New software from Enterprise Rent-A-Car will give detailed benefit-in-kind (BIK) tax information from the use of daily rental and car clubs.

The new functionality on the rental company’s Enterprise Travel Direct (ETD) booking platform will ensure drivers and employers are compliant with HMRC rules.

Ryan Bushell, head of public sector sales at Enterprise, explained: “As with every business travel offering there is a BIK tax compliance consideration, similar to organisations operating their own car pool fleets. This latest upgrade to ETD ensures that businesses can enjoy all the cost and sustainability benefits of a car club and ensure HMRC compliance when employees book rentals.”

Organisations can use the management information provided through ETD to investigate exceptions, and to create reports in case of an HMRC audit.

Coronavirus Impact on Travel

Many public sector bodies and a growing number of private sector organisations are looking for flexible and efficient mobility solutions as employees return to work after lockdown.

Car clubs, parked on-site as a virtual ‘pool’ of low-emission cars exclusively for employees to hire by the hour or day, offer a flexible and convenient solution for a wide range of employee mobility needs, says Enterprise.

“Business travel is an even greater consideration as organisations start to bring employees back to the office after lockdown,” continued Bushell. “It is essential to ensure it is managed efficiently and with full adherence to the tax rules.

“In addition, most organisations now need to enforce a travel policy to ensure employees use the most cost-effective and sustainable means of business travel.

“ETD delivers compliance and manages demand, all while providing a valuable service where employees can quickly self-serve when they need to book travel, knowing they are using the best option for their trip.”

Employee car clubs can have BIK implications if employees use the vehicles for private mileage. Businesses must therefore keep an accurate record of mileage, origin and destination of each trip taken in a dedicated car club vehicle, ensuring no private use, which ETD now automates as part of the booking process.

ETD also embeds each organisation’s travel policy into the booking function, allowing businesses to evidence that this is enforced through every journey.

The platform automatically tracks the origin, destination and mileage for every trip, whether in a dedicated car club, a rental car or in the employee’s own vehicle.

The platform automatically tracks the origin, destination and mileage for every trip, whether in a dedicated car club, a rental car or in the employee’s own vehicle.

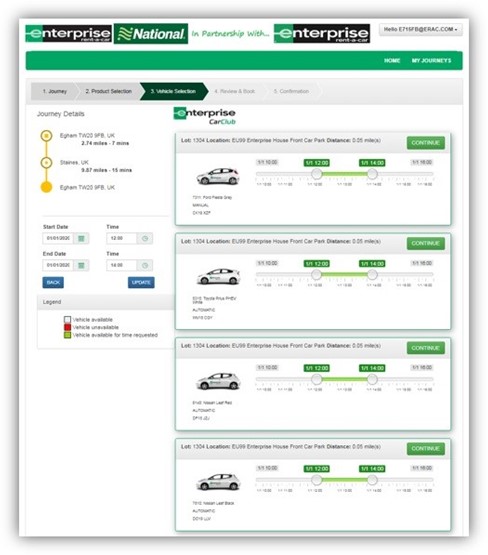

ETD enables customers to compare the cost of daily rental, hourly car club, pool car and grey fleet travel based on a planned journey and real-time vehicle availability.

Employees can compare the actual cost of a specific journey at a specific time, depending on whether they use a private car, a car club or daily rental, says Enterprise.

It also provides the opportunity to migrate away from the ‘grey fleet’ of using a private, often older and more polluting vehicle for business and reimbursing mileage.

Login to comment

Comments

No comments have been made yet.