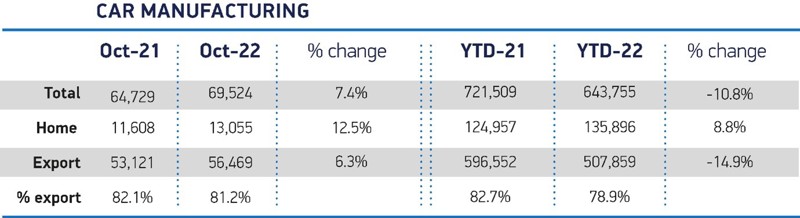

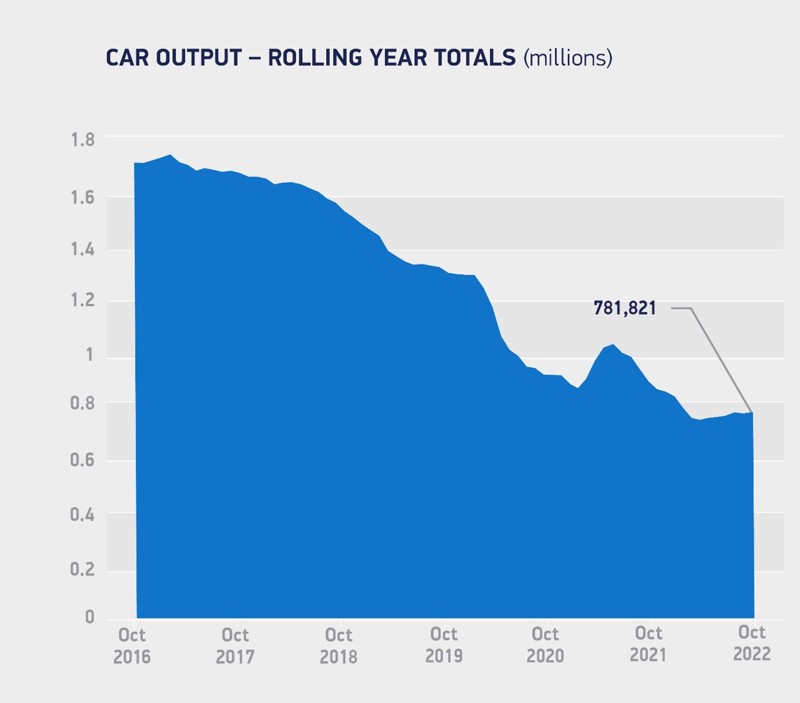

UK car production returned to growth in October with 69,524 units rolling off factory lines, according to new data from the Society of Motor Manufacturers and Traders (SMMT).

This was an increase of 7.4% compared to September, which itself was the first fall after four consecutive months of growth, showing how supply chain turbulence, in particular global chip shortages, continues to affect manufacturers.

However, October’s performance was still 48.4% lower that 2019’s total of 134,669 and 52.8% off the five-year pre-pandemic average for the month.

Mike Hawes, chief executive of SMMT, said: “A return to growth for UK car production in October is welcome, though output is still down significantly on pre-Covid levels amid turbulent component supply.

“Getting the sector back on track in 2023 is a priority, given the jobs, exports and economic contribution the automotive industry sustains.

“UK car makers are doing all they can to ramp up production of the latest electrified vehicles and help net-zero, but more favourable conditions for investment are needed and needed urgently – especially in affordable and sustainable energy and availability of talent – as part of a supportive framework for automotive manufacturing.”

Production for both home and overseas markets were up 12.5% and 6.3% respectively. Export of the latest volume, luxury and specialist models drove output with 81.2% of cars made heading overseas, equivalent to 56,469 units, while 13,055 cars were turned out for the domestic market.

Export growth was led by rising shipments to the US (26.4%), Japan (6.0%), South Korea (68.7%), Australia (125.4%) and Turkey (1,298.7%), although the total volumes to these markets remain comparatively small.

By far the majority (54.9%) of cars heading overseas went to the European Union.

UK production of battery electric, plug-in hybrid and hybrid vehicles rose again, with combined volumes up 20.3% to 24,115.

Year-to-date, UK car factories have produced a record 61,339 BEVs, up 16.2% on the same period in 2021.

Richard Peberdy, UK head of automotive at KPMG, said: “Whilst manufacturers are still working their way through the order books that have built up as a consequence of limited new car supply, fresh consumer demand for vehicles is increasingly coming under threat as the cost of living rises.

“The cost of producing cars is rising, with a range of materials more expensive due to inflation, and the industry is nervously awaiting the outcome of the government’s review into energy price support for businesses beyond the end of March. Exposure to rising energy prices during 2023 would further pressure new car prices and threaten the global competitiveness of the UK automotive industry.

“The race for countries to be seen as world leaders in electric vehicle production is well underway and the UK’s position for manufacturing cars, vans and parts depends on very considerable investment in battery manufacturing and skills. At this stage it is not clear where this is going to come from.”

Login to comment

Comments

No comments have been made yet.