Q:

Is it time to launch a salary sacrifice scheme?

A:

Allowing employees to get a fully-insured and maintained car in exchange for a contractual reduction in their gross pay gives them access to new vehicles for less than if purchased as a private consumer.

The employer also saves on the associated employer national insurance contributions (NICs) on the salary that is sacrificed.

Here we carry out a SWOT analysis on the funding method, looking at its strengths, opportunities, weaknesses and threats.

Strengths

Salary sacrifice schemes have significant benefits for both employees and employers.

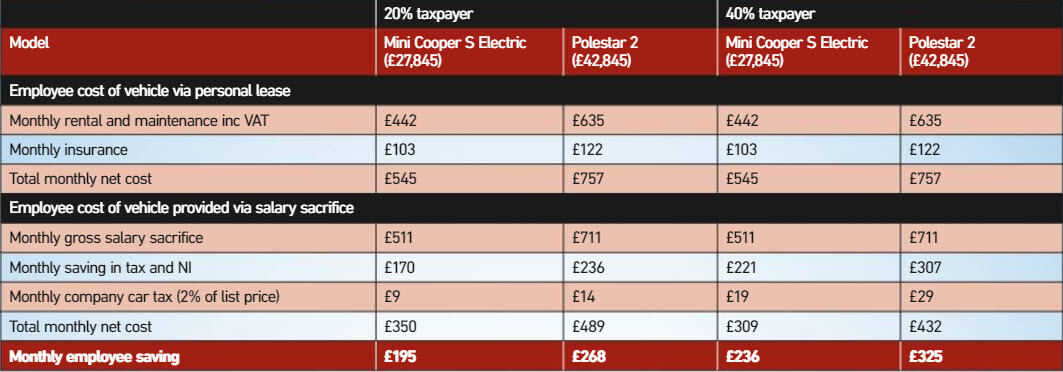

Employees are given access to a new car at – thanks to the tax benefits of the scheme – typically significantly lower prices than through a personal lease (see table) or buying it on hire purchase.

There is also no initial payment that needs to be made, no complicated individual credit checks to go through and maintenance, servicing, insurance and breakdown are covered by the payments to the scheme.

There is also no initial payment that needs to be made, no complicated individual credit checks to go through and maintenance, servicing, insurance and breakdown are covered by the payments to the scheme.

The ordering process is also simple: the employee selects their car, the length of term and mileage they intend to use and the vehicle is then ordered.

Employers also accrue tax savings: for example, an organisation which provides a 40% taxpayer with a Mercedes-Benz EQC through salary sacrifice will make an annual NIC saving of £1,987.

The forthcoming 1.25 percentage point levy on NICs will have little impact on the tax efficiency of the scheme, says LeasePlan.

From the 2022/23 financial year, employer NICs will increase from 13.8% to 15.05%, but this will see employer contributions increase by only a small amount for sub-50g/km vehicles due to their low taxable values.

As an example, for battery electric vehicles (BEVs), LeasePlan told Fleet News the increase will cost an employer another £9.34 a year on a Kia e-Niro 3 and £10.71 on a Polestar 2 Long Range Single Motor.

The increase is more for PHEVs: £34.48 for a Mercedes-Benz A250 e AMG Line Exec Edn, and £62.68 for a BMW 330e Sport Pro Saloon.

Another benefit of introducing a salary sacrifice arrangement is it enables greater access to ultra-low emission vehicles across a much wider population of employees than a company car scheme.

This can help to deliver sustained reductions in roadside pollution and carbon emissions.

Last year, BEVs or plug-in hybrid electric vehicles (PHEVs) accounted for every model in the salary sacrifice specialist’s top 10: in 2019, this was just one – the Tesla Model 3.

Tusker, for example, has seen the average order emissions reduce from 108g/km to 35g/km in just two years.

BEVs currently account for 70% of new car orders, 17% are PHEVs and the remaining cars internal combustion engine (ICE).

Salary sacrifice can also help organisations reduce emissions from their grey fleet, which the Association of Fleet Professionals (AFP) says will be one of the major challenges over the next few years.

By the end of 2022, and certainly looking into 2023, it’s likely that many major fleets will have something like a 30-50% rate of EV penetration, said the AFP.

However, the rate of change for grey fleet is much, much slower. Among private motorists using their car for work purposes, those opting for PHEVS and EVs are still very much the outliers and that situation may persist for a while.

For organisations who are determined to work towards low-carbon and net-zero futures, this is a genuine issue and, the AFP believes, one of the major challenges for fleets over the next few years.

Probably, the most obvious solution is a EV-based salary sacrifice scheme.

It is also essential to ensure that infrastructure and reimbursement to support grey fleet EVs is being properly managed.

That might mean helping grey fleet drivers who are keen on PHEV or EV adoption to install charging at home or, if they don’t have a driveway, to access charging elsewhere.

It also means ensuring that reimbursement for charging is being carried out correctly, something that current advisory fuel rates (AFRs) don’t always cover.

Tusker research showed the vast majority of their drivers would not have opted for an EV had it not been for the salary sacrifice scheme.

Weaknesses

While the benefits of a car salary sacrifice scheme are far-reaching, there are circumstances in which it does have weaknesses.

There are two key areas that restrict this as a truly inclusive solution across all employee bases, says JCT600 VLS.

There remains a lack of availability of suitable family-sized vehicles at the lower end of the market.

Furthermore, while the net cost to the employee is very attractive, the gross deduction required, driven by increased rental costs on higher value product and increased insurance costs, can be significant, which puts greater pressure on national minimum wage requirements and can affect the eligibility of the lower earners.

Employees would not be eligible to participate in a salary sacrifice scheme if the deduction causes their salary to fall below the national minimum wage.

Other implications for an employee include potentially affecting their entitlement to tax credits, the amount they repay to the student loan company, or their entitlement to the state pension.

Salary sacrifice has the benefit of not needing a large upfront payment, but some drivers want to put down an amount at the start of a lease to lower their monthly outgoing, said Tusker.

It also may not work for companies with higher staff turnover. And for those coming up for retirement, we always recommend gaining external professional advice before ordering as there may be potential impacts for their pensions.

Many salary sacrifice providers, including Tusker, offer lifestyle protections as part of schemes which ensures events are covered should employees leave the business.

Opportunities

Traditionally, salary sacrifice schemes have been a way of giving employees who are not eligible for company cars access to new vehicles in a tax-efficient way, but this approach is changing.

What we’re seeing increasingly is businesses saying they’ll put all company car drivers in cash and then allow them back into the car scheme, but only through the sacrifice route, said HRUX.

“The big advantage of that is that the amount of the salary sacrificed is genuinely what you think that car is going to cost you for the mileage and term that the employee wants to do, whereas with a company car on an attachment basis, there’s always a degree of blank cheque,” said a spokesperson.

“For example, you’ve got two employees: one lives just around the corner and the other lives 200 miles away. In 2022, you may give them the same entitlement and just pay for it.

“The one who lives 200 miles away will cost you twice as much as the one that lives around the corner: with salary sacrifice, the employee pays the full cost of the vehicle by way of the sacrifice.

“If the salary sacrifice rules stay with us for more than a couple of years, I think you’ll see a lot of big fleets will become sacrifice-only just so the employee is picking up the true commercial cost of the car they’re going into.”

Threats

As with any tax-efficient scheme, changes to the rules could have a huge impact on salary sacrifice appeal.

In 2017, its popularity declined when the Government introduced the optional renumeration arrangements (OpRA) legislation.

OpRA effectively removed its tax and NI efficiency as it meant an employee would be taxed on the greater of the value of the benefit or the salary they gave up, making it less attractive to organisations and employees,

At the time, the Government made a tax and national insurance exemption for vehicles with CO2 emissions of 75g/km and less which, then, were a relative rarity.

The drive towards decarbonisation has meant they are now far more available with many more manufacturers producing increasing numbers of ultra-low emission vehicles (ULEVs).

The BIK regime in 2022 is also favourable to EVs, further adding to the appeal of salary sacrifice.

However, the impact of the OpRA legislation on salary sacrifice does highlight how vulnerable the scheme could be to future tax changes.

Another threat to the success of a salary sacrifice scheme comes from its implementation.

The major pitfalls arise from salary sacrifice just being seen as opportunistic to take advantage of the significant cost efficiencies,” said JCT600 VLS.

Any scheme must be designed, implemented and managed to ensure it is a fantastic employee benefit and retention tool without it causing a burden on the business, and while supporting the environmental, social and governance (ESG) agenda of the business.

Tusker adds appointing the wrong supplier is also a threat to a successful scheme as this can impact the levels of take up by drivers and the overall effectiveness of the initiative.

The communication and implementation of the scheme is vital – if a supplier gets this wrong then the take up of the scheme by employees will be reduced, it said.

Vetting your salary sacrifice supplier before appointing them is vital as you would do with any key supplier being added to your supply chain.

Organisations should look for a supplier that will support the full customer journey; the design, implementation, launch and ongoing management.

When selecting a supplier, fleets should also consider debundling services such as insurance.

The AFP said feets should approach insurance bundled with their salary sacrifice scheme in the same way as any other purchasing process, setting out a tender with specific aims and talking to a variety of suppliers before making a final decision.

“We’re aware within the AFP that there can be a variance of around 30% in pricing for identical products when this kind of exercise has been carried out – and that is a pretty significant additional cost for drivers.

“It would be wrong to assume that just because something is being sold as an add-on to the salary sacrifice scheme, that it represents good value.

“Some providers appear to be viewing it as a means to make excess profits,” said a spokesperson.

> Interested in comparing electric vehicle data? Check out our EV tool.

> Interested in ensuring the efficient use of EVs. Check out our dedicated editorial sections: Insight & policy | EV news | Charging & infrastructure | Costs & incentives | Benefit-in-kind | EV case studies | EV road tests

> EVs by price: lowest to highest