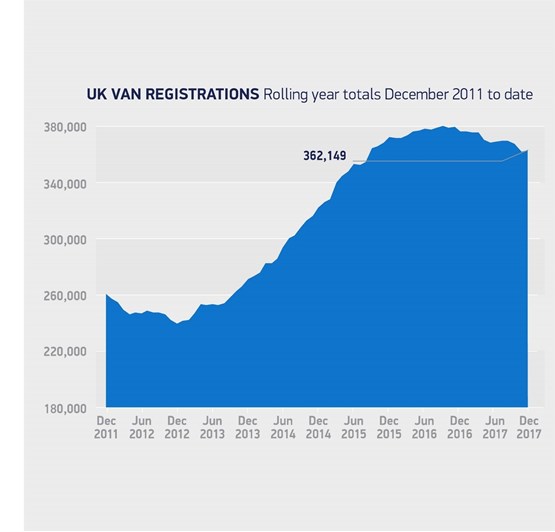

The new light commercial vehicle (LCV) market declined in 2017, a 3.6% fall on 2016, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT).

It is the market’s first decline since 2012 but with 362,149 new vans and pick-ups driven off forecourts in the year, demand is still at its third highest in a decade.

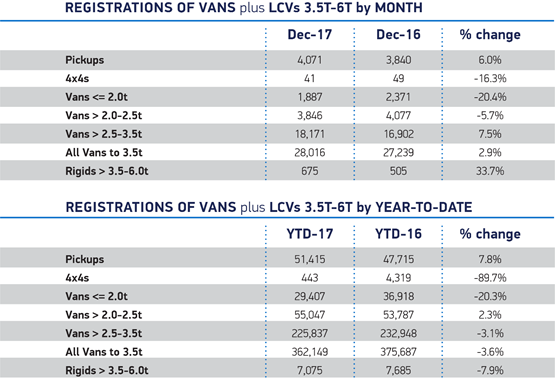

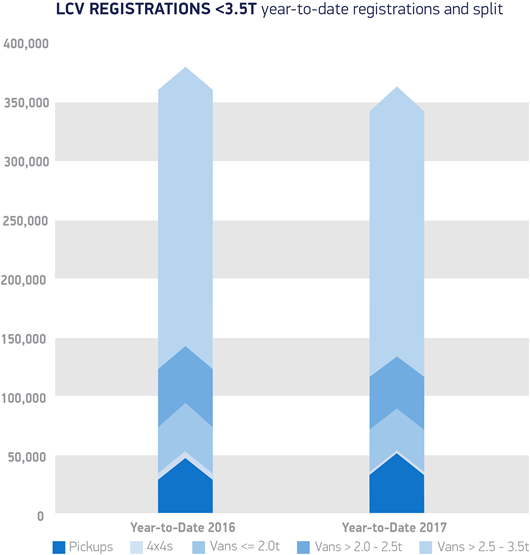

The markets for vans under 2.0 tonnes and heavy vans weighing 2.5-3.5t drove the overall annual decline, falling by 20.3% and 3.1% respectively. However, demand for pick-ups and smaller vans weighing 2.0-2.5 tonnes saw uplifts of 7.8% and 2.3% respectively, compared with 2016.

December, meanwhile, saw LCV registrations increase 2.9% to 28,016 units. Pick-ups were particularly popular, with demand rising 6% in the month, while registrations of larger vans weighing 2.5-3.5t grew 7.5%. Demand for car-derived vans weighing under 2t and smaller vans weighing 2.0-2.5t fell by 20.4% and 5.7% respectively.

Mike Hawes, SMMT chief executive, said: “While the market has slowed in 2017, this was in line with expectations and demand remains at a high level. In fact, LCV registrations have increased 62.5% since 2010.

“For 2018, however, we expect the economic and political uncertainty to continue to affect the market so Government must rebuild business confidence and encourage operators to invest in new vehicles given fleet renewal is fastest way to reduce overall emissions.”

Russell Adams, commercial vehicle manager at Lex Autolease, told Commercial Fleet that despite further falls in LCV registrations, the leasing market continues to be buoyant.

“We’ve experienced strong growth over the past 12 months, driven largely by increased demand from tradespeople and businesses operating across construction and ecommerce,” he said. “These sectors and their supply chains rely heavily on commercial vehicles to transport materials, tools, and manpower and we expect this momentum to continue in 2018.

“It’s interesting that the recent falls in registrations have been driven by fewer sales of heavier vans, where there is little in the way of alternatives to diesel. This reflects what we’re seeing in the leasing market where customer interest in electric LCVs has increased dramatically.

“Businesses are waiting for larger electric vans to become available and the new models set to launch in 2018 may be the stimulus needed for the zero-emission LCV market take off. But, this will hinge on manufacturers offering affordable prices and vehicles that can truly replace diesel in a variety of job roles.”

Login to comment

Comments

No comments have been made yet.