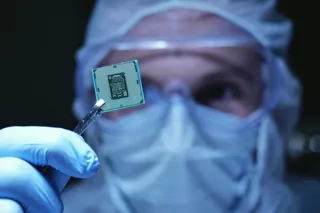

The semiconductor shortage is being blamed for poor fleet and business new car registrations, with the company car market recording a 43.4% year-on-year fall, new figures suggest.

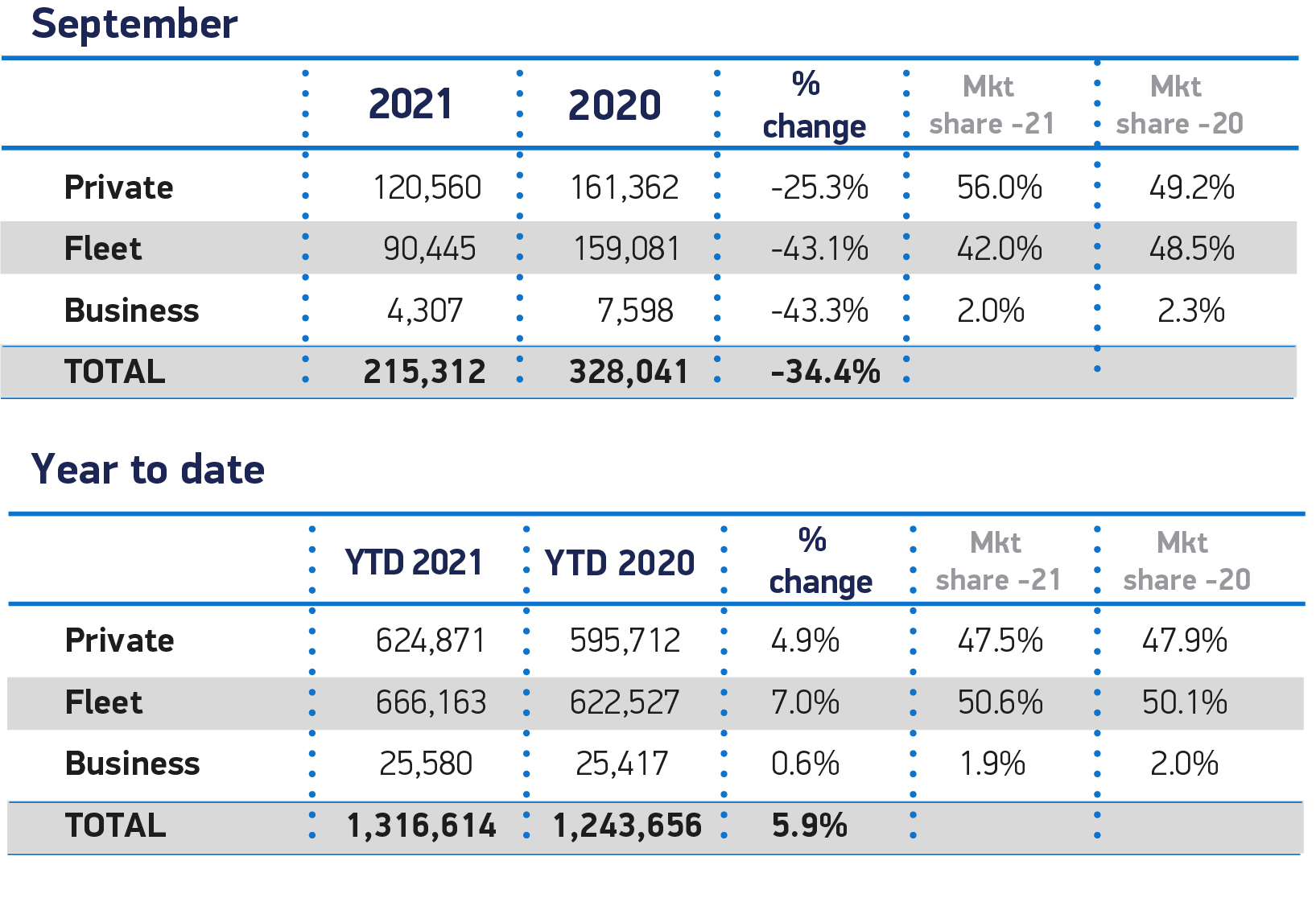

Last month, 94,752 new cars were registered to fleet and business, compared to 166,679 units registered in September 2020, according to new data from the Society of Motor Manufacturers and Traders (SMMT).

Year-to-date, however, new company car sales are almost 7% up on where they were this time last year, with 691,743 fleet and business registrations compared to 647,944 during the first nine months of 2020.

Fleet and business accounted for 44% of overall new car sales during the month. Overall, 215,312 new cars were registered in September, some 34% down on September 2020’s figures.

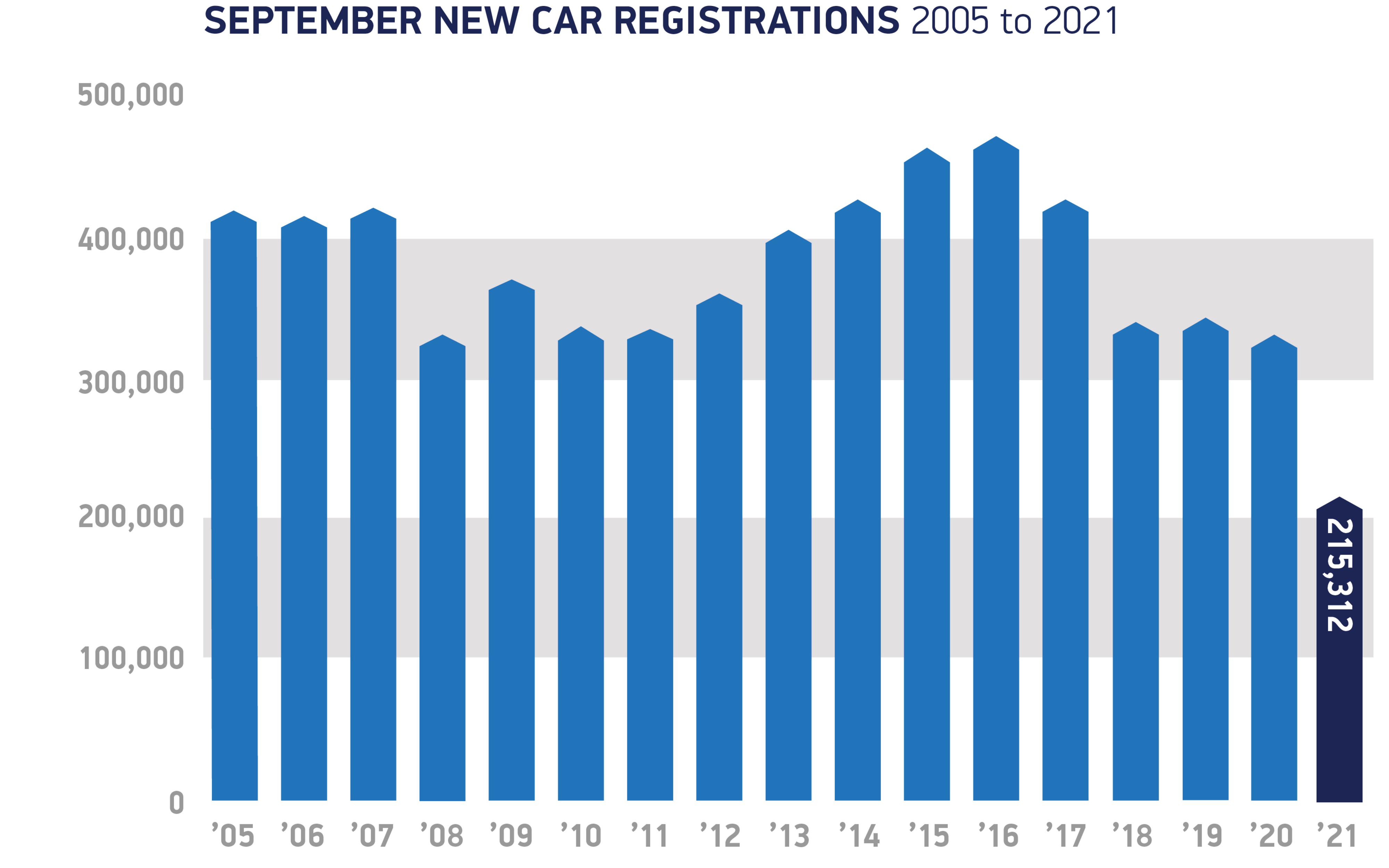

It was the weakest UK new car market figures for September recorded since 1998 ahead of the introduction of the two-plate system in 1999.

September is typically the second busiest month of the year for the industry, but with the ongoing shortage of semiconductors impacting vehicle availability, the 2021 performance was also down 44.7% on the pre-pandemic 10-year average, SMMT figures suggest.

SMMT chief executive, Mike Hawes, said: “This is a desperately disappointing September and further evidence of the ongoing impact of the Covid pandemic on the sector.

“Despite strong demand for new vehicles over the summer, three successive months have been hit by stalled supply due to reduced semiconductor availability, especially from Asia.”

New electric vehicle uptake

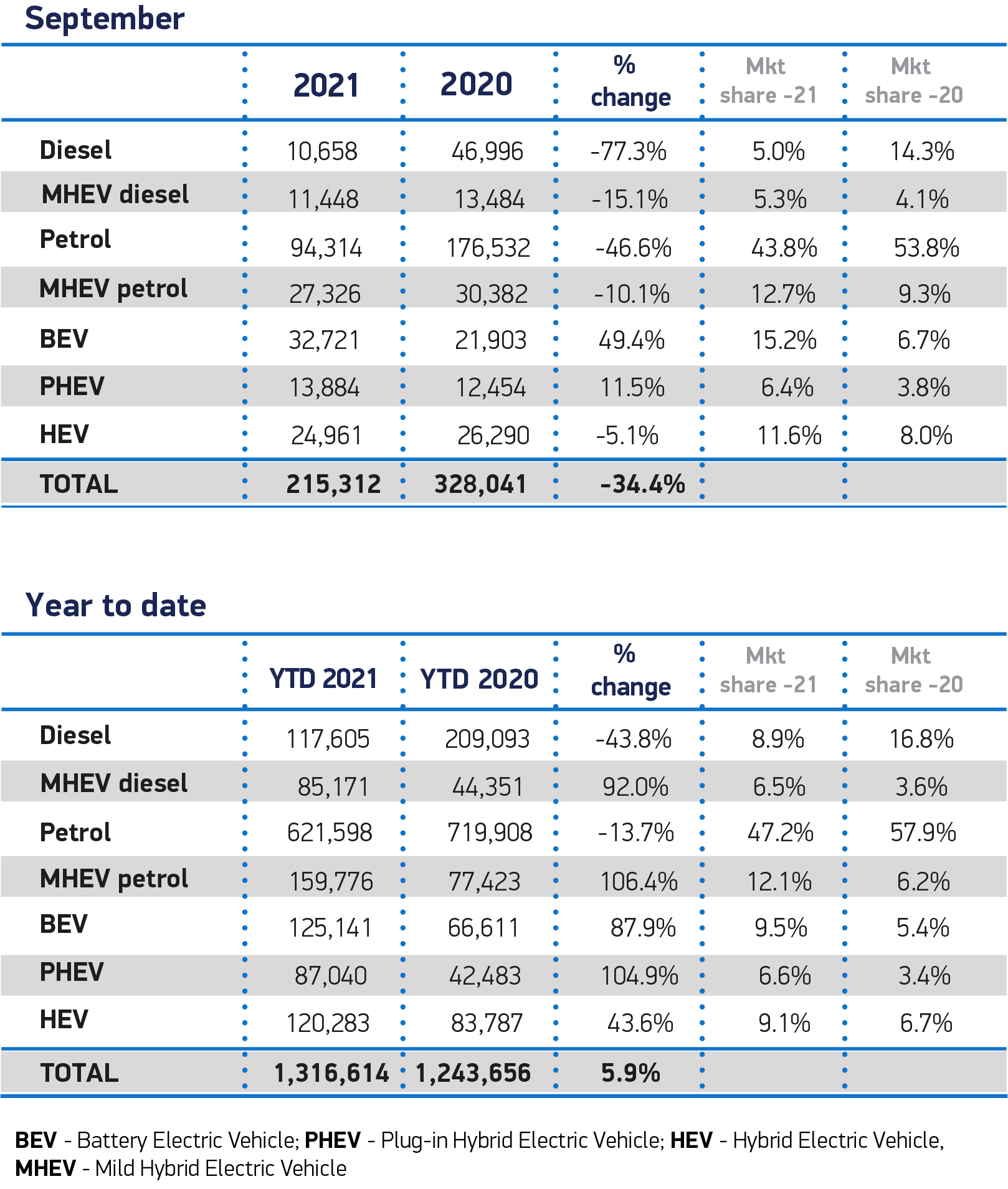

September was the best month ever for new battery electric vehicle (BEV) uptake. With a market share of 15.2%, 32,721 BEVs were registered in the month.

In fact, the September performance was only around 5,000 vehilces shy of the total number registered during the whole of 2019.

Plug-in hybrid (PHEV) share also grew to 6.4%, meaning more than one in five new cars registered in September was zero-emission capable.

Meanwhile, hybrid electric vehicles (HEVs) grew their overall market share from 8% in 2020 to 11.6%, with 24,961 registered in the month.

Hawes said that despite supply challenges, the “rocketing uptake” of plug-in vehicles, especially battery electric cars, demonstrates the increasing demand for these new technologies.

Jamie Hamilton, automotive director and head of electric vehicles at Deloitte, said: “With battery electric vehicles outpacing even plug-in hybrid this month, this demonstrates a level of consumer confidence that the charging infrastructure will be in place.

“However, gaps still remain and a more equitable rollout of public charging points would ensure EVs are also accessible to those households without off-street parking.

“Petrol and diesel shortages may have also inadvertently created some charge anxiety, so ensuring more visible charging points will only strengthen public confidence in EV feasibility.”

Meryem Brassington, electrification propositions lead at Lex Autolease, added: “The recent fuel shortage will only have further heightened awareness of the importance of transitioning to an electric future. As EVs continue to rise in popularity, industry must work collaboratively to ensure there isn’t a tipping point of demand outstripping supply.”

Vehicle supply impact to last into 2023

Fleet operators and company car drivers face delays of more than one year for certain new car and van models, while others are being delivered with missing features, as the global semiconductor shortage worsens.

And some automotive industry executives do not see the problem ending any time soon.

One is predicting the disruption could last until 2023. Speaking at the IAA Munich auto show last month (September 7-12), Daimler CEO Ola Kallenius said soaring demand for semiconductors means the auto industry could struggle to source enough of them throughout next year and into 2023, though the shortage should be less severe by then.

The carmaker has cut its annual sales forecast for its car division, projecting deliveries will be roughly in line with 2020, rather than up significantly.

Critics are predicting the crisis will have a greater impact on automotive than the coronavirus pandemic. Almost 95% of fleets responding to a Fleet News poll said they were experiencing vehicle delays.

Fleets are being urged to sit tight and continue to place orders for new vehicles, while also being warned that existing models may have to remain on the road for in excess of an extra 12 months.

Matthew Walters, head of consultancy services at LeasePlan, said: “The impact on fleet is pretty severe.

“Last year, we saw a number of formal extensions for companies during the worst of Covid-19 where vehicles couldn’t be delivered and where vehicles couldn’t be collected. These vehicles needed to be extended outside their primary contract term.

“Now we’re in a situation moving into next year where, as an industry, we are likely to see an extension programme again.

“I think it’s a similar period of activity with our customers now, to help them understand what it means for their current order bank, when their orders will be delivered and what that means for their replacement cycles.

“The customer still needs to place orders for vehicles to get themselves in the queue and we are working with them and being open and frank as to when those vehicles are going to be delivered.”

Login to comment

Comments

No comments have been made yet.