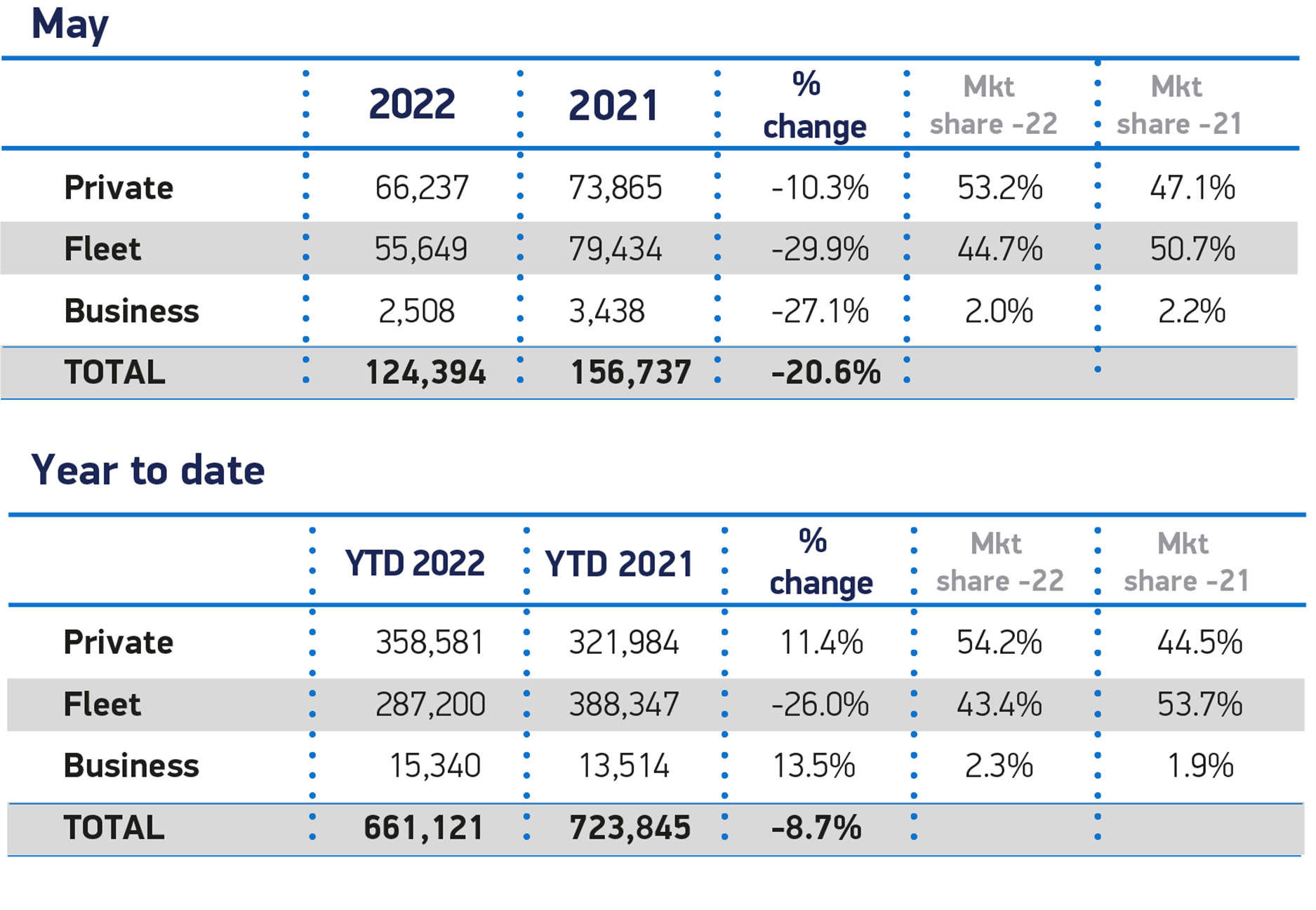

Fleet and business registrations declined by 30% in May, with new data showing there were 23,000 fewer company cars registered, compared to the same month last year.

The figures, from the Society of Motor Manufacturers and Traders (SMMT), show there were 58,157 cars registered to fleet and business, last month.

There were 82,872 cars registered to fleet and business in May 2021.

Year-to-date, the SMMT data suggests that there has been a 25% decline in company car registrations, with 302,540 units registered compared to 401,861 from January to May, last year.

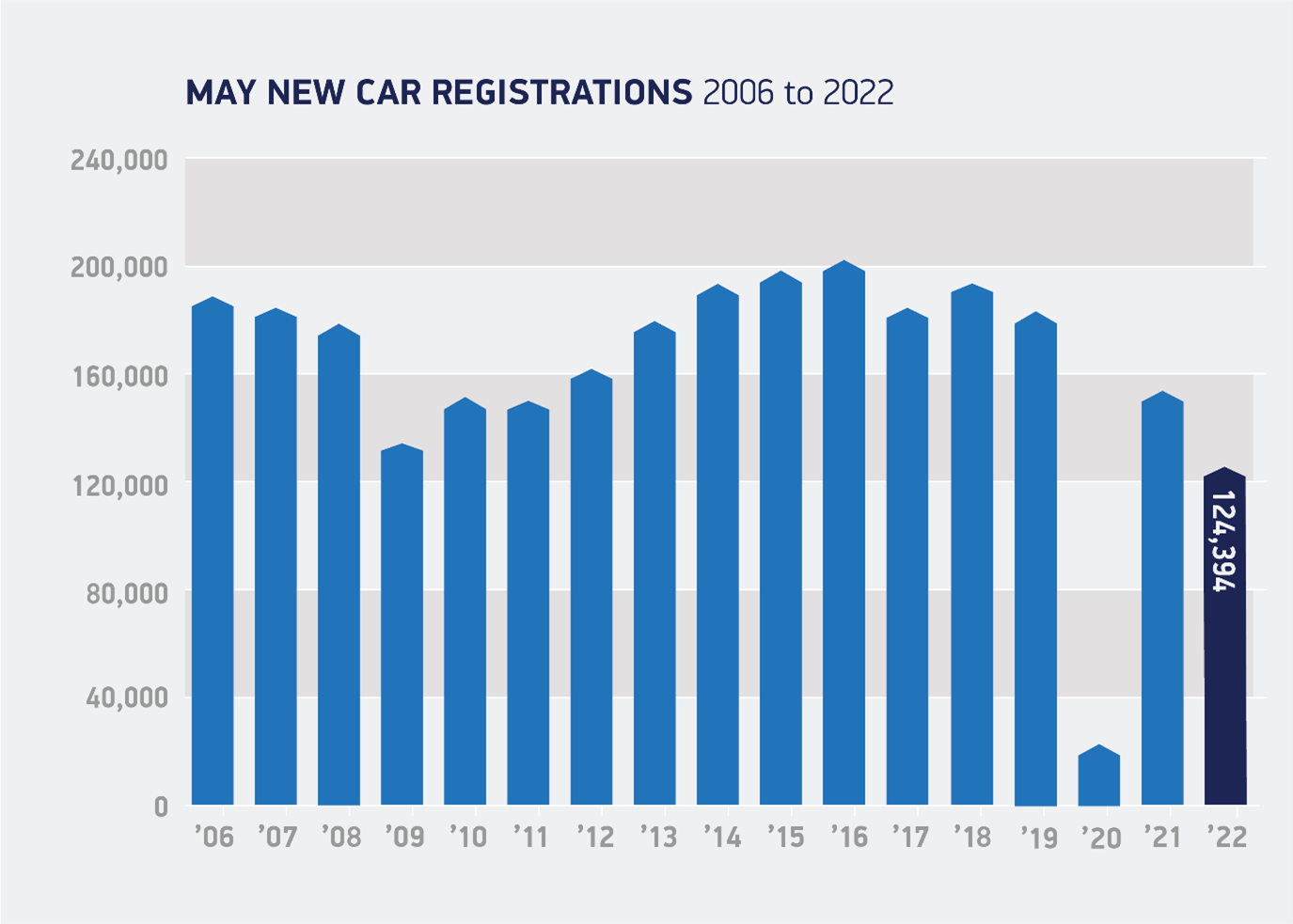

Overall, new UK car registrations fell by 20.6% to 124,394 units in the second weakest May since 1992, as supply shortages continued to hamper new purchases and the fulfilment of existing orders.

The new car market is 32.3% below the 2019 pre-pandemic level despite strong order books.

The supply chain challenge has contributed to an overall market decline in the year to date of 8.7%, equivalent to 62,724 fewer units.

This is 40.6% below the five-year average recorded from January to May, as the new car market continues to struggle to emerge from the impact of the pandemic.

While private consumer purchases fell by 10.3%, their market share increased year-on-year by 6.1 percentage points to 53.2%, in part due to manufacturers striving to fulfil deliveries – particularly of electric vehicles – to private buyers, with the commensurate effect on the business and large fleet sectors, which now comprise 46.8% of the market.

Mike Hawes, SMMT Chief Executive, said: “In yet another challenging month for the new car market, the industry continues to battle ongoing global parts shortages, with growing battery electric vehicle uptake one of the few bright spots.

Mike Hawes, SMMT Chief Executive, said: “In yet another challenging month for the new car market, the industry continues to battle ongoing global parts shortages, with growing battery electric vehicle uptake one of the few bright spots.

“To continue this momentum and drive a robust mass market for these vehicles, we need to ensure every buyer has the confidence to go electric. This requires an acceleration in the rollout of accessible charging infrastructure to match the increasing number of plug-in vehicles, as well as incentives for the purchase of new, cleaner and greener cars.”

Manufacturers have worked hard to sustain progress towards the decarbonisation of road transport and the delivery of UK’s ambitious net zero targets, says the SMMT.

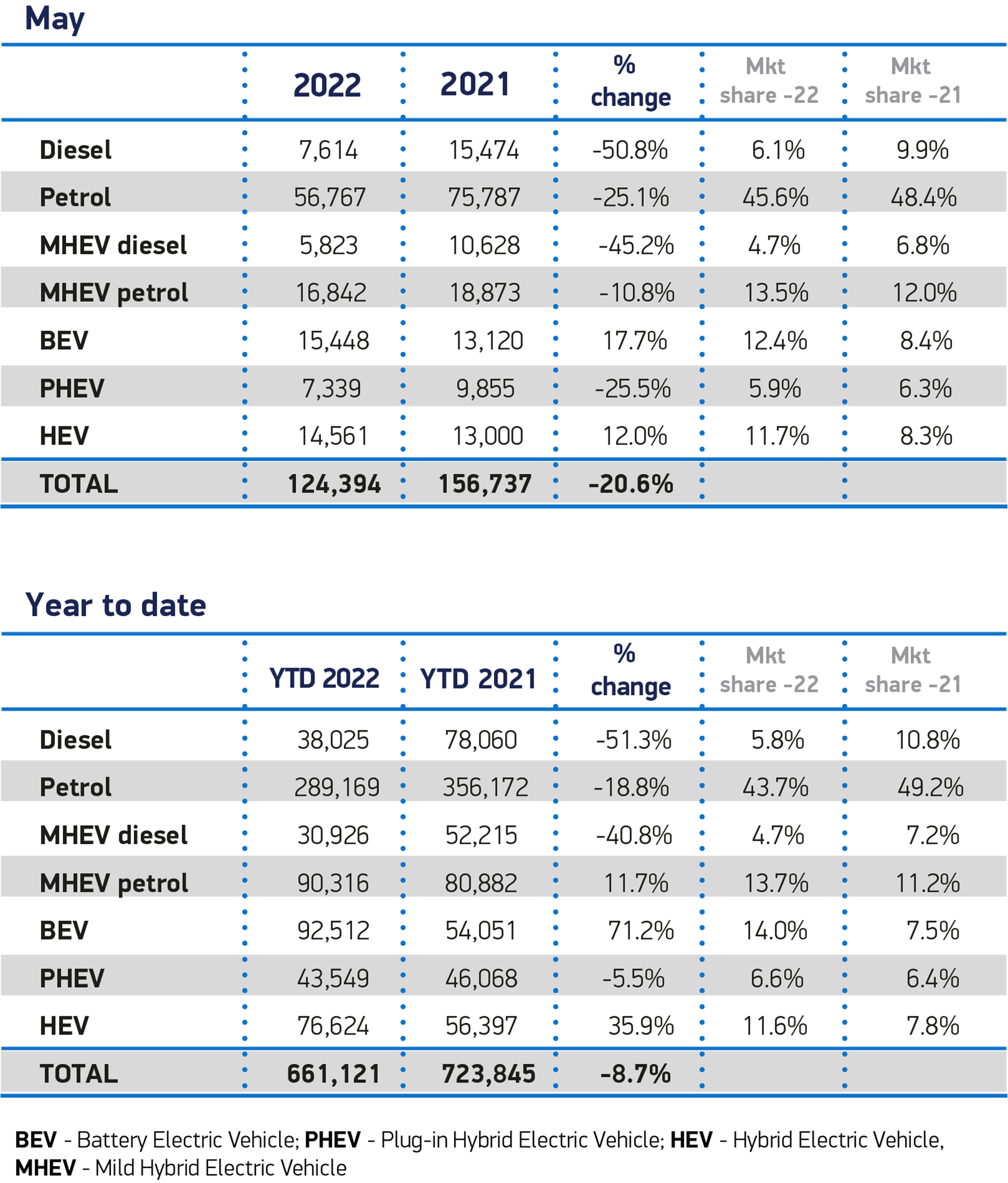

May saw registrations of battery electric vehicles (BEVs) rise by 17.7%, representing one in eight new cars joining the road last month.

Plug-in hybrids declined by 25.5%, while hybrids were up 12%, meaning deliveries of electrified vehicles accounted for three in 10 new cars.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “Demand for electric vehicles continues to show no signs of slowing down as the UK accelerates along its journey towards cleaner and greener transport.

“We must now ensure that the supply of available charge points across the country is able to withstand the influx of electric cars on the roads.

“This is particularly important at a time when the second-hand EV market is beginning to gather momentum to encourage more motorists to make the electric switch.”

Jon Lawes, managing director of Novuna Vehicle Solutions, added: “Electric vehicles have been flying off production lines this year, so much so that new EV registrations still seem highly likely to reach parity with petrol and diesel vehicles in a matter of months.

“It’s a psychologically important tipping point, and one we are accelerating towards so quickly because prolonged supply chain challenges are strangling production across the industry, causing manufacturers to prioritise the supply of EVs in the face of healthy demand.

“Supply is constrained on both sides of the market, but we’ve yet to see recently emerging fears around battery supply do much to curtail the production of EVs, and certainly not to the same extent as across the rest of the industry.

“We’re very much in a sellers’ market, which points to further price rises, and longer waiting lists which means consumers and commercial fleet operators need to plan well ahead and consider extending existing leasing contracts to cover the delay in new vehicle deliveries.”

Superminis continued to be the most sought-after segment by British motorists, making up 32.7% of registrations in the month, despite their registrations falling 16.4% to 40,667 units, followed by dual purpose, which accounted for 28.9% of the market even after a 14.1% fall in volumes.

The small volume luxury car segment was the only area of growth, up 16.8%, to 369 units.

Jamie Hamilton, automotive director and head of electric vehicles at Deloitte, said: “With fuel prices at the pump at record highs, many consumers are thinking more about the potential benefits of moving to electric; some for the first time.

“Were it not for continued supply constraints, the growth of EVs could have been even sharper this month.”

He added: “Fleets have an important role to play in speeding up the transition to electric. However, fleet managers need to be given more support in order to realise the benefits and opportunities associated with a holistic transition to electric, rather than just a standard ‘vehicle by vehicle’ replacement.”

Chris Knight, automotive partner at KPMG UK, believes the cost of living crisis poses questions for the UK automotive industry for the rest of 2022.

“How many consumers delay purchasing a vehicle altogether is a key question, but so is where those wishing to buy lower-price new cars turn in a market where such models are in lower supply and have long waits,” he said.

“Some carmakers continue to feel that smaller and lower margin cars are a less attractive proposition at this time, but others may increasingly see a growing market gap to be seized.

“This landscape could give rise to new entrants, such as some Chinese car makers, who are poised to take market share in the lower-price segments of the UK’s thriving electric car market.”

Login to comment

Comments

No comments have been made yet.