Demands on the UK’s electricity network are set to rocket as the country moves closer to the ambition of a net zero economy by 2050.

National Grid estimates overall electricity consumption in that year will be 890tWh, almost three times as high as 2020’s figure of 304tWh.

Much of this will be down to the increased use of electricity in energy-consuming sectors such as industry and heating, but the electrification of the UK’s road transport network will also have a significant impact.

National Grid expects EVs to account for more than 80tWh. “Questions will be raised about how they will be charged as the demand on the electricity supply grows,” it says in its 2021 Future Energy Scenarios report.

“Smart charging, where EV owners release some control on the best time to charge to third parties or automation based on price, will be an effective tool to support the local and national electricity networks.”

The most basic form of smart charging allows the user to manually set the times a vehicle will be charged, allowing them to make savings by taking advantage of the time-of-use tariffs which feature lower electricity prices at times of high supply and low demand, such as at night between 1am and 5am.

Fleets which operate a back-to-base model where vehicles are plugged in at a depot can use this to stagger charging times to help avoid a costly electricity network upgrade that may be needed if all their EVs are charged at the same time.

“In some cases, the cost to electrify the site could be higher than the cost of the vehicles, making the transition commercially unviable,” says Nicole Thompson, director of social innovation and head of co-creation partnerships for Hitachi Vantara.

The next step in smart charging is to use artificial intelligence so the chargers communicate with the electricity network to respond to changes in the level of supply, demand and cost.

For this, the user would specify the level of charge required and the time the vehicle is needed by, and the system would manage the flow of energy to the battery to ensure this happens.

Greater flexibility

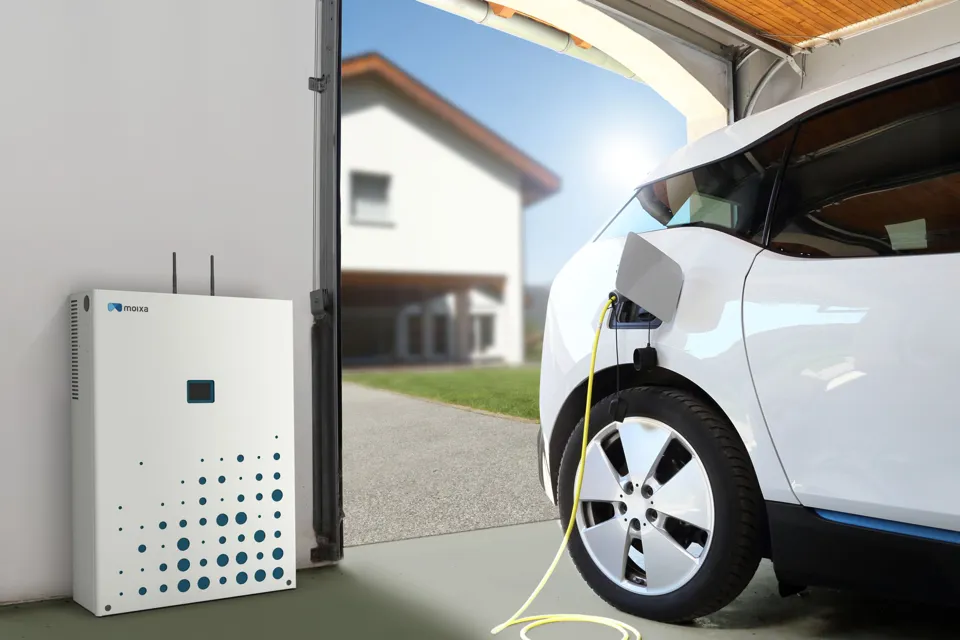

“There is much more renewable energy coming on to the grid now and that’s really good news for a whole host of reasons,” says Ben Fletcher, associate director of EV at smart battery hardware and software company Moixa.

“It also means that having the flexibility where you can decide what vehicle is – and isn’t – charging and work with the grid is super important in probably a way that hasn’t been as important before, especially with the size of EV fleet that’s coming.

“That’s where the smartness comes in. There are electricity tariffs which are helping to support like Octopus Agile, which tracks the wholesale price of electricity.

“That’s a ground-breaking tariff and is a fantastic tool that has the ability to change every half-hour, but you have to be on top of it and tracking what’s going on as well as triangulating it back to when you actually need your vehicle to be ready by.

“The smartness will allow customers to make the most of these kinds of tariffs alongside the energy companies and the National Grid in the transition to more and more renewable energy.”

Moixa is a partner in the EV Fleet-centred Local Energy System (EFLES) project, which aims to show how artificial intelligence (AI) can break down the barriers to electrification for fleet operators by maximising the cost and carbon savings from EVs.

Supported by the Government’s Industrial Strategy Challenge Fund for Research and Innovation, other project partners are UK Power Networks, UPS and Cross River Partnership.

It builds on the Smart Electric Urban Logistics (SEUL) trial from 2017 to 2019 which saw Cross River Partnership, UPS and UK Power Networks develop charging technology at UPS’s Camden depot to meet the challenge of charging an EV fleet without a costly upgrade of the local power network.

“We started off with EVs in London back in 2008 and had an expensive power upgrade, which could take us up to 63 EVs,” says Claire Thompson-Sage, sustainable development co-ordinator at UPS.

“We reached that limit in 2017, so we worked with the SEUL project to develop smart grid technology to enable us to have a fully-electrified fleet in London, which we’re aiming towards now.

“The (EFLES) project is built on looking at how we can optimise the power.”

Thompson-Sage says that, as UPS charges its vehicles overnight, it uses very little power during the day and it will use the project to look at how it manages its energy systems, including on-site solar panels and static battery storage.

Capital expenduture savings of 70%

The SEUL project identified capital expenditure savings of around 70% through using a smart charging solution instead of upgrading the local electricity network.

ELFES takes this a step further and the integration of Moixa’s GridShare platform will monitor and analyse a multitude of data sources at the depot including energy prices, power demand and weather forecasts to optimise charging for when energy is cleanest and cheapest, while also using on-site energy storage and solar power generation.

“SEUL was about managing capital costs, but what about operational costs?,” asks Sefinat Otaru, ELFES project manager, Cross River Partnership.

“This was how this project came about and, once it wraps up next year, it’s going to be very much about sharing the results and just helping other organisations that are interested make connections with the right people so that, hopefully, they will pick up the ball and keep it rolling.”

Smart charging for fleets is also the subject of a number of other trials, such as the Fleet Connected Smart Charging (FCSM) project.

This is led by data science company Miralis Data, energy management company Envisij and EV charging firm Mina.

It aims to produce a smart charging solution to optimise the electricity capacity of a site to enable fleets to transition to EVs quicker and more efficiently.

During the project, which has secured funding from the Office for Zero Emission Vehicles, Envisij will report real-time and projected site power capacity and site demand, while Miralis will devise a smart charging solution to optimise the remaining capacity, charging vehicles within cost and capacity parameters. The solution is expected in 2022.

The Government has also identified smart charging as having a key role to play and the Automated and Electric Vehicles Act 2018 gives it the powers through secondary legislation to mandate that all charge points sold or installed in the UK have smart functionality.

In 2019, it introduced the requirement that all Government-funded home EV charge points must use smart technology and it is now proposing that home and workplace chargers installed from May must be pre-programmed to switch off during peak hours (8-11am and 4-10pm) to ease pressure on the National Grid.

Owners and fleets will be able to override the pre-set times to take account of night workers and people who have different schedules.

Smart charging not for all

While the number of smart chargers – both at homes and at businesses – are rapidly increasing, smart charging may not suit all drivers, says Fletcher, adding: “There will be some people who will take their vehicle home and they might be on 24-hour call, so they need to charge the vehicle as quickly as possible.

“For them, it’s go home and put the vehicle on charge immediately because that person needs the confidence that if they are called out in the middle of the night, they’ll be able to respond.

“Other drivers will have a much more predictable duty cycle. They may get home at 6pm and leave at 7am the next day, giving a window of opportunity where the charging can be optimised against the relevant tariff to make sure that both work in terms of money and CO2.

“That would benefit the fleet manager in terms of the costs that are being put in, but it’s also benefiting the user because they’re not thinking about any charging schedules.”

National Grid’s Future Energy Scenario also highlights the role vehicle-to-grid (V2G) – which enables battery electric vehicles (BEVs) to provide energy storage services to the electricity network – can play.

This allows users to plug their BEV in to charge and, potentially, sell any surplus electricity back to the local and national networks at peak times.

The Project Sciurus trial found the simulated annual revenue for a driver using V2G was £340 compared with using an unmanaged charger. In contrast, smart charging could capture £120 from tariff optimisation.

The initiative, which project partner Cenex says is the world’s largest V2G trial, began in 2018 and has more than 320 V2G units installed in UK homes.

Participants are able to set their preferences for charging parameters and remain in control of when their vehicles are ready to use. They get paid a fixed rate for every kWh exported to the grid.

In its Project Sciurus White Paper, Cenex analysed the plug-in behaviour of users over a 12-month period, looking at different user-types, and found that, although domestic V2G propositions are suitable for a range of drivers, ‘utility style fleet vans’ are among the prime candidates for the technology.

The low-carbon consultancy describes this category as small vans used to carry small volumes of tools and equipment between domestic appointments.

They are owned by a company, but kept by the driver and charged at home or on public networks.

However, Cenex points out the home the vehicle would be connected to would not be the property of the company and, therefore, is unlikely to support V2G activities with the vehicle at the premises unless there are financial or other benefits for the organisation.

V2G drawbacks

While there are other benefits to a fleet opting to install V2G technology, for example the potential to preserve the health of a battery, there are also drawbacks.

Currently the cost of a V2G charging unit is around £4,000 to £6,000, which is significantly more than a smart charger.

Other trials are also taking place in the UK, such as Western Power Distribution’s Electric Nation initiative, which features 100 Nissan EV owners in the Midlands, south-west England and South Wales.

Some industry figures are less convinced about the role V2G will play in the future of the wider charging ecosystem.

“The way I explain it to people is that smart charging gives you 90% of the benefits of V2G for 10% of the complexity,” says Erik Fairbarn, founder and chief executive of Pod Point.

“For that reason, I don’t think it’s a very significant part of charging in most cases, but if you’re talking about depots of buses or fleets of vehicles in a particular location, there are use cases there which I think it could make sense in.

“But if we’re talking broadly across the charging ecosystem, it’s probably one to keep an eye on but I wouldn’t expect much to happen there in the short-term.”

Fletcher adds: “The answer to the question ‘will V2G work for me?’ is ‘it depends’. It depends on the type of fleet and the way the vehicles are used.

“There will be points when the grid is under immense stress but to have the benefit of feeding power back to the grid at those times, the vehicles actually need to be plugged in and available.

“That will absolutely fit in with how the duty cycle of some fleets work, but for other fleets it might be more difficult.

“When you’re talking about BEVs and V2G it’s easy to fall into the trap of talking about them as batteries with wheels, but the key point to remember here is that people actually buy vehicles to get from point A to point B.

“That has to be at the heart of running a BEV. The smartness and V2G needs to be there to enable the vehicles to move things or people from A to B as easily and efficiently as possible, not to have supporting the grid as its main function.”

> Interested in comparing electric vehicle data? Check out our EV tool.

> Interested in ensuring the efficient use of EVs. Check out our dedicated editorial sections: Insight & policy | EV news | Charging & infrastructure | Costs & incentives | Benefit-in-kind | EV case studies | EV road tests

Login to comment

Comments

No comments have been made yet.