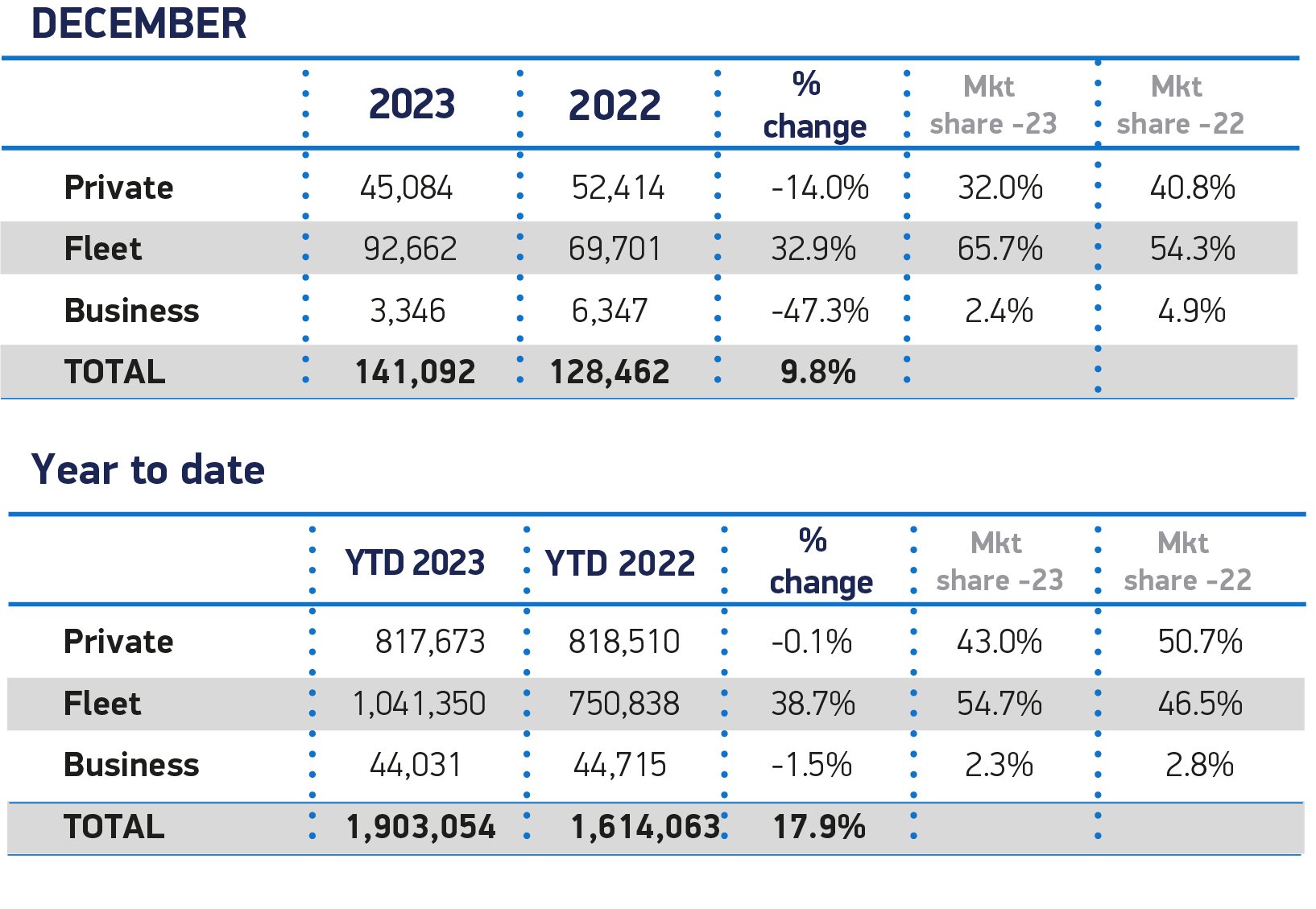

Fleet and business new car registrations surpassed one million units last year, a third more than the it achieved in 2022, according to new data published by the Society of Motor Manufacturers and Traders (SMMT).

There were 1,085,381 company cars registered to fleet and business, which equated to 57% of the overall market and was a 33% uplift on the 795,553 cars registered in 2022.

Fleet and business registrations also dominated December’s sales figures, with 96,008 new cars registered, equating to 68% market share and a 26% increase on the 76,048 registrations recorded in December 2022.

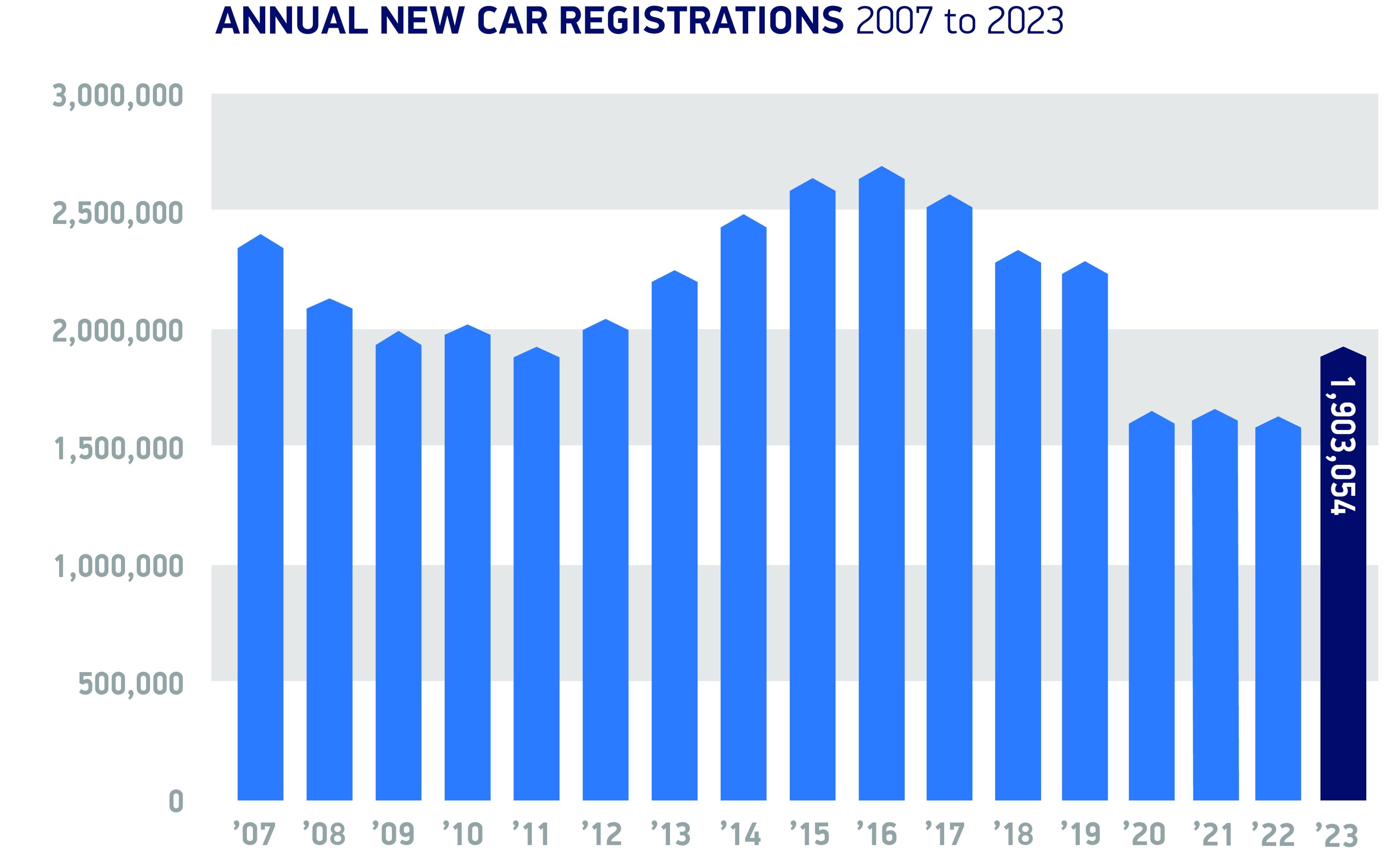

Overall, the UK new car market recorded its best year since the pandemic as a strong December, up 9.8%, wrapped up the 17th month of consecutive growth.

Some 1.9 million new cars reached the road during 2023 – an increase of 17.9%.

Private consumer demand remained stable at 817,673 units after a strong recovery in 2022, with cost-of-living pressures and high interest rates constraining growth, said the SMMT.

While the overall new car market remains 17.7% below pre-pandemic levels, the surge in uptake compared with the previous year saw the value of new car sales jump more than £10 billion to around £70 billion, with 288,991 additional vehicles reaching the road.

Mike Hawes, SMMT chief executive, said: “With vehicle supply challenges fading, the new car market is building back with the best year since the pandemic.

“Energised by fleet investment, particularly in the latest EVs, the challenge for 2024 is to deliver a green recovery.”

In terms of vehicle type, buyers showed a continued preference for superminis, dual purpose and lower medium cars, which accounted for 29.8%, 28.6% and 28.2% of the market respectively.

These three segments have been the most popular since 2013.

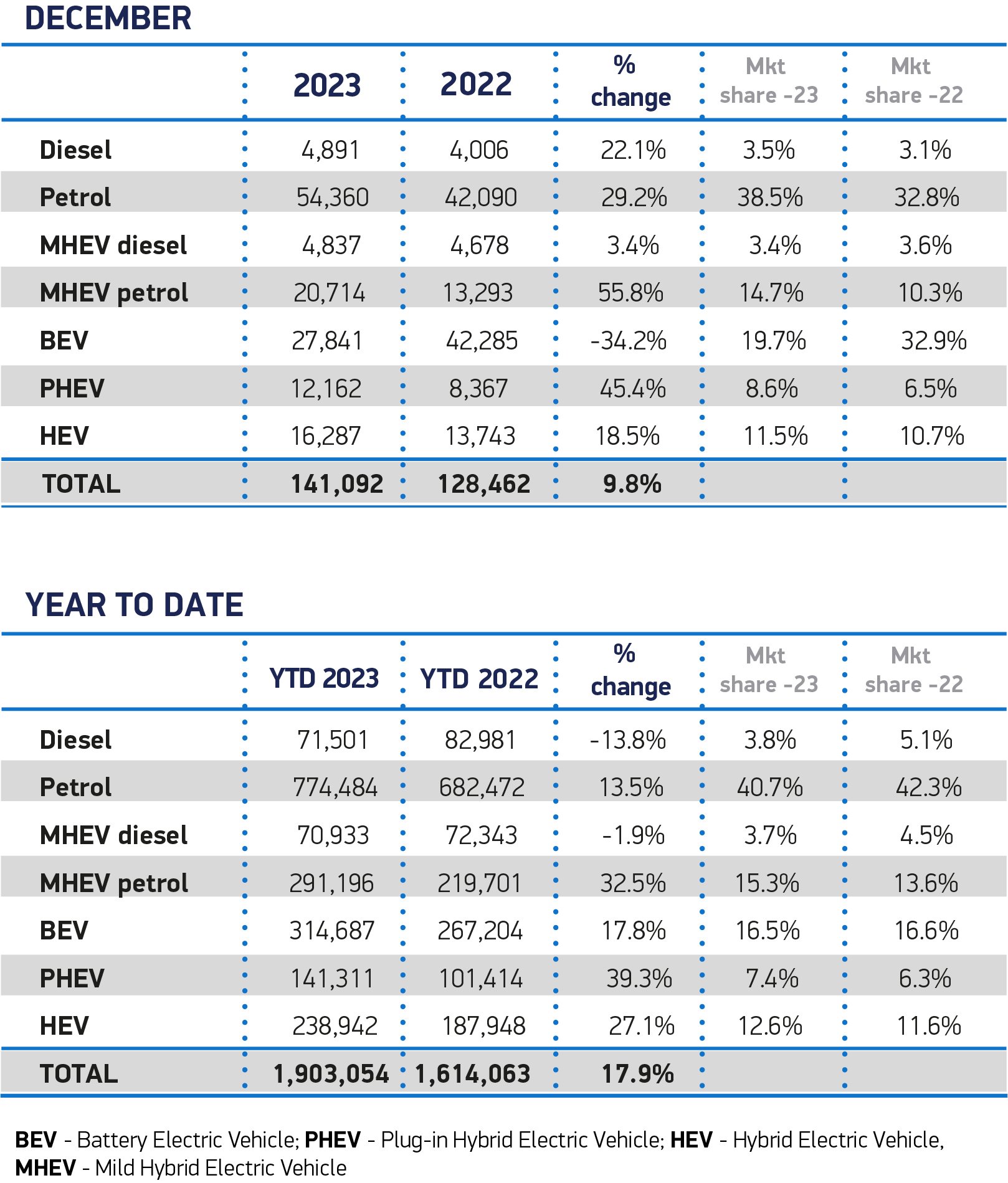

Decline in electric vehicle sales in December

Battery electric vehicle (BEV) volumes fell by more than a third (34.2%) in December, with 27,841 pure electric cars registered in the month, compared to 42,285 registered in December 2022.

This may well be explained by manufacturers holding back on some deliveries with the zero-emission vehicle (ZEV) mandate which requires 22% of all new car sales this year to be zero emission.

Looking at the year as a whole, BEV uptake reached a record volume – up by almost 50,000 units with 314,687 new registrations.

Indeed, 2023 saw more BEVs reach the road than in 2020 and 2021 combined, helping average new car CO2 emissions fall by 2.2% to 108.9 g/km.

Hybrid electric vehicles (HEVs) also recorded robust growth, up 27.1% to reach a 12.6% market share.

Plug-in hybrids (PHEVs) also enjoyed a strong year, with a 39.3% increase in registrations to account for 7.4% of the market.

Overall, BEVs accounted for one in six new cars registered in 2023, with the majority taken by business and fleet buyers who benefit from compelling tax incentives. In contrast, one in 11 private buyers chose a BEV. As a result, market share slipped to 16.5%.

Since the end of the plug-in car grant in June 2022, the UK is the only major European market with no consumer BEV purchase incentives.

Call to halve VAT on electric vehicles

The SMMT is calling on Government to support private buyers by halving VAT on new BEVs for three years.

This temporary cut would give private consumers access to fiscal support at a level similar to that enjoyed by business buyers, enabling manufacturers to deliver larger volumes of zero emission vehicles, it said.

Over the past five years, BEV uptake has risen almost 20-fold, with the Treasury reaping a VAT windfall due to these vehicles typically having higher purchase costs than their ICE counterparts.

Halving VAT would give consumers an estimated additional £7.7bn in BEV buying power to the end of 2026, while reducing the Treasury’s tax take by just 22% per vehicle for each additional driver switching from an ICE to a BEV.

This would encourage an extra 270,000 new car buyers in Britain to go electric and put 1.9 million new EVs on the road by the end of 2026, suggests the SMMT.

“Government has challenged the UK automotive sector with the world’s boldest transition timeline and is investing to ensure we are a major maker of electric vehicles,” said Hawes.

“It must now help all drivers buy into this future, with consumer incentives that will make the UK the leading European market for ZEVs.”

Looking ahead to 2024, the latest market outlook – published in November – anticipates 2024’s new car market to reach 1.97 million units, with 439,000 BEVs taking a 22.3% market share.

Jon Lawes, managing director at Novuna Vehicle Solutions, said: “Whilst fleets continue to charge ahead with EV adoption, policymakers must demonstrate greater ambitions during 2024 to inspire confidence in the transition and help the industry make good on the new ZEV mandate taking effect this week.

“The last-minute reprieve on the costly Rules of Origin tariffs was a crucial moment for EV adoption, but inadequate charging infrastructure coupled with the lack of incentives to convince non-fleet drivers to make the switch remain significant barriers to realising wider EV growth and still need addressing.”

Nick Williams, managing director of Lex Autolease, part of Lloyds Banking Group, believes that the long-term commitments made by Government have helped to support BEV uptake, but he says that more needs to be done by policymakers, OEMs and the wider industry to drive adoption levels to ensure the UK remains an attractive place to invest.

“Efforts must be focused on the continued rollout of charging infrastructure, driving down new vehicle costs and providing OEMs with the confidence they need to invest in the long-term, all of which will be key to generating the used market, essential in making electric vehicles more accessible and achieving widespread adoption in the future,” he explained.

Kim Royds, at British Gas, also believes that more must be done to help drive EV adoption rates. She said: "It's important we rapidly build the country’s network of charging infrastructure.

"Access to publicly available fast charging points and expanding roadside charging infrastructure will be vital to ensure no one is excluded from EV ownership.

"The £70 million pilot to boost charging capacity at sites across England is a welcome step, but it’s crucial we continue to make further investments to make the electric future possible.”

Login to comment

Comments

No comments have been made yet.