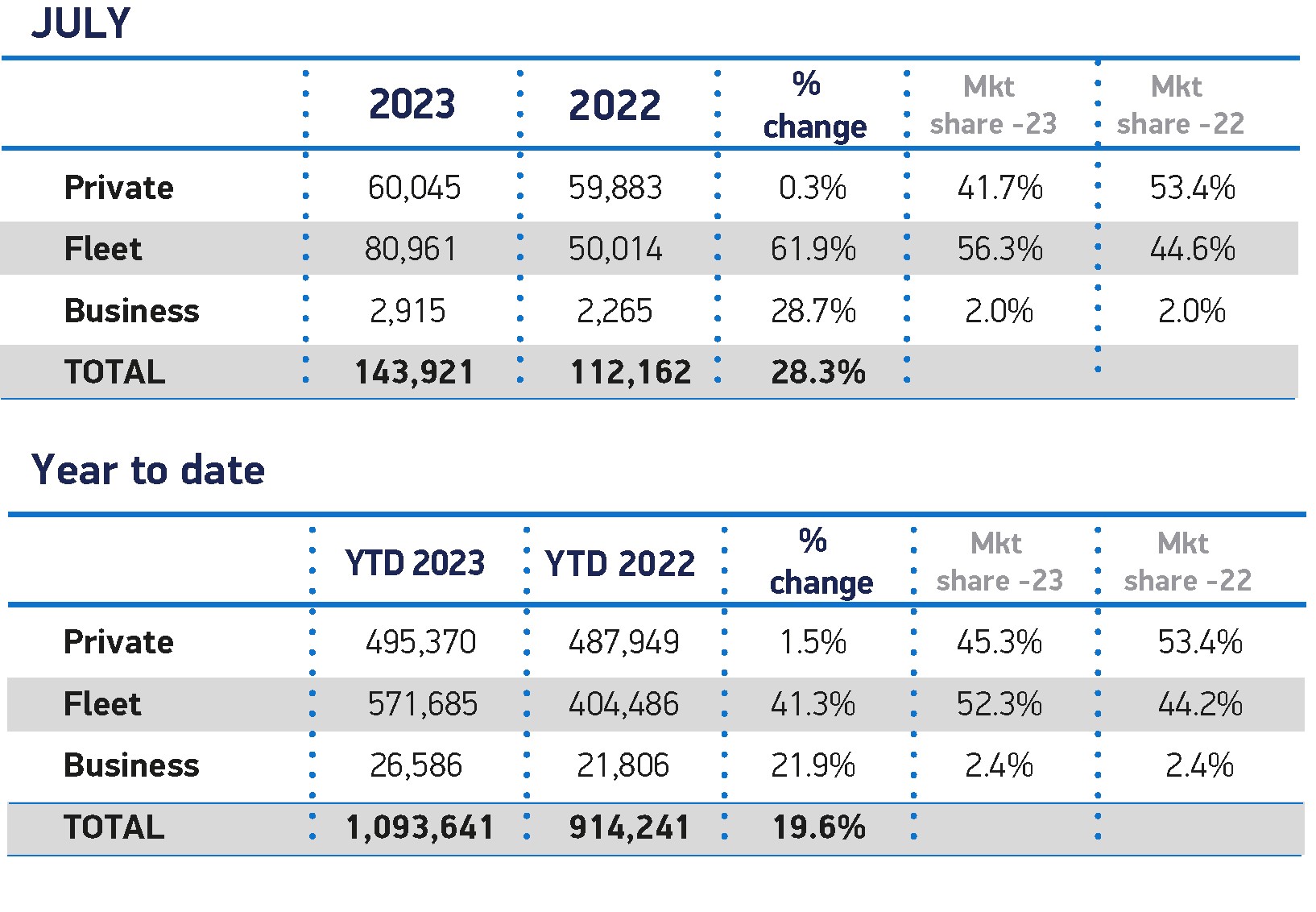

New cars registered to fleet and business were up an incredible 60% in July, while private sales were flat, up by just 0.3%

New figures from the Society of Motor Manufacturers and Traders (SMMT) show that 83,876 new cars were registered to fleet and business last month, a 60% uplift on the 52,279 units reported in July 2022.

Overall, the new car market grew by 28.3% to 143,921 in July, with private registrations vertically static year-on-year, up by just 0.3%.

Fleet and business registrations accounted for 58% of the new car market, up 12 percentage points from where it was in July 2022.

Year-to-date, fleet and business new car registrations now stand at 598,271 units, up 40.3% on the 426,292 vehicles registered over the same period last year.

Including private new car registrations, just over 1 million new cars have been sold so far this year, a 19.6% increase year-on-year, with fleet and business responsible for 55% of the market.

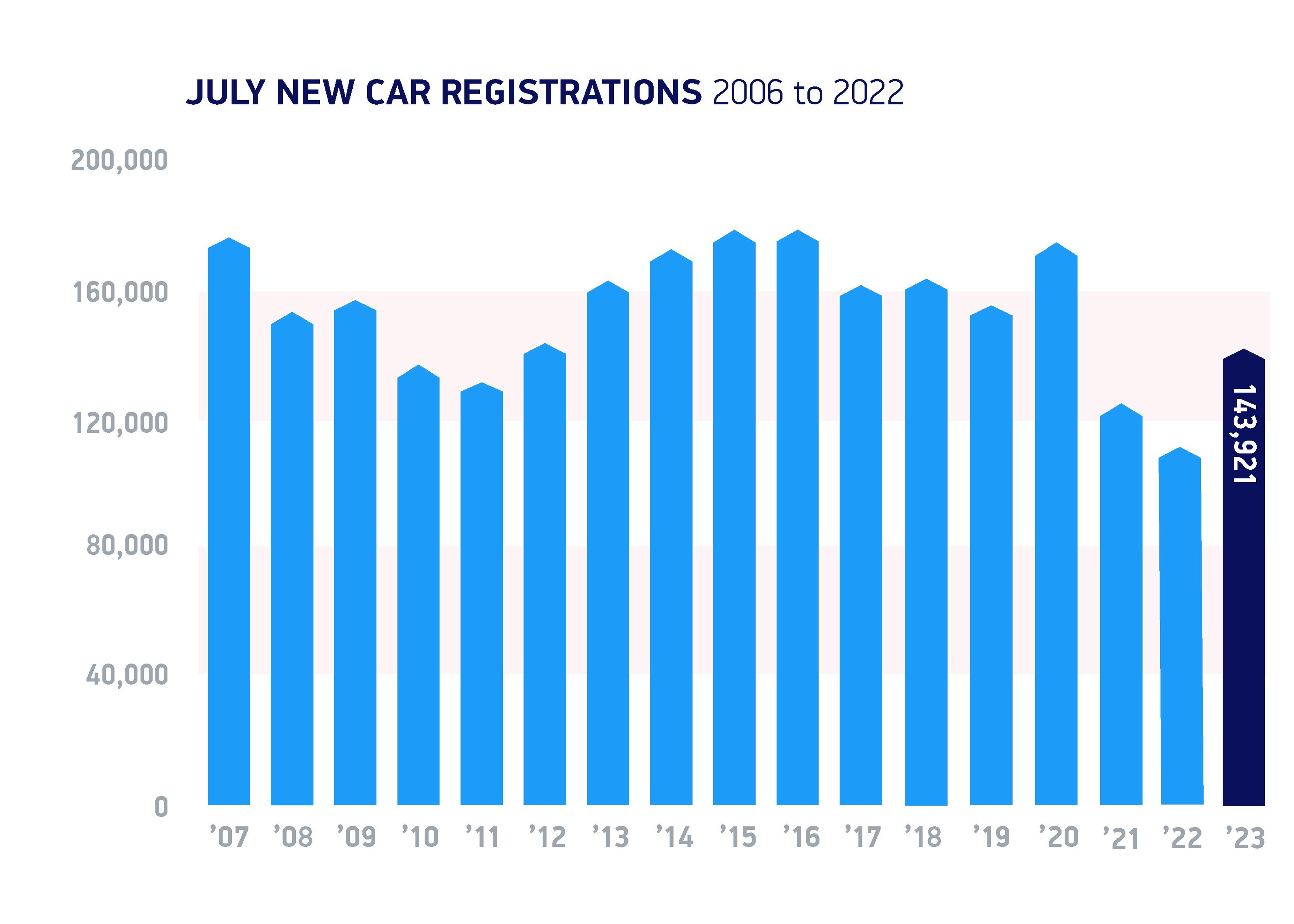

SMMT say that it was the best July performance since 2020, when pent-up demand for new cars was unleashed following three months of lockdown during the pandemic.

Despite this continuous growth, however, the overall market year to date remains behind pre-pandemic levels.

Electric vehicle registrations

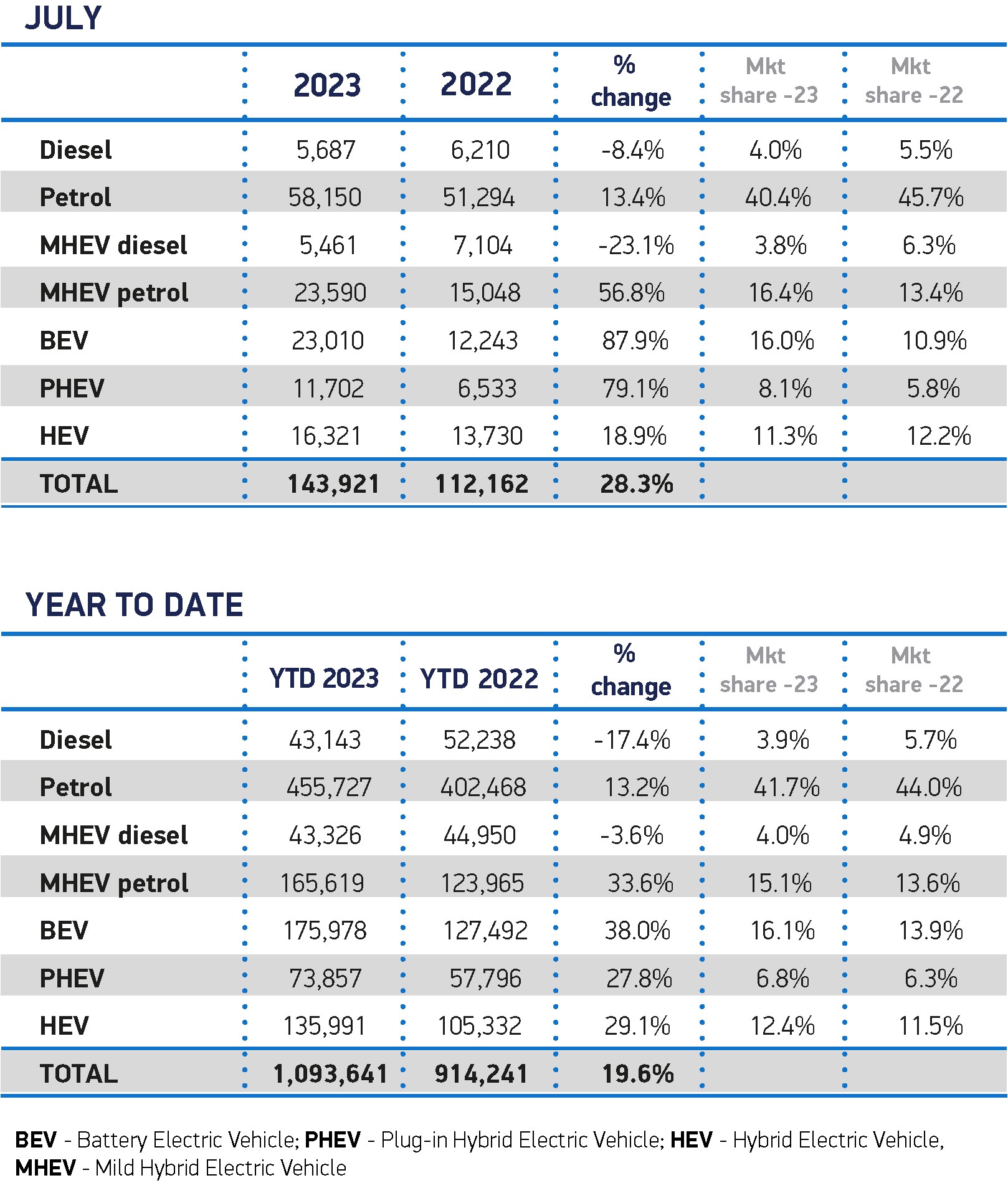

Electrified vehicles accounted for more than a third (35.4%) of the market in July.

Hybrid (HEV) volumes grew, although their overall market share fell to 11.3%, and plug-in hybrid (PHEV) registrations saw a significant uplift for the second month in a row as uptake rose 79.1% to account for 8.1% of the market.

The biggest increase, however, was for battery electric vehicles (BEVs), which recorded an 87.9% increase to account for one-in-six (16%) of all new registrations for the month, a market share broadly consistent with that seen so far this year.

The demand for battery electric cars was such that a new one was registered every 60 seconds in the month.

The SMMT believes that this will accelerate to one every 50 seconds by the end of the year, and up to one every 40 seconds by the end of 2024.

Mike Hawes, SMMT Chief Executive, said: “The industry remains committed to meeting the UK’s zero emission deadlines and continues to make the investments to get us there.

“Choice and innovation in the market are growing, so it’s encouraging to see more people switching on to the benefits of driving electric.

“With inflation, rising costs of living and a zero-emission vehicle mandate that will dictate the market coming next year, however, consumers must be given every possible incentive to buy.

“Government must pull every lever, therefore, to make buying, running and, especially, charging an EV affordable and practical for every driver in every part of the country.”

The latest market outlook now anticipates overall new car registrations to reach 1.847 million by the end of the year, a 0.9% rise on expectations in April.

Of these, BEVs are expected to take a 17.8% market share or 330,000 units, a slight decrease on April’s outlook, while PHEVs are set to achieve 7.2% of the market with 134,000 units.

Looking further ahead, the outlook for 2024 has been downgraded marginally by 0.7% to 1.951 million units, reflecting wider concerns about the cost of living.

BEVs are expected to achieve an overall 22.6% market share next year reaching 440,000 units.

With a further 155,000 PHEVs anticipated to be registered, commanding 7.9% of the market, plug-in vehicles are likely to account for three in every 10 new cars registered in 2024.

Nick Williams, managing director of Lex Autolease, said: “Every month electric vehicle registrations continue to grow, with another 23,010 vehicles added to our roads in July, helping drive the transition to electric.

“This month, all eyes will be on Government as we await the result of its consultation on the zero emissions vehicles mandate.

“It’s promising that recent weeks have seen multiple manufacturers commit to an electric future in the UK, with EV-focused investments recently announced by Renault and Geely, and Jaguar Land Rover-owner Tata.

“However, if we’re to see real change we need a robust finalised mandate with ambitious targets, as well as continued support for the rollout of charging infrastructure right across the country.”

Jon Lawes, managing director at Novuna Vehicle Solutions, believes that recent calls to dilute net zero targets are creating a level of uncertainty detrimental to driver appetite for EVs and the industry’s propensity to deliver a zero emissions future.

“Jaguar Land Rover’s investment in a much-needed electric car battery gigafactory illustrates the enormous benefits on offer when business has confidence in the UK’s transition," he added.

"Yet, any uncertainty around the direction of travel the Government is taking threatens to undermine momentum as 2030 approaches.

“Crucially, the Government must not only stand firm on the ZEV mandate to provide clarity to OEMs but also accelerate investment in public charge points and address the insufficient grid capacity needed to give businesses and consumers the confidence to make the switch.”

Gav Murray, director of EVs at British Gas, welcomed the increase in EV registrations, but warned: "The inequality of charging infrastructure across the country means millions of people can’t chose to adopt EVs because they can’t access adequate charging facilities.

"Those that do have access to public chargers face unfair costs for their use.

“We need to see VAT on public chargers – currently four times higher than the rate paid by those able to charge at home – cut to the point of parity, so not discriminating against people who want an EV, but have to rely on public charge points.”

Login to comment

Comments

No comments have been made yet.