The UK’s biggest fuel retailers are being urged by the RAC to cut the price of petrol by at least 5p a litre to 150p to reflect lower wholesale costs.

The motoring organisation claims that the Government’s 5p cut in duty, brought in shortly after Russia’s invasion of Ukraine last year, is not benefitting drivers but instead appears to be helping retailers who have chosen to increase their margins.

RAC fuel spokesman Simon Williams said: “Our analysis sadly shows that despite the Competition and Markets Authority’s investigation confirming drivers were being ripped off at the pumps – something we have been saying for years – and the Government acting on the findings, nothing has changed.

“Drivers are still losing out massively when wholesale prices come down.”

Analysis by the RAC shows that despite oil trading around $90 a barrel and sterling only being worth $1.20, the delivered wholesale price of petrol averaged just over 113p last week which means, with the UK average price of unleaded standing at 155.33p, average retailer margin was more than 16p a litre before VAT is applied.

This is in stark contrast to the long-term average of 7p a litre and is even far higher the 10p margin that smaller, independent retailers argue is now fair due to inflation, it said.

Diesel, which is currently averaging 162p across the country, is overpriced by around 4p a litre, it added.

Last week, a litre of wholesale diesel averaged 123p meaning average retailer margin is around 12p, compared to the 8p long-term figure tracked by the RAC since 2012.

The Competition and Markets Authority concluded its investigation in the summer and found that the big four supermarkets had overcharged drivers by 6p a litre in 2022, costing them around £900 million.

The report recommended retailers be required to provide real-time pump prices by site and that a price monitoring body be created – both of which the Government has pledged to legislate for.

In fact, after being strongly encouraged to publish prices by the former Energy Secretary ahead of it being mandated in law, many larger retailers started doing so. There is not any news as to when a pump price watchdog may be set up.

Williams continued: “Drivers and, indeed, the Treasury should be furious that the 5p-a-litre duty cut, which has been in place since the end of March 2022 is not being passed on at forecourts.

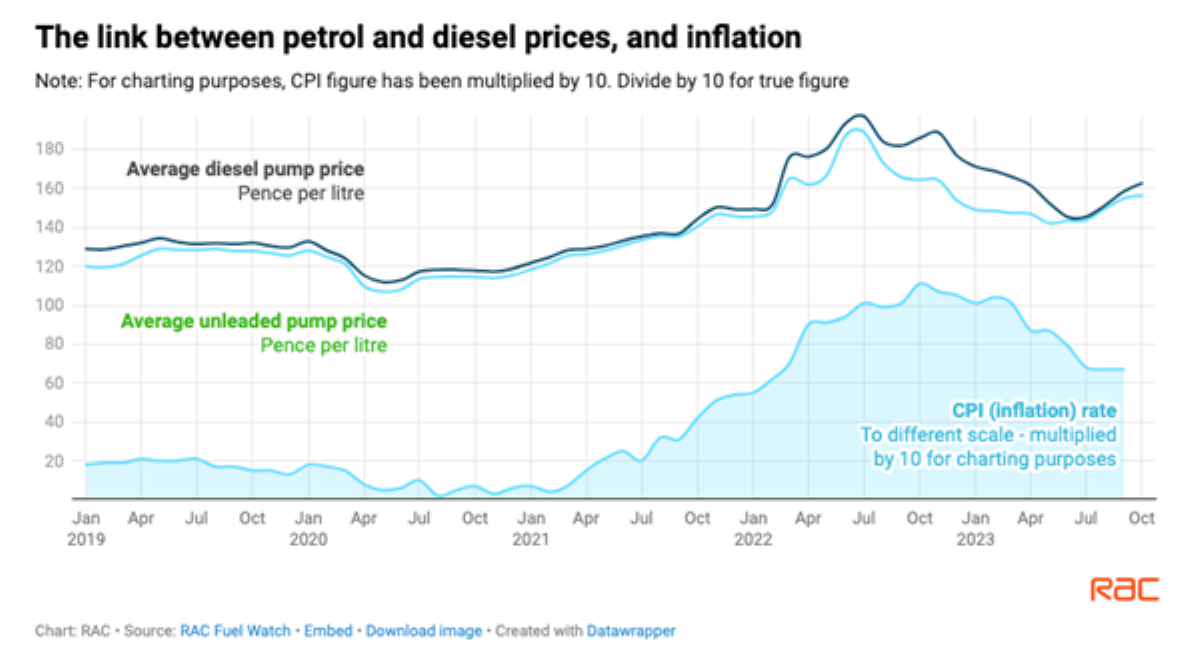

“There is no doubt from studying RAC Fuel Watch data that margins are up across the board, and while retailers argue their costs have increased due to inflation, the irony remains that there is a definite link between pump prices and consumer price inflation.

“A failure to cut pump prices to fairer levels when there is a clear opportunity to do so has the effect of keeping inflation artificially high – which is clearly in nobody’s interest.”

RAC data shows the big four supermarkets’ margin on petrol has been around 14p in October compared to an average of 7p so far this year, which is more than double the 3.4p for the whole of 2019.

“We badly need the Government to set up the price monitoring body recommended by the CMA and for it to carry powers to take action against big retailers that don’t reflect downward movements in the wholesale market such as we’ve been experiencing in the last six weeks,” said Williams.

“We have informed the Treasury that its 5p duty cut isn’t helping drivers as intended and we’re now calling on the big four supermarkets, which lead the retail market by virtue of the fact they sell around half of all the fuel bought by drivers, to explain their steadfast refusal to cut prices to fairer levels.

“Sadly, we know this is highly unlikely to happen and instead, at best, we’ll get another banal statement from the British Retail Consortium while independent retailers will feel the need to defend themselves, despite us recognising that this isn’t a problem of their making.”

|

Average supermarket fuel margins – pence per litre |

|||

|

|

Petrol |

Diesel |

Combined |

|

Pre-Ukraine war |

3.7 |

5.7 |

4.7 |

|

Post-Ukraine war |

9.2 |

9.8 |

9.5 |

|

2016 |

2.2 |

2.4 |

2.3 |

|

2017 |

2.5 |

3.8 |

3.2 |

|

2018 |

3.1 |

6.6 |

4.9 |

|

2019 |

3.4 |

8.1 |

5.7 |

|

2020 |

4.7 |

8.2 |

6.4 |

|

2021 |

5.8 |

6.0 |

5.9 |

|

2022 |

10.8 |

7.5 |

9.1 |

|

2023 to date |

7.0 |

11.7 |

9.4 |

|

October 2023 |

14.3 |

7.8 |

11 |

Login to comment

Comments

No comments have been made yet.