The overall cost of charging an electric vehicle (EV) on the public network increased by 11% over the past year, according to new data published by Zapmap.

Taking more than a million recorded charging sessions per month and calculating the weighted average cost that an EV driver pays to charge on the public network, the Zapmap Price Index Index takes into account the increases in price by individual charge point operators, as well as where the largest volume of energy consumption occurs.

The figures show that the increase in costs on the rapid/ultra rapid network - where the majority of charging takes place - is driven by two key factors – consolidation and the changing mix of charging.

Although many charge point operators held their prices last year, others significantly increased theirs to bring them in line with the rest of the market.

While there was previously quite a difference in pricing levels, the top six rapid/ultra rapid charging networks have now all settled on a price point of 79p per kWh, with InstaVolt on 85p per kWh.

In terms of the changing mix of charging, the amount of energy transferred each month by ultra-rapid charge points overtook that of rapid charge points, in June 2023.

During December 2022 for instance, rapid charge points delivered almost half (49%) of all kWh delivered in the month, while ultra-rapid charge points delivered 29% of the total.

In contrast, December 2023 saw rapid chargers deliver just 32% of all kWh in the month, with ultra-rapid chargers delivering 45% of the total.

The figures show that, although ultra-rapid options are generally more expensive, electric car drivers increasingly used these high-powered devices as their numbers grew in 2023.

According to Zapmap, the estimated energy transferred by ultra-rapid charge points increased by nearly 150% over the course of the year, while the number of ultra-rapid devices increased by 112% in the same period.

The consolidation of prices at the new higher level in public charging can be seen in the context of uncertainty in wholesale energy prices - there are no price caps for business - and an increase in the costs of building and operating charge points.

One major factor, says Zapmap, has been a change to the grid code that means operators are having to absorb standing charges that are, in some cases, 10 times what they were two years ago.

In parallel, charge point operators are facing increasing pressure to deliver a good return on investment.

Melanie Shufflebotham, co-founder and chief operating officer at Zapmap, said: “This year, with the continued uncertainty in wholesale energy prices and other cost pressures, don’t expect prices on the public charging network to come down in the near future.”

However, looking to the future, Shufflebotham believes there are reasons to be positive. “There is continued pressure on the Government to equalise the VAT levels between domestic and public charging at 5%,” she added.

“FairCharge is campaigning hard on this and the recent recommendations from the House of Lords also state that the Government should act on this.

“In addition, the industry is working both to look at the standing charges and to see if they can get electricity within the Government’s Renewable Transport Fuel Obligation.”

Many EV drivers charge at home for most of their energy needs, with the energy price cap currently sitting at around 28p/kWh.

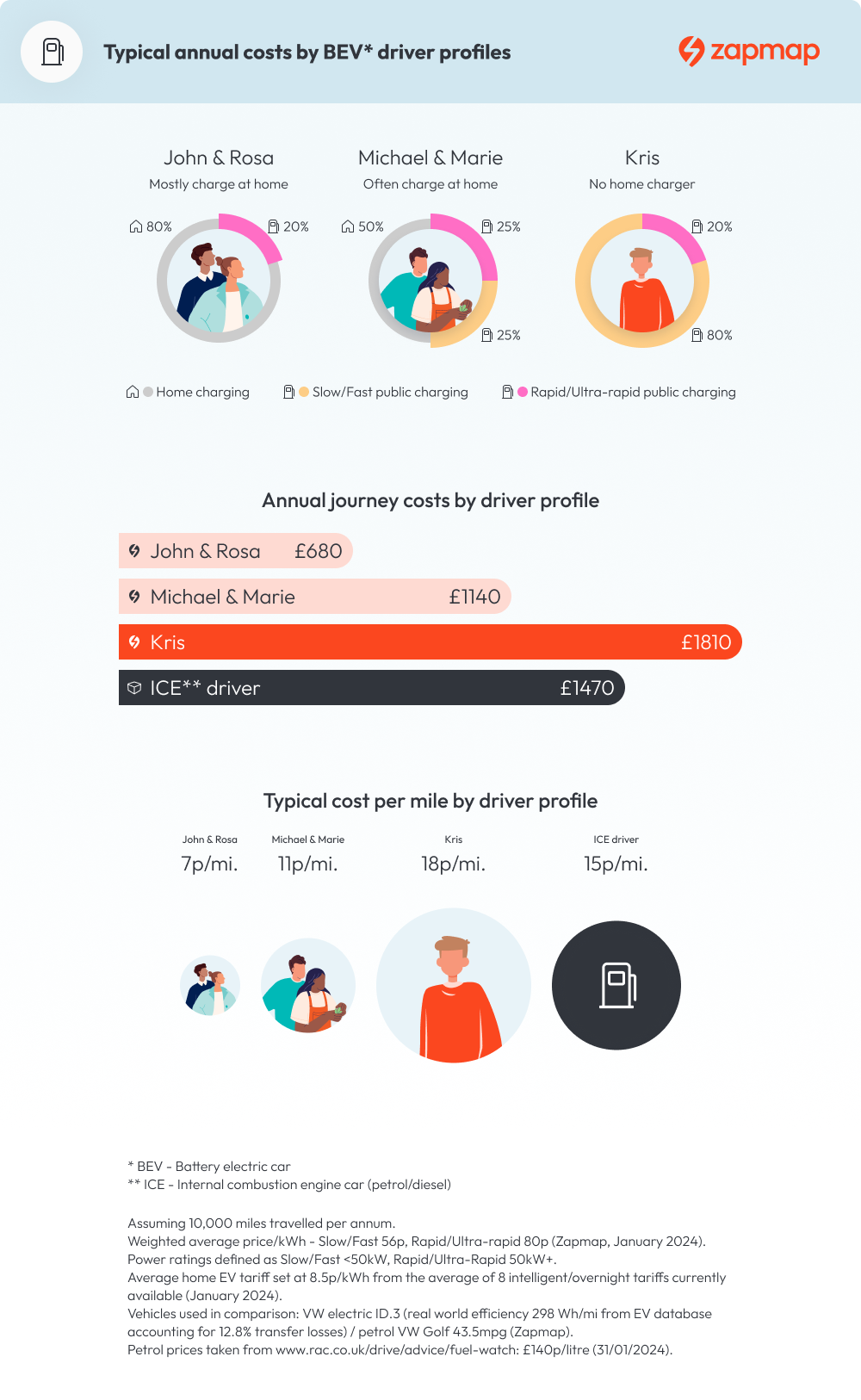

According to the Zapmap Price Index, the typical cost per mile in January for a couple who primarily charge their electric car at home (80% of the time) was 7 pence per mile (ppm).

This contrasted with 15ppm for the driver of a typical vehicle with an internal combustion engine.

Other driver profiles showed that the typical cost per mile for a couple who do half their charging at home, 25% on public rapid/ultra-rapid charge points and 25% on slow/fast chargers was 11ppm last month.

However, a driver doing 80% of their charging on the public network would see their typical costs sitting at around 18ppm.

Currently, the Government’s advisory electricity rate (AER), used to reimburse electric company car drivers for business mileage, is 9ppm.

There is certainly concern about the price of public charging, with 62% of respondents to Zapmap’s annual charging survey highlighting the high cost of charging on the public network as a problem - up from 41% in 2022.

Additionally, only 14% of respondents said they were willing to pay more than 80p/kWh for high-powered charging.

Jade Edwards, head of insights at Zapmap, said: “It’s really interesting to see from these figures how EV charging prices changed last year, in line with the more than 100% growth in ultra-rapid devices being installed across the country.

“Although 2023 saw some charge point operators increase their prices to move more in line with the market, the changing mix of public charging options and the shift in use from rapid to ultra-rapid devices is also a contributing factor.

“This is particularly significant because we know that electric car drivers were less likely to seek out a cheaper alternative to refuel than when driving a petrol or diesel car.”

How the price for public charging changed in 2023

|

Power Rating |

Weighted average p/kWh paid - December 2022 |

Weighted average p/kWh paid - December 2023 |

% change |

|

Slow/Fast |

49 |

55 |

12% |

|

Rapid/Ultra-Rapid |

73 |

81 |

11% |

Login to comment

Comments

No comments have been made yet.