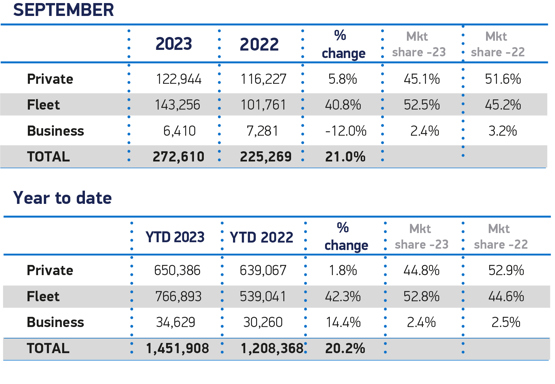

Fleet and business registrations are driving the new car market, growing 37.3% year-on-year, compared to a 5.8% increase in private new car sales in September.

There were 149,666 new company cars registered to fleet and business in the month, an increase of more than 40,000 units on the 109,042 registered in September 2022.

The new figures, from the Society of Motor Manufacturers and Traders (SMMT), show that there were 122,944 private new car sales in the month - an increase of just 5.8%.

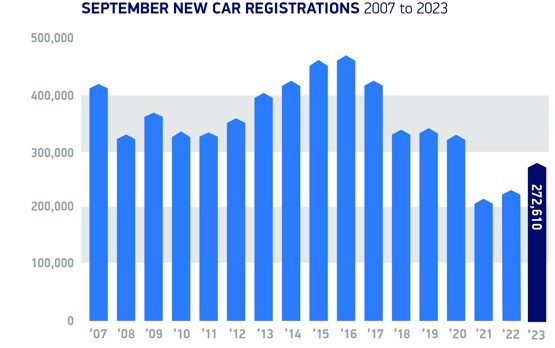

Combined, they helped the new car market grow by 21% in September, with 272,610 registrations overall.

It was the 14th consecutive month of growth and was also the second busiest of the year after March, with the new number plate delivering its traditional market surge despite a challenging economic backdrop.

SMMT says that the exceptional growth in company car registrations represents a market rebalancing after constrained supply in 2022 restricted deliveries to business and fleet customers.

Year-to-date, there have been 801,522 company cars registered to fleet and business, a 40.6% increase on the 569,301 units registered in the first nine months of 2022, equating to a market share of 55.2%.

Richard Peberdy, UK head of automotive at KPMG, said: “Personal car ownership still makes up just under half of the UK car market, but the growth of new car sales has understandably been hit this year by the cost-of-living crisis and a higher cost of car financing.

“Some motorists’ car choices will however be captured by the growth in business and fleet vehicle data, in the form of company car ‘user-choosers’ and salary sacrifice arrangements through employers.

“Therefore, fleet and business purchases certainly continue to drive the growth in the UK car market, with electric vehicles a key part of this - aided by low benefit-in-kind tax and high write-down allowances.

“There are no such Government incentives for private car sales – but EV prices are dropping as more EV brand competition enters the market, while more EV stock entering the used market is also leading to EV price corrections.”

He continued: “More competition and lower pricing is key to increasing EV adoption and ensuring that the battery electric market share of 16% rises in order to meet the 22% target set for 2024 by the Zero Emissions Vehicle Mandate.

“Availability of charging points on residential streets remains a major barrier to transition to EVs for the many people who don’t have off-street parking.

“And ensuring that on-street charge point numbers increase is also key to the UK meeting the 22% ZEV target next year.

“The Government might also look at the disparity between VAT charged at 5% on home charging versus the 20% charged for on-street charging.”

Battery electric vehicle share decreases

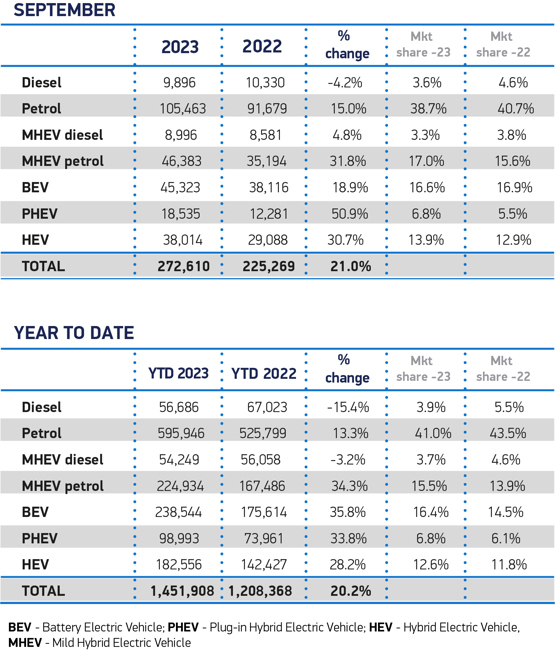

Electrified vehicle uptake continued to grow in the month, with plug-in hybrid vehicles (PHEVs) up 50.9% to take a 6.8% market share and hybrid electric vehicles (HEVs) up 30.7% to account for 13.9% of all registrations.

Battery electric vehicles (BEVs), meanwhile, recorded their 41st consecutive month of growth – with 45,323 drivers making the switch, an 18.9% uplift.

Given this growth was less than the overall recorded by the market, however, BEV market share slipped back slightly to 16.6% from 16.9% a year ago.

BEV volume increases were driven entirely by fleet purchases, which rose by 50.6% as buyers were drawn to the advanced technology, outstanding performance, reduced environmental impact and compelling tax incentives.

Conversely, private BEV registrations fell 14.3% with less than one in 10 private new car buyers opting for electric during the month.

Such a decline underlines the importance of providing these motorists with purchase incentives and other mechanisms to stimulate demand, says the SMMT.

Mike Hawes, SMMT chief executive, said, “With tougher EV targets for manufacturers coming into force next year, we need to accelerate the transition, encouraging all motorists to make the switch.

“This means adding carrots to the stick – creating private purchase incentives aligned with business benefits, equalising on-street charging VAT with off-street domestic rates and mandating charge point rollout in line with how electric vehicle sales are now to be dictated.

“The forthcoming Autumn Statement is the perfect opportunity to create the conditions that will deliver the zero-emission mobility essential to our shared net zero ambition.”

Nick Williams, managing director of Lex Autolease, part of Lloyds Banking Group, added: “Moving forward on phasing out the sale of new petrol and diesel cars and vans between 2024 and 2030 will provide consumers and businesses with the certainty needed to switch to EVs.

“That confidence coupled with the new registration plate release is reflected in strong September figures from the SMMT, which saw a further 272,610 new vehicles join the UK’s roads.

“I’m hopeful that the delay on the final phase out date won’t impact these figures in the coming years, as renewed commitments from manufacturers and businesses looking to hit their own carbon targets will help to drive continued growth.

“The revised deadline and the commitment to the ZEV mandate provides both clear, long-term policy support and the appropriate sense of urgency and should ensure industry, businesses and consumers can continue to plan effectively for an electric future.”

Jon Lawes, managing director at Novuna Vehicle Solutions, believes that the Government has been sending “mixed messages” about its net-zero policy and the decision to scrap HS2 will fuel concerns about its commitment to long-term infrastructure investment, a key pillar of the EV transition.

“High-speed charging access and grid capacity is a persistent challenge,” he said. “The launch of the UK’s largest charging hub in Birmingham is a positive sign and shows corporates are ready to embrace the transition.

“However, this needs be matched by ambitious policymaking on critical infrastructure to give businesses and consumers confidence in EV adoption."

Login to comment

Comments

No comments have been made yet.