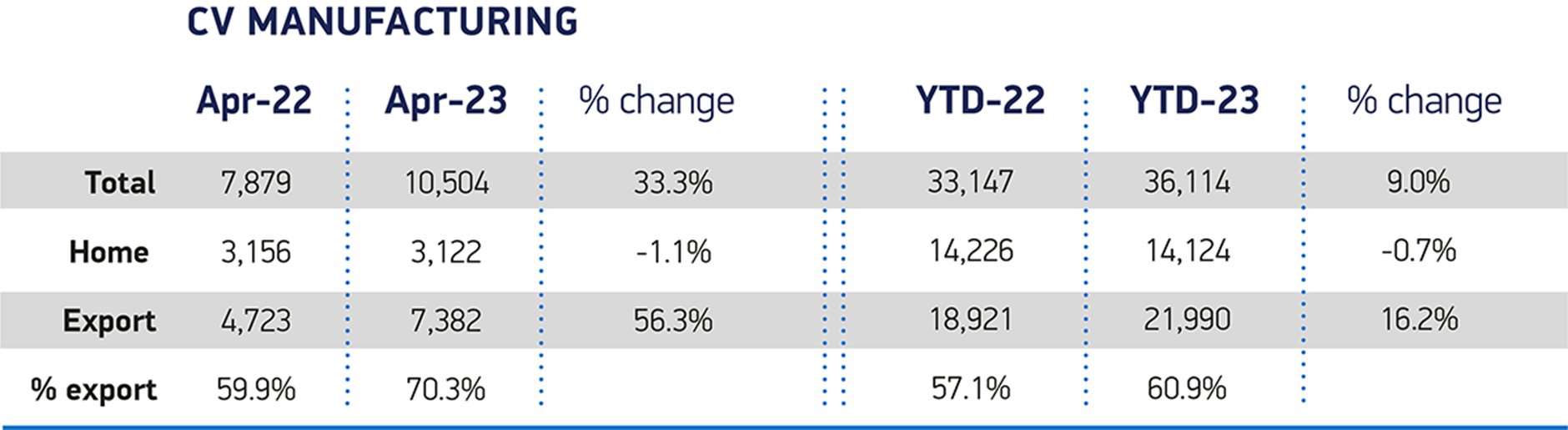

UK commercial vehicle manufacturing output increased by a third (33.3%) in April, with 10,504 vans, trucks, taxis, buses and coaches produced, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

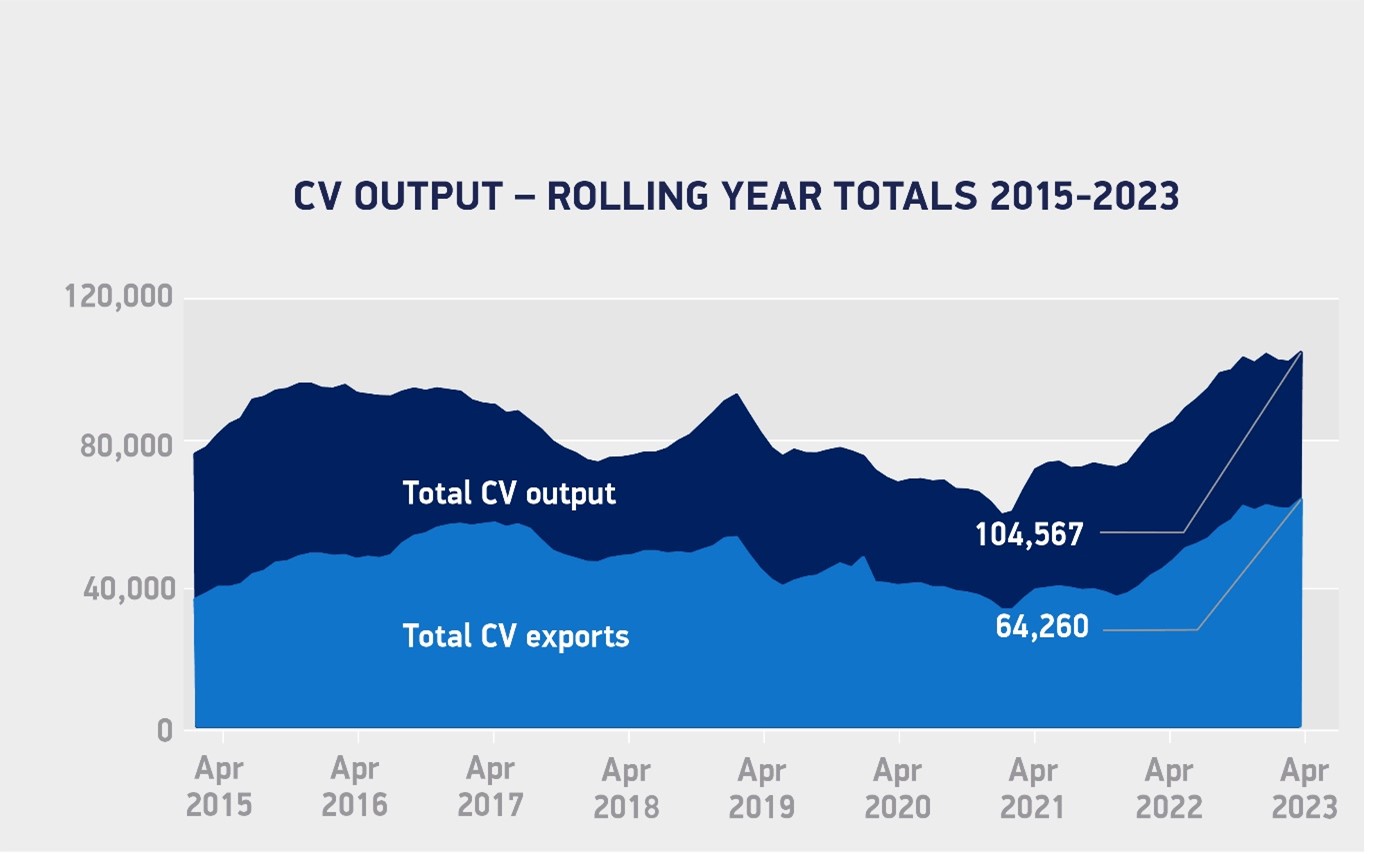

In a sign that recent supply chain shortages are easing, following two months of decline, production ramped up to deliver the best-performing April since 2010.

Growth was driven by a 56.3% increase in the number of vehicles produced for export, with 7,382 units – or seven in 10 vans produced – heading abroad, with the European Union remaining the sector’s biggest overseas customer responsible for 94.4% of exports.

Mike Hawes, SMMT chief executive, said: “It’s good news to see the commercial vehicle market bounce back – surpassing even pre-pandemic levels – to deliver the best April performance in 13 years.

“This is healthy growth driven by significant demand from overseas markets, namely Europe, highlighting the need to protect this trade, which is critical to our ongoing success.”

Increasing local production for a greater range of brands also added a boost to output. Production for the domestic market remained relatively flat declining by just 1.1% to 3,122 units.

Manufacturing output is now up 9% in the year to date at 36,114 units, with exports in the first four months ahead by 16.2% at 21,990 units – the best tear-to-date performance since 2012.

Production for the UK, meanwhile, remains down, by 0.7% to 14,124 units.

Overall production volumes, however, are expected to increase further throughout the year, reflecting easing supply chain constraints and new electric van manufacturing coming on stream.

Hawes said: “For growth to continue, however, Government must introduce measures, which not only invite investment and reduce the erratic energy costs which threaten our competitiveness, but also find a sensible solution to the rules of origin challenge faced by manufacturers.”

Earlier this month (May), Stellantis warned the Government its commitment to build electric vehicles (EVs) in the UK is at risk, unless Brexit trade rules are re-negotiated.

The car maker, which owns 16 car brands, including Vauxhall, said: "If the cost of electric vehicle manufacturing in the UK becomes uncompetitive and unsustainable, operations will close."

In 2021, Stellantis announced it was investing £100 million in Vauxhall’s Ellesmere Port manufacturing plant to create a new electric vehicle (EV) factory. The plant produces commercial and passenger versions of the Vauxhall and Opel Combo-e, Citroen e-Berlingo and Peugeot e-Partner.

In a submission to a Commons inquiry into EV production, Stellantis outlined that its UK investments were centred on meeting the strict terms of the post-Brexit free trade deal.

Until January 1, 2024, the rules stipulate that at least 40% of the content of EVs and 30% of batteries must originate from the EU or the UK.

From 2024 until January 1, 2027, this increases to 45% of the vehicle and 50-60% of batteries. If this is exceeded, carmakers will have to pay a tariff of 10%.

Login to comment

Comments

No comments have been made yet.