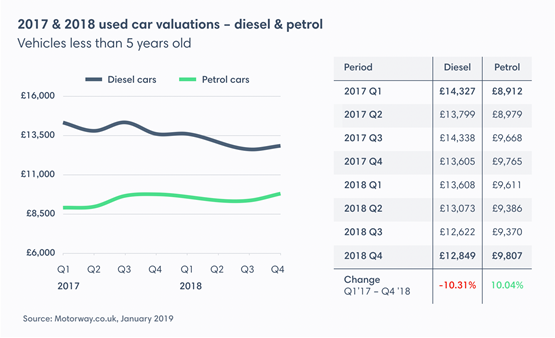

The average price of a used diesel car fell by 10.3% between Q1 2017 and Q4 2018, according to Motorway.co.uk.

The analysis from the car buying comparison website was based on a sample of 130,000 valuations of up to 5-year old diesel and petrol cars on its site.

In terms of petrol cars, it showed that equivalent used petrol prices increased 10% between Q1 2017 and Q4 2018.

The average diesel value in Q1 2017 was £14,327, dropping to £13,605 by Q4 2017, and £12,849 a year later – a fall of £1,478 for the average used diesel.

Meanwhile, the average petrol price increased from £8,912 in Q1 2017 to £9,807 by Q4 2018, an increase of £895 over the same period of the study.

Motorway.co.uk also analysed diesel and petrol valuation data for individual car makes. The research revealed significant differences in how different brands have changed over the past 12 months and two years.

Motorway.co.uk also analysed diesel and petrol valuation data for individual car makes. The research revealed significant differences in how different brands have changed over the past 12 months and two years.

Looking at the most popular makes valued during 2017 and 2018 on the comparison website, most major car brands including Ford, Mercedes and Volkswagen saw diesel price drops, with the biggest falls seen with Land Rover, BMW, Vauxhall and Audi.

The average price of a used BMW diesel car has slumped by 16.1% since the start of 2017, falling almost £3,000 from £17,269 in Q1 2017 to £14,441 in Q4 2018, according to Motorway.co.uk. This compares with average prices of BMW petrol variants which have remained steady (falling just 0.6%) over the same period.

The average price of a diesel Audi has fallen 14.3% since the beginning of 2017, compared to a 8.4% increase in price for the petrol variants, it said.

Meanwhile, the average price of a Land Rover was down more than £6,000 from £30,493 to £24,399 between Q1 2017 and Q4 2018 (a fall of 20%).

Alex Buttle, director of Motorway.co.uk, said: “Increasingly, people looking to buy a used car are deciding on fuel type before choosing what make and model they want to purchase.

Alex Buttle, director of Motorway.co.uk, said: “Increasingly, people looking to buy a used car are deciding on fuel type before choosing what make and model they want to purchase.

“Despite newer Euro-6 diesel engines now matching petrol equivalents for efficiency, consumer sentiment has simply moved away from diesel – possibly forever.”

However, the findings from Motorway.co.uk do not tally with the analysis of pricing experts at Cazana (fleetnews.co.uk, December 21).

Rupert Pontin, director of valuations at Cazana, said: “If used diesels were bad news, retail demand would have diminished and retail pricing followed suit and this has not happened and shows little signs of doing so.”

Furthermore, the Vehicle Remarketing Association (VRA) says that new diesel car sales are falling so quickly that there could be shortages of them on the used market (fleetnews.co.uk, January 17).

Philip Nothard, deputy chair at the VRA, said: “The speed of decline in diesel has been much more rapid than the overall market but, generally speaking, demand for used diesels has not really fallen very much at all.”

The organisation – which represent companies that handle, sell, inspect, transport or manage more than 1.5 million used vehicles every year – says that while new car diesel demand has plummeted, corresponding used demand has stayed relatively firm.

Dylan Setterfield - cap hpi Head of Forecast Strategy - 01/02/2019 20:03

It's simply not true. You need to track the SAME VEHICLES over time to avoid model mix and other factors distorting the data. Here is the truth: Diesel values are UP +2.0% Jan-19 vs Jan-18 and over the past 2 years have been STRONGER than typical historic aging. Petrol values have been extremely strong and in the past 2 years have increased by 5.9% and 1.2%. This is unprecedented. However, it is only partly due to relative attractiveness of the fuel - the biggest factor is a shortage of smaller petrol used cars due to decreased levels of forced registrations from the manufacturers.