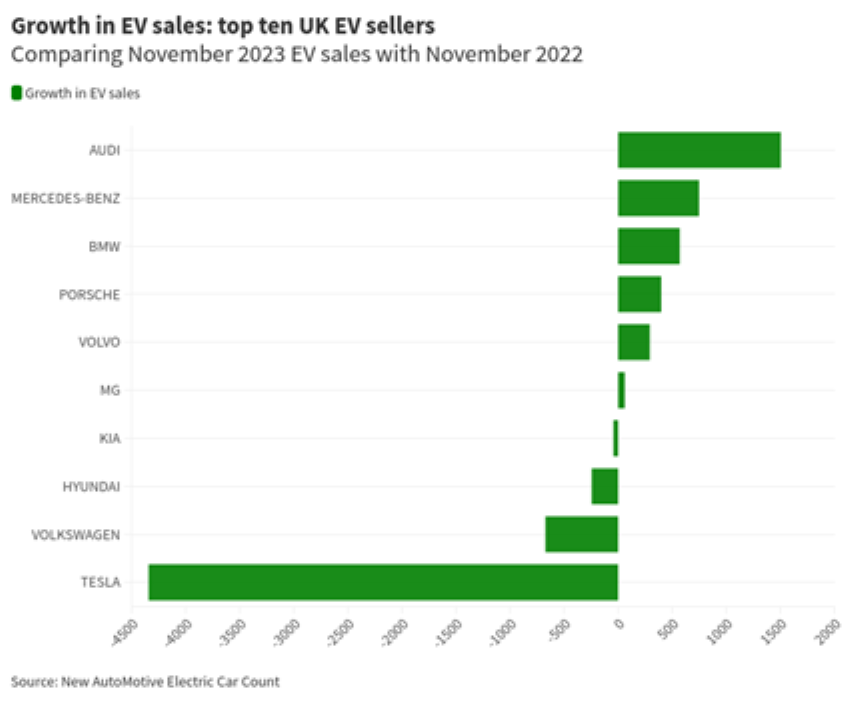

A large contributor to the drop in EV registrations is Tesla, which has suffered a series of setbacks in production in the second half of 2023, according to New AutoMotive.

Ben Nelmes, New AutoMotive’s chief executive, said: “This well-anticipated slowdown in sales of electric cars demonstrates the need for the Government to make it cheaper and easier for people to access the benefits of going electric.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, added: “The decline in sales of battery electric vehicles in November is a reminder that we also need to think about demand and the underlying charging infrastructure that’s required for consumer adoption.

“More clarity on residual values and better second hand car market for EVs will also help boost demand for new cars."

Gav Murray, EV director at British Gas, added: “It remains clear that electric vehicles hold great appeal for UK drivers and businesses, but much work remains to be done before they are accessible to all."

According to the UK Electric Fleets Coalition, almost one in three UK households have no access to off-street parking, so ample publicly available charging infrastructure, including kerbside charging, will be essential to make the switch to an EV a reality, he argues.

"This is a key stumbling block not only for private vehicle ownership, but also for commercial fleet managers, who often need employees to be able to charge vehicles off-site and at home," explained Murray.

"That’s why we, along with a coalition of leading UK businesses, are calling for the Government to accelerate its efforts to make EV charging available to everyone who will need it.”

With new regulation coming into force in January mandating that 22% of each manufacturer’s new vehicle registrations must be zero emission, the SMMT argues that sustained recovery depends on inspiring consumers with fiscal incentives, as well as greater investment in essential charging infrastructure that gives drivers confidence.

Halving VAT on new BEVs and reducing VAT on public charging to 5% in line with home charging would increase the attractiveness of driving electric and make the zero-emission transition more accessible to a larger number of consumers, it says.

Hawes continued: “With car makers gearing up to meet their responsibilities under new market legislation, and COP28 currently underway, now is the time to take sensible steps that will multiply that economic growth and minimise carbon emissions.

“Private EV buyers need incentives in line with those that have so successfully driven business uptake – and workable trade rules that promote rather than penalise the transition.”

Threat from new rules of origin

Even more urgent is the need to delay tougher new UK-EU Rules of Origin which will begin on January 1, 2024.

Failure to postpone these rules would see EVs traded both ways incur tariffs that would raise prices for consumers at a critical moment in the transition, says the SMMT.

Jon Lawes, managing director at Novuna Vehicle Solutions, said: “The £2 billion announced in the Autumn Statement to aid zero-emission vehicle manufacturing, combined with the UK’s first ever battery strategy and a promised consultation on fast-tracking charging infrastructure, have all been encouraging steps for the UK’s EV transition.

“However, the OBR is still predicting a dramatic fall in EV uptake and with the clock ticking on incoming tariffs, this poses a threat to UK vehicle manufacturing and undermines the commitments in last month’s budget.”

Nick Williams, managing director of Lex Autolease, part of Lloyds Banking Group, highlighted how last month, EV registrations for the year surpassed the total number of EVs registered in the whole of 2022, with registrations now at 286,846, against a total 267,203 vehicles registered last year.

“Long-term commitments from policymakers, such as the ZEV mandate and 2035 ban on petrol and diesel vehicle sales, are continuing to support electric vehicle adoption as both buyers and manufacturers have the confidence to invest," he said.

“The recent commitment from Nissan is a case in point. For the UK to lead in vehicle electrification and deliver the electric transition, it is vital we continue to encourage OEMs that Britain is the most attractive place to build their electric vehicles.”

Login to comment

Comments

No comments have been made yet.